Here in Guyana, we have the Integrity Commission, established since 1997, with no Commissioners in place for some years now, and no meetings held since 2006 when the late Bishop George had resigned as Chairman. While revised the Code of Conduct under the Act was gazetted in June 2016, it failed to address the shortcomings identified by the Transparency Institute Guyana Inc., especially in relation to penalties for violations as well as monitoring compliance with the Code. It appears inappropriate for any official of the Executive to be responsible for monitoring the Code, which responsibility should be that of the Commission.

Two Mondays ago, we began an assessment of Guyana’s economic performance in 2017 and the 2018 budget measures. We had urged that the debate be conducted in a civilized manner befitting of the status of our elected representatives, and putting the national interest first instead of partisan political interest. However, for yet another time, we were immensely disappointed at what took place on the first day’s sitting of the Committee of Supply to consider the Estimates. Pandemonium broke out when the Speaker ruled that one Member of Parliament was out of order for refusing to take his seat when requested to do so. What happened thereafter is public knowledge and need not be repeated here, except to place on record our greatest condemnation of yet another embarrassing moment in the history of our parliamentary affairs.

So far, we discussed the need for the Estimates to be prepared, not in isolation, but in the context of a framework that reflects the Government’s policies and priorities over the medium-term. We referred to the Medium-Term Expenditure Framework (MTEF) which Guyana introduced as far back as 2010 but which remained largely a work-in-progress. An MTEF is an annual, rolling three year-expenditure planning that sets out priorities and hard budget constraints against which sector plans can be developed and refined. While our Estimates do contain tables showing projections of revenues and expenditures for three years, the basis of arriving at these figures could not be ascertained. We ventured to suggest that for future budgets a medium-term policy framework document be prepared and included in the package of documents in support of the annual budget and the three-year projections.

A comprehensive range of medium-term policy instruments in support of the annual Estimates revolves around a fiscal framework (MTFF), a budget framework (MTBF) and a performance framework (MTPF). The MTFF encompasses a top-down specification of the aggregate resource envelope and allocation of resources across spending agencies. On the other hand, the MTBF incorporates both the top-down specification and the bottom-up determination of spending agency resource needs as well as a reconciliation of these requirements with the resource envelope. It also sets out institutional arrangements for prioritizing, presenting, and managing revenue and expenditure over a period of three to five years. The MTBF complements the MTEF and constitutes part of a wider framework, involving broadly the integration of policy, planning, and budgeting from a medium-term perspective. Finally, the MTPF involves the measurement and evaluation of outputs, outcomes and impacts in an attempt to achieve cost savings and value for money.

We then began a review of the budget measures for 2018 and were heartened about the removal of Value-Added Tax (VAT) on education services but remained concerned about the failure to do the same in respect of water and electricity. Over the years, the high cost of electricity and its unreliable supply are perhaps the two most important factors that adversely affect the investment climate in Guyana. Today, we continue that review by looking at the size of the national budget vis-à-vis available resources as well as other selected areas.

