BBCI, the owner of the Bridge, was incorporated in April 2005 following which the Berbice River Bridge Act was passed in December 2005 and assented to in January 2006. The Act provides for the establishment of a privately financed Berbice River Bridge and vests with the Minister responsible for Public Works (now Public Infrastructure) the regulatory authority for the operations of the Bridge. Key provisions of the Act include: (i) authority to enter into Concession Agreement; (ii) levying of toll fees during the concession period; (iii) contents of the Concession Agreement; (iii) responsibility for the maintenance of the Bridge; (iv) transfer on termination of the Agreement; and (v) fiscal concessions. By Order No. 42 of 2008, BBCI was granted a 21-year concession commencing June 2006. In according with Section 8 of the Act, the Minister is not authorized to enter into any guarantee of indebtedness incurred by BBCI to third parties in connection with the implementation of the Bridge Project.

The construction of the Berbice Bridge started in 2006 and was completed in 2008 at a cost of G$7.874 billion. It was financed through a combination of loans and equity contributions from the National Insurance Scheme, pension funds, insurance companies, commercial banks and other private investors. To this figure must be added cost of the feasibility study of US$1 million; US$11 million in expenditure on the construction of access roads on both sides of the River; and various expenditures totalling G$85 million incurred by the National Industrial and Commercial Investments Ltd. Therefore, the total cost of construction of the Bridge (both direct and indirect) was G$10.359 billion, equivalent to US$51.794 million.

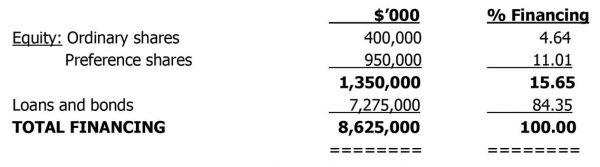

Financing Structure

The financing structure of BBCI, which has been in place since the construction of the bridge began, is as follows:

As can be noted, the ratio of debt to equity (i.e. gearing) is 84:16. With such a high level of gearing, the company faced from the very inception a significant financial risk. Interest on loans and other forms of borrowing has to be paid whether or not a profit is made. This is unlike equity where dividends are only paid when a profit is declared. In addition, funds have to be found to repay the loans as and when they become due for repayment, unlike equity which does not have to be repaid and which remains with the company throughout its life.

During the two-year construction phase, interest payments would have to be taken into account in determining the final construction cost to be amortised over life of the Bridge in the form of annual depreciation charges against income. During the operational phase, such payments are included as current expenditure of the Bridge. It follows that the higher the debt to equity ratio, the higher would be the cost of operation of the Bridge and hence the higher the toll fees. In fact, with interest charges at around 9.7 percent or G$705.7 million annually, this works out to about 58 percent of BBCI’s revenue, based on the 2012 audited financial statements of the company.

The repayment of the loans was to have commenced in 2014 but only interest payments were being honoured. This suggests, given the financial difficulties of BBCI, there might have been a rescheduling of the debts. At the end of 2014, BBCI is reported to have incurred accumulated losses totalling G$1.5 billion. The warning signals that the company was facing financial difficulties were there since then, but nothing was done to address the financial plight of BBCI.

This same highly geared financial structure as that of BBCI was replicated in the construction of the Marriott Hotel and the aborted Amaila Falls Hydro Project. In the case of the former, the debt to equity ratio was 70:30 while in relation to the latter the ratio was 80:20. It is public knowledge that within two years of commencement of operations, Marriott Hotel defaulted in the servicing of its debts to the Republic Bank, forcing the Government to assume responsibility for doing so in order to avoid the Bank levying on the assets of the Atlantic Hotel Inc., the owners of the Hotel. In all three cases, this undesirable mix of financing, overwhelmingly weighted toward debt as opposed to equity, would have resulted in higher construction costs since the cost of capital during the construction phase has to be capitalized and included in the final construction costs, not to mention the cost of servicing the debt during the operational stage. Moreover, funds have to found for the repayment of the debts when they become due for repayment.

In our column as far back as 7 September 2015, we had warned about this undesirable mix of financing for BBCI and suggested that the Company be restructured financially in order to not only reduce costs but also to obviate the need to find funds to repay the loans. In that article, we had also stated that when the Inter American Bank (IDB) was approached to assist in the financing of the cost of construction of the bridge, it was reluctant to do so. The IDB had indicated that it would have been better to upgrade the ferry service. Needless to mention, the then Administration ignored the advice and proceeded with the project.

