In our article of 15 May 2017, we referred to the announcement by ExxonMobil of “a world-class resource discovery of 1 billion oil-equivalent barrels” in Guyana’s waters. We noted that, while this is good news, there was no publicly available information as to the extent of oil revenues that will accrue to Guyana. The Government has since reported that it succeeded in negotiating a higher royalty rate from 1% to 2% on gross earnings. This is in addition to 50% of profits from the sale of all petroleum products by the oil company.

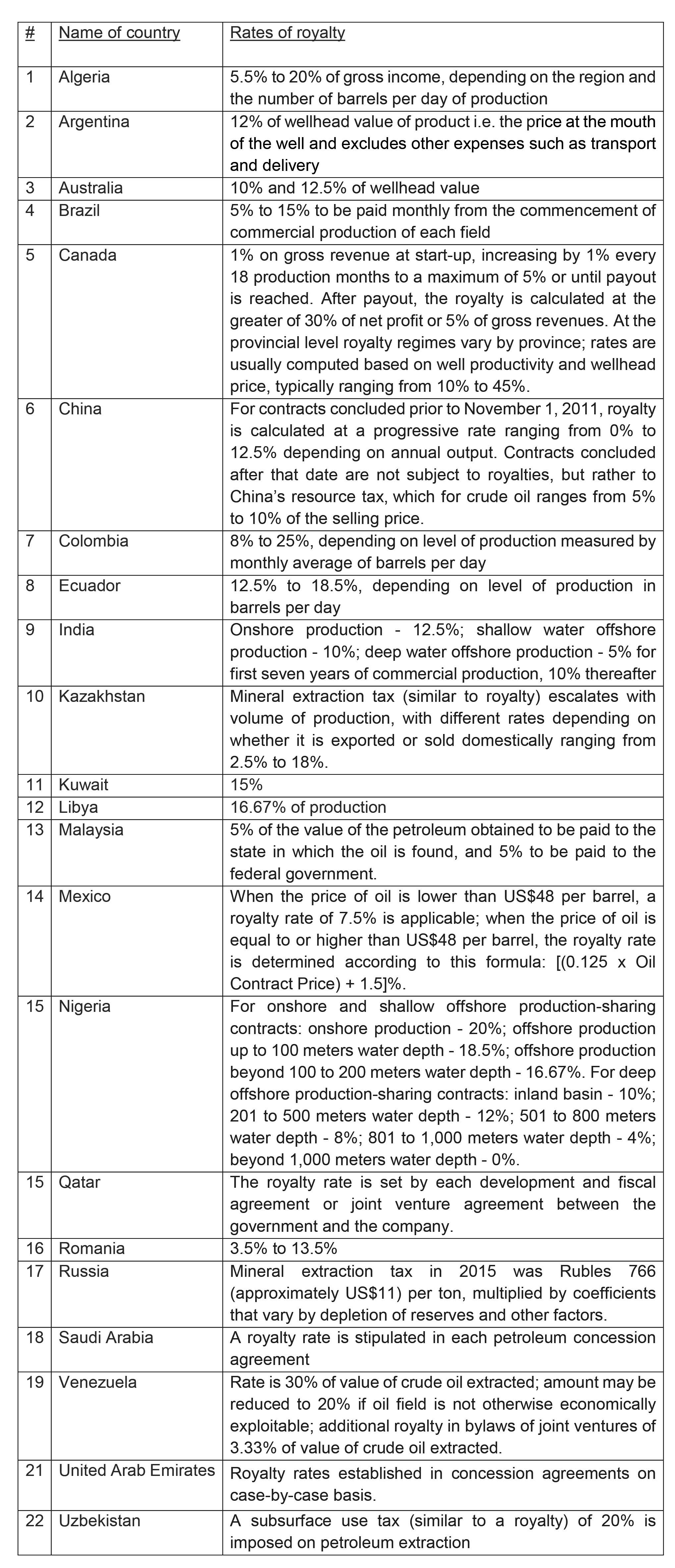

Rates of royalty on crude oil production

While the Government should be applauded for the successful negotiation of an increase in royalty rate, it is important to reflect on trends in other oil producing countries to ascertain the reasonableness of the rate. The following table is extracted from the information published by the Law Library of Congress:

As can be noted, royalty rates vary from country to country and within countries, depending on several factors. However, it is not clear how many of these countries also benefit from profit-sharing arrangements, though reference was to Bolivia, Indonesia, Malaysia and countries in the Middle East and Central Asia.