Another year of deficit budgeting

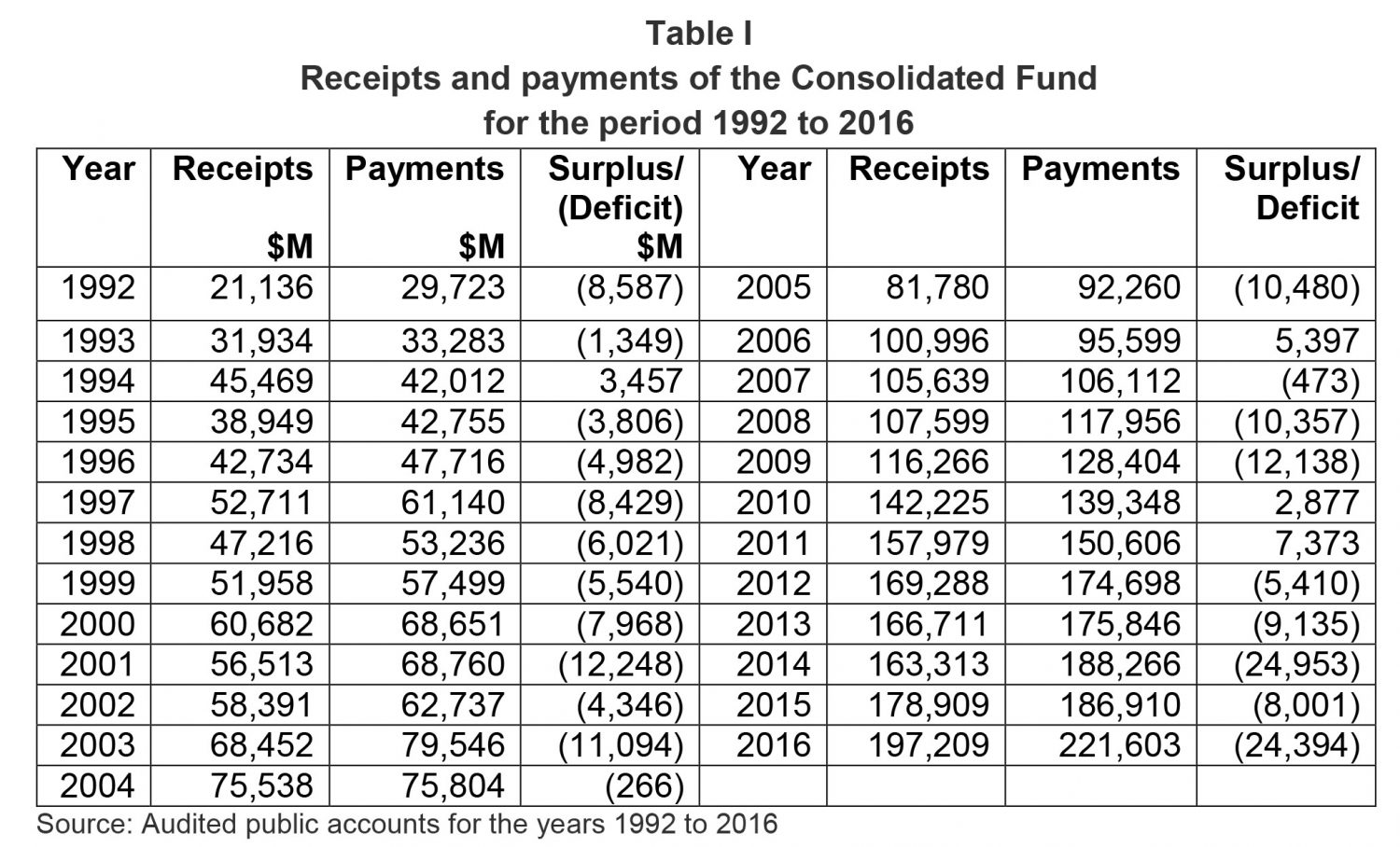

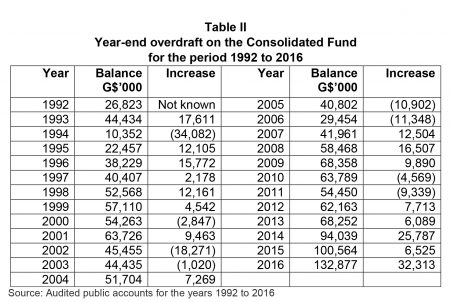

The National Assembly approved the Estimates of Expenditure for 2018 without modification in the sum of $267.094 billion, compared with budgeted revenue of $233.682 billion, giving a budgeted deficit of $33.412 billion. For 2017, the deficit is projected at $24.145 billion. This has been the pattern of our financial performance since 1992 and perhaps earlier. While we acknowledge that there may be occasions when deficit budgeting is necessary to spur economic activities and to achieve a higher growth rate, it should be a one-off exercise, not a permanent feature, for reasons of sustainability and long-term financial viability. Table I shows the trend of financial performance for the years 1992 through 2016.

