The report is in fact a five-page letter addressed to the Permanent Secretary of the Ministry of Natural Resources, with two appendices covering the rest of the 55 pages. Appendix A, comprising 29 pages, contains eleven items, namely: accounting overview of Exxon’s main subsidiary Esso Exploration and Production (Guyana) Ltd.; drilling and rig overview; labour; allocation methodologies; COVID-19 costs; benchmarking and contracts; capital expenditures (shared costs); taxes; coding; inventory and materials; and Liza FPSO. Also, included in this appendix is an eight-page report on “Stock Verification and Inventory Site Visit”. Appendix B, containing 13 pages, sets out the auditors’ response to 30 sets of questions posed by the Government.

The overall conclusion of the auditors is contained on page 2 of the letter in which they stated that in their opinion the amount shown as recoverable costs were in accordance with the Petroleum Sharing Agreement (PSA), except for items discussed in the report.

The Ministry of Natural Resources has since uploaded on its website what it described as “VHE’s ‘Initial’ Audit Report for the Stabroek Block Cost Recovery Audit – 2018 to 2020”. It is, however, unclear when the final report will be issued. The Ministry has also uploaded the audit report on the pre-contract costs undertaken by IHS Markit. One would have thought that an announcement would have been made about the availability of these two reports and where they can be located. However, this was not done.

In addition to the 55-page document that was the subject of our analysis, there is now a 135-document, 132 pages of which were an elaboration of the contents contained in Appendix A of the 55-page report. There were 51 queries raised by the auditors in relation to the amounts shown in the Cost Recovery Statement.

The remaining three pages deal with oil and gas produced from the Destiny Liza wells and associated cost oil, cost gas, profit oil and profit gas, as well as the average fair market price determined according to the PSA.

Amounts queried

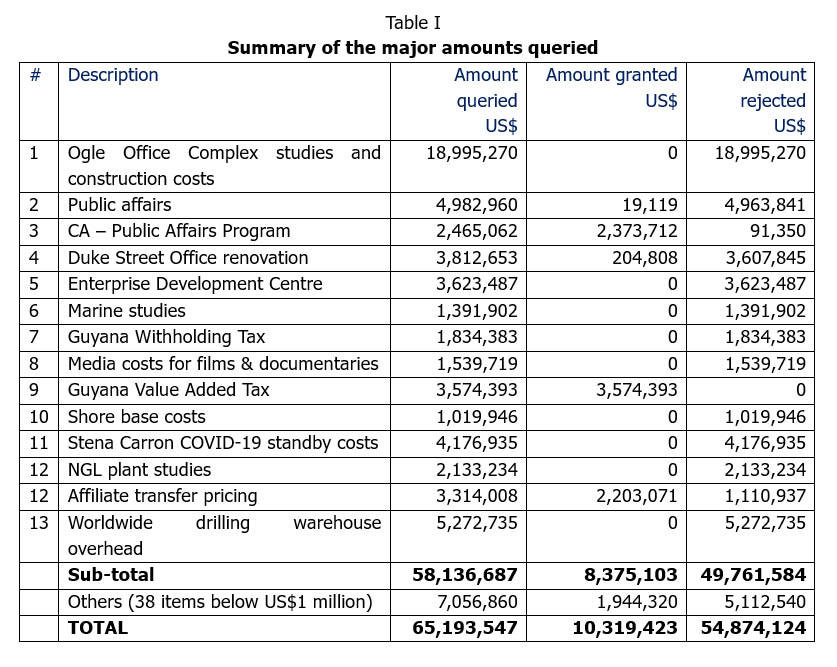

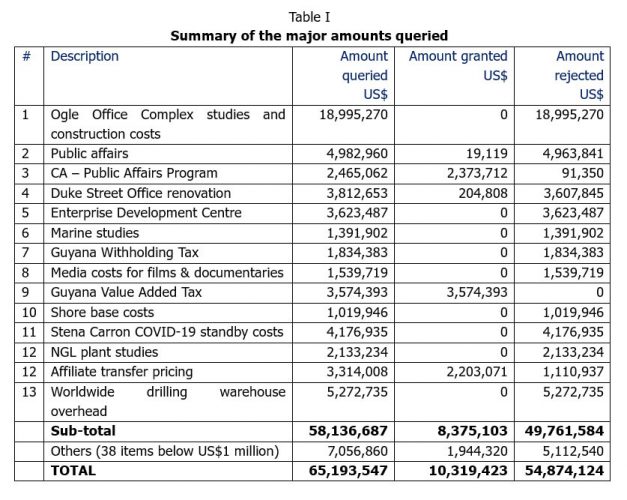

The amounts queried by the auditors totalled US$65.194 million, representing 0.88 percent of the total expenditure of US$7.435 billion shown in the Cost Recovery Statement. However, EEPGL accepted only US$10.319 million which was credited back to the Statement, leaving an amount of US$54.874 million unresolved. Table I gives a summary of the major items that the auditors queried.