In a profit-sharing arrangement, the oil company uses the revenue derived from production to recover its capital and operational expenditure. This is known as “cost oil”. The remainder, known as “profit oil” is split between the government and the company. To the extent that countries have this dual arrangement in place (i.e. royalty plus profit-sharing), it stands to reason that royalty rates will be lower than those that receive royalties only. The situation is further complicated by the level and other forms of taxation that countries impose on companies involved in crude oil extraction.

Revenue from royalty payments

The Guyana Government has announced that crude oil production will commence in 2020 with 100,000 barrels a day. Using the current world market price of approximately US$50 per barrel, and assuming that production will take place 300 days per year, the revenue derived from royalties per annum will be 2% of (100,000 x 300 x 50) = US$30 million, equivalent to G$6 billion. As a percentage of the 2017 National Budget of G$250 billion, this works out to 2.4%. This is not a significant sum as a measure of compensation for the extraction of one of the country’s natural resources, and therefore Guyana has to rely on the profit-sharing agreement for a greater portion of its revenue from crude oil production.

Profit sharing versus revenue sharing

A key concern relating to profit-sharing arrangements is that profits can vary significantly from year to year, considering; (a) the volatility of prices on the world market; and (b) the need to recover the initial investment over a period of time. There are detailed accounting rules to be followed in relation to the recovery of the investment. Generally speaking, the initial investment (i.e. expenditure not directly linked to production) is capitalized and shown as assets in the balance sheet of the oil company. The expenditure on physical assets e.g. plant, machinery and equipment, is written off against revenue over the economic useful life of the assets. Similarly, intangible assets are amortised over the life of the investment, typically over a 30-year period, using predetermined rates. Taking into account these considerations, it is entirely possible for losses to be recorded in the early years of operations.

Given the uncertainty of the extent of profits that is likely to accrue, there are strong arguments for there to be in place revenue sharing agreements rather than those relating to profit-sharing. A revenue-sharing agreement provides a guaranteed flow of income to governments once production begins, and can be monitored easily from the government’s perspective. There will no longer be a need for detailed and independent scrutiny of oil companies’ costs to ensure that only legitimate expenditure is charged against revenue. This is an area that has been the subject to intense disagreements between oil companies and governments. An additional consideration is that oil companies can curtail production in anticipation of higher prices in the future, with consequent adverse impact on profits. It was mainly for these reasons that India has moved away from the profit-sharing model to one of revenue-sharing, based a recommendation of the country’s Auditor General.

Accounting for exploration and development costs

There are two methods for the accounting for costs relating to the exploration and development of crude oil and natural gas: the “successful efforts” (SE) method and the “full cost” (FC) method. The SE method allows a company to capitalize only those expenses associated with successfully locating new oil and natural gas reserves. Using a predetermined rate, portions of these expenses are transferred and charged against revenue over the life of the investment. For unsuccessful (or “dry hole”) results, the associated expenditure is immediately charged against revenues for the accounting period in question. This is because there is no change in productive assets with unsuccessful results, and therefore the related costs should be expensed.

The alternative FC method allows all expenditure relating to locating new oil and gas reserves to be capitalized and recorded in the balance sheet as long-term assets, regardless of the outcome. The rationale behind this approach is that, in general, the dominant activity of an oil and gas company is simply the exploration and development of oil and gas reserves. Therefore, all costs incurred in pursuit of that activity should first be capitalized and then written off over the course of a full operating cycle.

Next week, we will examine the advantages and disadvantages of each of these two methods of accounting for oil and gas expenditure, and consider the impact on revenue for the host country.