The Consolidated Fund

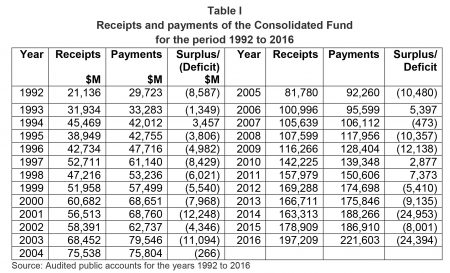

The yearly deficits have to be financed from the Consolidated Fund. However, this Fund has been in overdraft since 1992 and perhaps earlier. At the end of 1992, it was overdrawn by $26.823 billion. By the end of 2014, the overdraft increased by $67.216 billion to $94.039 billion. This is notwithstanding that over the years Guyana received significant financial benefit through the rescheduling and cancellation of its bilateral and multilateral debts as well as through payments under the Highly Indebted Poor Countries (HIPC) Initiative. During the two-year period 2015-2016, the overdraft on the Consolidated Fund increased further by $38.838 billion to $132.877 billion, and a further increase to $155.635 billion is expected by the end of 2017. Table II table shows the year-end overdraft position of the Consolidated Fund for the years 1992 through 2016:

Increases in social assistance and old age pension

The increases in old age pension and public assistance from $19,000 per month to $19,500 (or 2.6%) and $7,500 to $8,000 (or 6.7%) respectively, are a major source of disappointment, considering that for 2017 public servants earning less than $100,000 received an increase of 8%. In addition, no salary increases were announced for 2018 because, according to the Minister of Finance, negotiations with the Guyana Public Service Union (GPSU) had not yet been completed. With an allocation of $6.242 billion in the Ministry of Finance budget under “Other employment costs”, compared with a revised figure of $5.712 billion for 2017, the prospect of salary increases, based on collective bargaining with the GPSU, is not an encouraging one.

With projected inflation rate of 2% for 2017, real wages and salaries would have declined for public servants earning in excess $800,000 per month. In principle, all categories of employees should be granted an increase to cater for inflation in addition to a further increase based on a system of performance appraisal that has been discarded decades ago in favour of arbitrary across-the-board increases. In this regard, we draw attention to the following statement by the President at the handing-over of report of the Commission of Inquiry into the Public Service dated 11 May 2016:

We have to go back to a standard where performance of individuals is related to promotion and pay. We have fallen into the trap of across-the-board benefits; people feel that simply by going to work they will benefit. They are like a rudderless ship floating on an ocean of goodwill. Many people who expect that there is going to be some bonanza, I hope they discover that the bonanza will come from their own efforts…if they want to be lazy, they will get a lazy person’s salary…if they work hard, they will be rewarded.

Green agenda

While the exemption from Excise Tax for vehicles principally designed to accommodate LPG gas and Customs Duty for machinery and equipment used for setting up refilling stations for such vehicles respectively, is welcome, the positive effects of this measure may not to be felt in the immediate future. We would like to see measures aimed at restricting the importation of luxury-type vehicles that consume enormous amounts of fuel, compared with ordinary vehicles.

We should also aim to progressively cut the importation of fossil fuels with a view to its long-term elimination in favour of renewable sources of energy. In addition, how do we fix the problem at the Guyana Power and Light where one-third of the energy generated disappears through technical and commercial losses? And, have we abandoned our efforts to produce energy from hydroelectric power? Finally, it would also be a good idea for incentives to be granted for buildings to be outfitted with solar panels to avoid the use of electricity generated from fossil fuels?

Conclusion

It is evident from the above analysis that we have been living beyond our means, and had it not been for debt relief, budget support and other forms of assistance from the international community, we might have been in serious financial difficulties. We therefore need to devise a plan to achieve a balanced budget. This almost inevitably means cutting on the size of government. The rate of government expenditure is unsustainable, and our only hope is the flow of oil revenues, come 2020. It is mainly for this reason that this Column is advocating a renegotiation of the agreement with ExxonMobil for a higher rate of royalty as well as a switch from a profit-sharing arrangement to one of revenue-sharing. We must also beware of the ‘resource curse’ and the ‘Dutch disease’ that have inflicted several oil-producing nations.