Part 1

Level of savings

When one looks at the current account balance in the country’s balance of payments, the concern might be about the deficit that emerges annually and the amount of foreign currency that seems to be leaving the country. Even though concerns about the outflow of hard currency are important, the current account balance plays another role as it relates to savings and investment. Advocates of free trade would agree that the latter two issues were more important than the direction of the trade balance. Savings and investments lead to employment, possibly a wider choice of consumer goods, increased productive capacity and greater amounts of revenue for government. Short of being able to gather data from various economic units such as individuals, businesses and the government, one can rely on the balance in the current account to give a sense of how much Guyana is saving each year. The level of savings gives a good indication of the potential for direct investment in a country. This article seeks to discuss some of the implications of savings and investment that emerge from the behaviour of the country’s current account balance. The article is being presented in two parts.

Even though Guyanese might be familiar with the current account balance, many might not be aware of its components and how they impact the level of savings and investment by the country. The current account reflects the active exchanges that take place between Guyana and other economic territories around the region and the rest of the world. It is the place where the country records, in summary form, its business dealings with economic units from all other countries. The most conspicuous of the activities that occur is the trade in goods and services. Most Guyanese understand that transaction very well.

They know that things come for them from abroad resulting from purchases that they might have made online or otherwise. On the flip side, they themselves might send things abroad as part of a business arrangement with the expectation that they will be paid. Even when they are not directly involved, Guyanese know that many of the goods that they buy in the supermarkets and shops carry foreign labels and are not produced in Guyana. However, when all the exchanges of goods and services are settled, they result in a balance. The balance arises because some of the goods in the economic exchange might have a higher value than others. The balance of trade could be favourable or unfavourable. When it is unfavourable, as is the case mostly with Guyana, people cast aspersions about the prospects of the economy. But an unfavourable trade balance could contain significant positives as will be indicated later in the article.

Movements and outcomes

Apart from a deficit or surplus arising from the trade in goods and services, the current account also has some activities that affect the level of savings by the country and, consequently, the level of investment. These movements and outcomes arise from foreign investments, migration and tax policies. A foreign company might transmit abroad part of the salary of an expatriate employee. The foreign company might also have to pay interest on a loan taken from abroad and, in favourable times, it would be interested in paying dividends and repatriating its profits. Such movement might be two-way depending on the economic activities that Guyanese businesses have abroad. In Guyana’s case, migrant workers play a big part in determining the current account balance as is shown in Table 1 below. However, the bottom line is the movement of money in and out of the country has an impact on how much we keep and how much of those savings is invested.

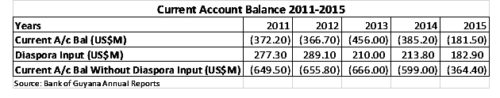

Table 1 below contains balances in the current account for a five-year period from 2011 to 2015. In none of the years, the current account balance was positive. The negative balances reveal that as a country, very little was being saved. That balance comes about after government, households and private businesses would have spent their money and then sought to acquire goods and services from abroad. As such, the excess comes from foreign transactions which makes what Guyana does with other countries very important. That Guyana can run a negative balance in the current account each year reflects the dynamics of international relations. Sometimes Guyana is unable to get its goods into foreign markets because of non-tariff barriers to trade. This is particularly the experience of agricultural and livestock products which must meet sanitary and phytosanitary regulations of importing countries. To the extent that such reasons are crucial to the export trade, some money and time should be invested in reducing the country’s export risk. In other instances, countries allow Guyana to buy goods and services on credit. The negative balance in the Table reflects what Guyana owes to other countries.

TABLE 1

Guyanese Diaspora

But as the data show, the situation could have been worse if the Guyanese Diaspora was not making a constructive contribution to the economy. Not only does it show how much higher the current account balances would have been without the Diaspora input, it amplifies the threat to the country’s capacity to invest.

The balances in the current account would have been almost twice as large as reported in the Bank of Guyana reports, but the Diaspora input has mitigated that impact. It also indicates the positive impact that the Diaspora has on the country’s ability to manage its external financial relations.

Notwithstanding the Diaspora input, Guyana must find money to pay its debts. Guyana has relied on two ways to tackle the current account deficit. It has sought to do so by increasing its exports and by attracting foreign investments. The two courses of action are not necessarily mutually exclusive, especially in cases where foreign investment is export-oriented.

Not only do they have consequences for two separate parts of the current account, each course of action on its own is significant for what it means for savings and investment in Guyana and the control that a government has over managing its economy. Herein, one would see too that the Diaspora contribution is not inconsequential.

Balance of trade

The attempt to increase exports affects the balance of trade. A favourable increase in the balance of trade puts Guyana in a better position to increase its savings. Higher levels of savings mean higher levels of domestic investment. Foreign trade that produces favourable balances therefore enables Guyana to have greater control over its investments and the management of its economy.

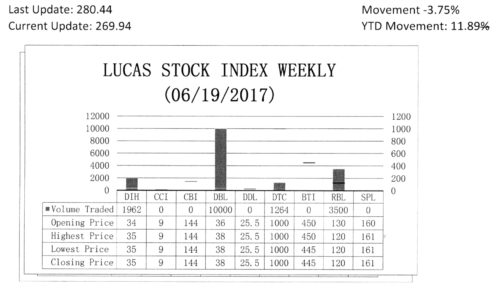

The Lucas Stock Index (LSI) declined 3.75 per cent during the third period of trading in June 2017. The stocks of six companies were traded with 237,694 shares changing hands. There were no Climbers and three Tumblers. The stocks of Banks DIH (DIH) fell 12.29 per cent on the sale of 15,863 shares, the stocks of Republic Bank Limited (RBL) fell 4.17 per cent on the sale of 35,448 shares and the stocks of Demerara Tobacco Company (DTC) also fell 1.0 per cent on the sale of 1,134 shares.

The chance of this happening increases with the inclusion of oil and gas in its production structure. Oil revenues were likely to be generated at a faster pace than revenues from other exports which means that the balance of trade could increase at a rapid rate. The savings rate would increase and so would the rate of investment. Working and investing

Though not the subject of this article, the issue becomes what Guyana invests in. An examination of the composition of Guyana’s imports reveals that trade is a significant driver of domestic investment. In the country’s national accounts, imports are classified in a manner that reflects the economic use of imports.

The classification is given as consumption, intermediate-consumption and capital goods. Capital goods cost plenty money and are therefore not things that people buy to play around with. But one could reclassify the imports as productive and non-productive imports with intermediate consumption goods and capital goods as productive and consumption goods as non-productive. Even though Guyana runs a trade deficit, 75 per cent of the value of what it imports is used for productive purposes. Guyanese therefore should not feel discouraged by the perennial trade deficit. A high import bill of productive items shows that the country is serious about working and investing. If Guyana continues to maintain this type of trade profile after the inclusion of oil and gas in its production structure, oil revenues will serve it well.

(To be continued)