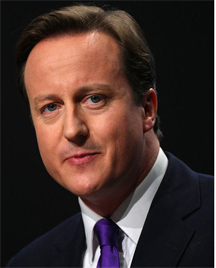

LONDON (Reuters) – British Prime Minister David Cameron said yesterday he was tightening laws to end tax evasion without deterring “aspiration”, hoping to end scrutiny of his personal wealth and restore trust in his leadership.

In a charged session in parliament during which one opposition lawmaker was ejected after labelling the prime minister “dodgy Dave”, Cameron defended those who want to use money to support their families – something he said his late father had done when he set up an offshore fund revealed by the Panama Papers.

But the measures he announced did little to ease some of the criticism of a leader accused by the opposition of being a hypocrite for going after tax evaders in view of his father’s fund and for being slow to detail his financial affairs.

Cameron sought to underline the difference between illegal tax evasion and legal tax avoidance, trying to address concerns over his leadership, hurt not only by questions about his wealth in the past week but also by divisions in his Conservatives over EU membership.

“It is right to tighten the law and change the culture around investment to further outlaw tax evasion and discourage aggressive tax avoidance. But as we do so, we should differentiate between schemes designed to artificially reduce tax and those that are encouraging investment,” he said.

“Aspiration and wealth creation are not somehow dirty words, they are the key engines of growth and prosperity in our country and we must always support those who want to own shares and make investments to support their families.”

He said most of Britain’s overseas territories, including the British Virgin Islands and Cayman Islands, and Crown Dependencies, like Jersey, would now provide British law enforcement and tax agencies full access to information on beneficial ownership of companies to offer greater transparency.

He also said he was introducing legislation this year to make it a criminal offence for companies if they fail to stop employees from instructing clients on ways of evading tax, part of what he called some of the most robust action ever taken by a British government to close tax loopholes.