Without the sight of the current balance sheet of BBCI, it is difficult to ascertain the extent of financial difficulties the company is facing. Accumulated deficits are but just one consideration in determining whether or not the company is a going concern, that is, its ability to operate for the foreseeable future without default in terms of discharging its liabilities as and when they are due. A company can accumulate losses while at the same time having a healthy cash balance due mainly to some items of expenditure not resulting in a cash outflow. One such expenditure is depreciation. The 2010 and 2011 audited accounts of BBCI reflected an annual depreciation charge of $140.5 million. At this rate, after ten years of operation, the accumulated depreciation would be $1.4 billion.

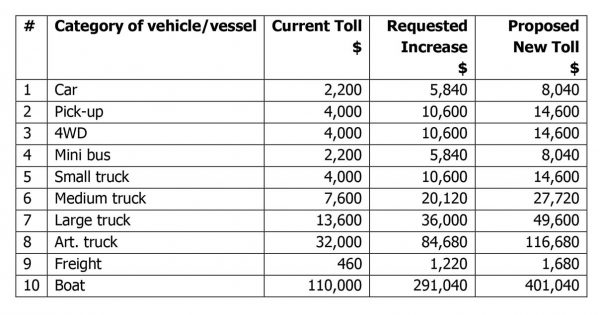

BBCI’s Request for Increases in Toll Fees

BBCI has requested the Government to approve of an increase of 265 percent in tolls for vehicles and vessels using the Bridge, as shown in the table below:

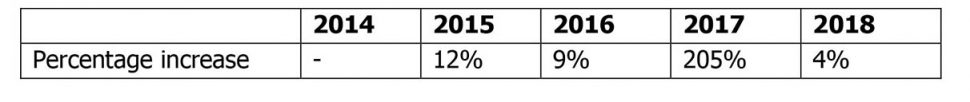

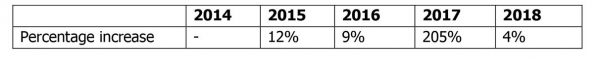

The percentage annual increases proposed for all categories of vehicles and vessels for the period 2014-2018 are as follows:

As can be noted, the proposed increase in tolls for 2017 is more than double the proposed tolls for 2016. BBCI therefore needs to explain on what basis it is requesting such a significant increase in 2017. Could it be that BBCI is trying to garner enough funds to repay the amounts borrowed for the construction of the Bridge? Or is it a case where funds are needed to carry out urgent maintenance works, such as replacing the pontoons? In either case, did the first computation of the toll fees not take into account these two aspects? Is it a case where users are being double-charged for the service? It appears unconscionable that such users are being to pay for what clearly was a flawed financing arrangement for the construction of the Bridge.

Audited accounts, AGM and filing with the Registrar of Companies

A review of BBCI’s website indicated no information about the audited financial statements of the company, when last BBCI held an AGM and whether annual returns were filed with the Registrar of Companies. In 2010 and 2011, BBCI recorded profits before tax of G$137,330 and G$216,794 respectively while depreciation charges and interest on loans and bonds averaged $140.7 million and $704.1 million respectively. According to a Christopher Ram publication of 3 May 2015, BBCI had written to the Registrar indicating that the Minister of Finance had approved of an extension for the holding of the AGM for 2012, 2013 and 2014 until 30 June 2015. It is not clear what the current position is in terms of having audited accounts, holding AGMs and filing of returns with the Registrar.

Conclusion

The BBCI is in serious financial difficulties to continue operating for the foreseeable future since: (i) funds have to be found to repay the loans and bonds that were used to finance the construction of the Bridge; and (ii) urgent maintenance works, such as replacing the pontoons, need to be carried out. The solution is not the more than doubling the rates of toll for vehicles and vessels using the Bridge. As a short-term solution, the Government needs to assume responsibility for carrying out the maintenance works. In the long-run, BBCI in collaboration with the Government should consider the financial restructuring of its operations by either an offer to convert debt to equity. If lenders are unwilling or unable to do so, the Government should repay them and treat the amounts involved as equity in the books of BBCI. In this way, some 58 percent of BBCI’s revenue, which goes towards the servicing of its debts, will be saved.

The Government has announced its desire to use the Public-Private Partnership (P3) model for the construction of the New Demerara Harbour Bridge. One hopes that it will not make the same mistakes as those of the Berbice Bridge and the Marriott Hotel in terms of the financing arrangements. A UK-based non-governmental movement, Jubilee Debt Campaign, issued the following caution about P3s:

In fact, the cost to a government is usually higher than if it had borrowed the money itself, because private sector borrowing costs more, private contractors demand a significant profit, and negotiations are normally weighted in the private sector’s favour. Research suggests that [P3s] are the most expensive way for governments to invest in infrastructure, ultimately costing more than twice as much as if the infrastructure had been financed with bank loans or bond issuance.