EEPGL charged to the Cost Recovery Statement 100 percent of the construction costs of the Ogle Office Complex in the year in which they were incurred, instead of amortising such costs over a period of time, as provided for the PSA as well as generally accepted accounting principles. The auditors expressed disagreement with this treatment and stated that:

Allocation of costs should follow operational usage, regardless of the size of the different operations…By charging 100% of the construction costs as incurred, the Contractor is essentially having the Government of Guyana fund the construction of EEPGL’s expansive Ogle office complex; that does not align with usage for Petroleum Operations.

EEPLG contended that the investment decision to build the office was made for the benefit of the

Stabroek Block in support of its operations and that without it the ‘in-country footprint would be minimal’. A similar argument was put forward for charging 100 percent of the costs for Duke Street office improvements and the Shorebase Expansion project.

Public affairs and public affairs awareness programmes

EEPGL included on the Cost Recovery Statement 93 – 100 percent of costs relating to public affairs, which the auditors did not consider as recoverable costs since they were not related to production. Of the amount of US$7.448 million charged to the Statement, the Contractor reversed charges totalling US$2.376 million. The remaining unrecoverable costs, which totalled US$5.072 million, relate to the following:

(a) Sponsorship of marketplace public awareness campaign for the Guyana Manufacturing and Services Association

(b) Media messaging, stakeholder relations, and issues management

(c) Recording, editing, and voice talent for public service messages on Guyana’s Sovereign Wealth Fund

(d) Hosting visit for Shell Beach Outreach Program

(e) Liza Destiny Arrival Commemoratory Event

(f) Branded drawstring sports packs and bottles

(g) Media monitoring services and newspapers

(h) Exxon brochures

(i) Center for Strategic & International Studies Support for Guyana Diaspora

(j) P&GA employee/expatriate labor and associated expenses

Marine studies

EEPGL included on the Cost Recovery Statement 100 percent of costs from Environmental Resources Management, ERM Guyana, and RPS Group for various studies of the impact of oil and gas operations on fish, bird, and turtle migrations, habitats, and survival. According to the auditors, a portion of the costs should have been allocated to non-Stabroek operations.

EEPGL argued that: (i) the studies were necessary as part of the Payara Environmental Impact Assessment and were needed to meet requirements following the issuance of an environmental permit for the Payara project in the Stabroek Block; and (ii) the Oil Spill Response Plan for Guyana included the Wildlife Response Plan, the studies for which were fundamental for drafting the Plan.

Withholding Tax

EEPGL included in the Cost Recovery Statement Withholding Tax amounting to US$1.834 million relating to deep water invoices for Destiny FPSO financing costs. The PSA stipulates that the financing amounts are inclusive of Withholding Tax and is therefore not recoverable costs. EEPGL responded by stating that: (i) the total interest due for the period is a function of interest rate plus the LIBOR rate and therefore does not include Withholding Tax; (ii) the amount must be grossed up for Withholding Tax to arrive at the correct total; and (iii) the language of Section 3.5 of the PSA is an oversight.

Media costs

EEPGL charged amounts totalling US$1.540 million to the Cost Recovery Statement for films and documentaries The auditors are of the view that these costs did not relate to production. However, EEPGL argued that the media items were used for internal and external communications in connection with and for the benefit of Stabroek Block petroleum operations. (This part of the report is inaccessible because the relevant pages could not be loaded from the Ministry’s website.)

Value Added Tax

Amounts totalling US$3.574 million were included on the Cost Recovery Statement as Value Added Tax (VAT) on various third-party invoices. However, since EEPGL is exempt from VAT, there should be no charge to the Statement. EEPGL explained that the Guyana Revenue Authority (GRA) was yet to issue exemption letters for all vendors, and therefore it had no alternative than to consider the VAT on the invoices as recoverable costs, until it receives vendor-specific letters of exemption. EEPGL further stated that if GRA makes VAT refunds, the Statement would be adjusted accordingly.

Shorebase costs

EEPGL included amounts totalling US$1.020 million in the Cost Recovery Statement, representing the cost of pipe racks and general and usual shorebase operations at the JFL Shorebase. Guyana Energy Support Services provided labor for loading and offloading boats and transporting equipment to various locations. These invoices were charged to the Statement during the period February 2018 to February 2019. However, these costs were incurred prior to October 2016 and there are not recoverable costs.

Stena Carron COVID-19 standby costs

During the period March – May 2020, EEPGL charged US$4.177 million to the Cost Recovery Statement, representing COVID-19 standby costs relating to Stena Carron drillship and vendors’ standby time. According to the auditors, the costs should have been allocated to wells which used the Stena Carron and not 100 percent to the Stabroek Block, based on industry standards. EEPGL contended that the decision to retain the Stena Carron rig during the COVID-19 pandemic was driven solely by the planned Yellowtail-2 drilling operations.

NGL plant studies

EEPGL included on the Cost Recovery Statement costs amounts totalling US$2.133 million for ground and air surveys, mooring studies, and Contractor and Affiliate labor for the proposed gas-to-power pipeline and onshore NGL plant. According to the auditors, while costs for the gas-to-power pipeline project are recoverable because the pipeline will transport gas to the “Delivery Point”, those for the NGL plant are not since the plant will be located past the delivery point.

Affiliate transfer pricing

EEPGL included on the Cost Recovery Statement the actual costs of affiliate employees performing work for the Stabroek Block, plus a profit margin ranging from one percent to 15 percent. The actual amount charged was US$3.314 million. According to the auditors, the profit element is not a recoverable cost. EEPGL argued that it is a “transfer pricing” mechanism imposed by some countries. EEPGL agreed to credit the Cost Recovery Statement with amounts totalling US$2.203 million.

Worldwide drilling warehouse overhead

EEPLG included in the Cost Recovery Statement an allocated share of overhead for its worldwide drilling warehouse(s) amounting to US$5.273 million. According to the auditors, this is a duplication since annual overhead charge covers all overhead functions performed outside of Guyana, including this worldwide drilling warehouse overhead.

EEPGL argued that these charges relate to warehousing costs for the petroleum operations for long lead exploration materials held at its Houston warehouse and that the Stabroek Block received an allocation based on the value of material transferred to Guyana.

Oil and gas produced from Destiny Liza wells

We now turn to the last three pages of the 135-page report dealing with oil and gas produced from the Destiny Liza wells and associated cost oil, cost gas, profit oil and profit gas, as well as the average fair market price determined according to the PSA.

During the period December 2019 to December 2020, a total of 27,625,084 barrels of oil and 30,735,345 Mcf of natural gas were produced. Produced oil was stored on Destiny Liza FPSO and offloaded for sales. All gas produced was either used for fuel, flared, or injected back into the formation for future oil recovery purposes. No gas was sold and therefore there was no cost gas or profit gas. Ernst & Young (EY), an independent international accounting firm, determined the average fair market price reflected in monthly statements to EEPGL and the Government.

The auditors’ findings were as follows:

(a) All oil barrels lifted/offloaded from the Destiney FPSO were accounted for and included in the average fair market price.

(b) EEPGL properly accounted for the two percent royalty paid to the Government.

(c) Oil and gas production volumes were supported by monthly statements provided to the Government.

(d) Raw measurement data upon which the monthly statements were created, were not made available. However, there was no reason to conclude the data presented in the monthly statements would differ from the raw measurement data utilized by EEPGL for production management. EEPGL indicated that Government personnel were fully aware of all measurement points and were present for calibrations and offloads.

(e) EEPGL was requested but did not provide a schematic showing all metering points on the Destiny Liza FPSO. The schematic would provide a visual representation of the physical flow of production as it is produced.

(f) EEPGL’s methodology accounted for all oil and gas volumes shown as having been produced, with a proper allocation between cost oil and profit oil in accordance with the PSA. The Government received its proper share of profit oil for the period reviewed.

(g) Cost oil barrels equalled 75 percent of total oil produced except for certain months where total sales barrels were less than 75 percent of production. The remaining oil production that was not sold was reflected as profit oil and split 50/50 between EEPLG and the Government. This methodology results in more profit oil being available to the Government for sale earlier than by applying the straight 75 percent of production to cost oil.

(h) EEPGL valued cost oil using the monthly prices provided by EY. For each month oil was lifted from the FPSO and sold by a Contractor, EY obtained the bills of lading supporting offloaded barrels and the Contractor’s third-party and Affiliate sales documentation. In any month that the Contractor’s total Affiliate sales were 50% or more than total volumes, the correct arithmetic average of the Platts market index price was used to value the cost oil.

(i) EEPGL’s cost recovery calculation used the correct value of cost oil.

(j) Profit oil was appropriately split 50/50 between the Contractor and the Government.

(k) EEPGL accounted for all gas production as injection, fuel use, or flare, resulting in zero net production from December 2019 through December 2020. As such, no gas was available for cost gas or profit gas.

The auditors’ conclusions

The auditors stated that they were not able to validate EEPGL’s production volumes with measurement data outside of the information provided in the monthly statements to the Government. However, since the Government had significant oversight in the FPSO production operations, there was minimal risk for unreported production. They concluded EEPGL properly accounted for cost oil and profit oil barrels as well as the value of cost oil for cost recovery purposes.

Our conclusion on the report

We maintain our previously stated position that the report by VHE Consulting on the audit of the Cost Recovery Statement for the period 2018-2020 lacks basic structure, rendering it difficult for the average reader to go through the report to ascertain what the findings and conclusions are.

The combined report, comprising 190 pages, is too long and unwieldy. There is a significant amount of unnecessary quoting from the PSA, and the report is badly in need of editing to ensure conciseness and user friendliness. Additionally, the auditors had stated that the documentation and process of transferring materials out of inventory could not be examined but gave no reasons why this was so. This is a major shortcoming of the audit since the value of materials issued from inventory to production over the period under review would have constituted a significant portion of the total amount shown in the Cost Recovery Statement.