Acknowledging that oil exploration agreements he signed with two start-up private operators within the two week-period in the run up to the last general elections look “suspicious,” former president Donald Ramotar says negotiations had started long before.

“I know it looks suspicious but I thought we would have won the elections anyhow and that it was just the continuation of an already started process from 2013,” Ramotar told Sunday Stabroek in an interview last week.

“If the election wasn’t stolen from us, we would have continued along the same trajectory with the same companies, so there was nothing sinister about those signings,” he added.

Days before the May 11th, 2015 general and regional elections, in which his party was voted out after over two decades in power, Ramotar signed a contract with JHI and Associates (Guyana) Inc, which was only registered here on May 4th, 2015.

Another agreement between the government of Guyana and Ratio Energy Limited and Ratio Guyana Limited, the former incorporated in Gibraltar and latter in Guyana, was signed on April 28th, 2015.

According to documents from the Deeds Registry, when JHI was incorporated, it had one director—ousted CGX executive John Cullen, of Lot 37 Amelia Street, Barrie, Ontario Canada, L4M 1M5. Cullen, who is described as a financial executive, is also the Secretary of the company.

The address of the local office was given as Lot A 16-17 Shamrock Gardens, Ogle, East Coast Demerara, the same address as his former CGX co-executive Edris Kamal Dookie, who is also director of the Mid-Atlantic Oil and Gas Inc. This newspaper understands that Cullen and Dookie were both ousted from CGX but that company never explained why.

Another executive of the CGX Team, Dennis Peiters, of Karankawa Trail, Kathy, Texas, replaced current Deputy Director of the Ministry of Natural Resources’ Petroleum Directorate Nicholas Chuck-A-Sang in November, 2015, as one of Mid-Atlantic’s directors.

Mid-Atlantic was incorporated here on April 8th, 2013, with Fazal Hosein of 1124 Paria Avenue, Chaguanas, Trinidad and Tobago, listed as a director. Chuck-A-Sang and the Marriott’s Chairman Hewley Alphonso Nelson were also listed as directors. On October 2nd, 2015, Dookie bought all of the company’s 5,000 shares at $100 each. Chuck-A-Sang ceased being an executive of the company on October 1st, 2015 and was replaced by Glenn Roland Low-A-Chee.

JHI’s website states that the company, which was founded in 2014, is focused exclusively on the Guyana-Suriname Basin, “anchored by the Canje Block, [with] our large exploration license covering over 6,000 square kilometers bordered by world-class exploration companies who have announced plans to spend over $2 billion drilling 10 wells on their license areas over the coming 24 months.”

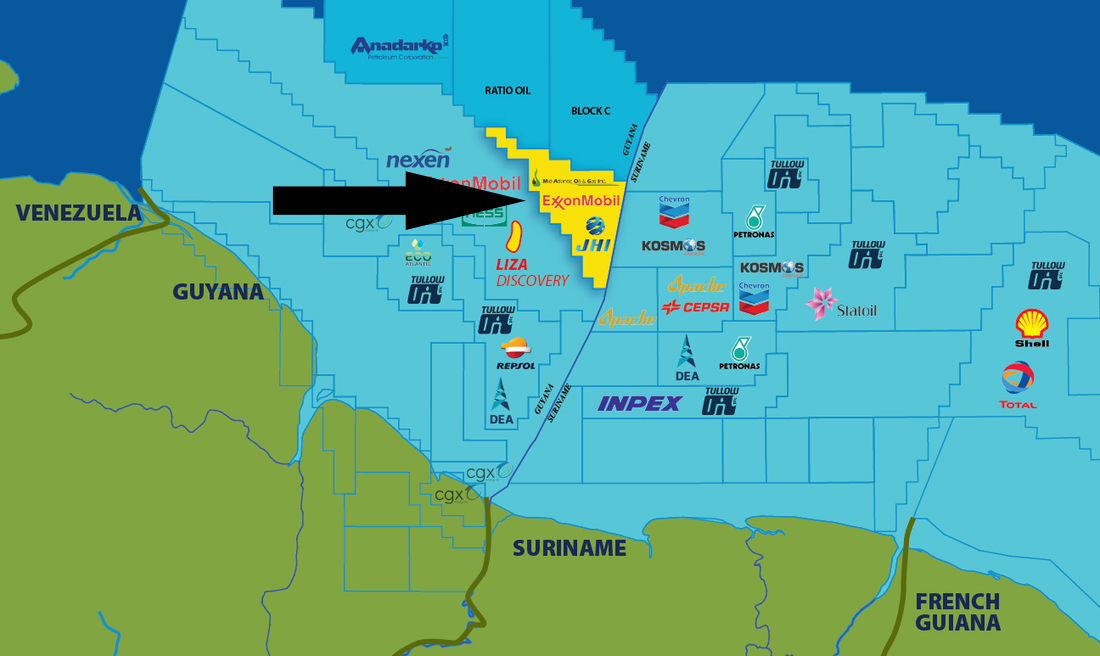

Mid-Atlantic Oil & Gas Inc. (25%) and ExxonMobil (35%), which is Block Operator, also have participating interests in the Canje Block.

In February this year, French oil major Total announced that it had bought a 35% working interest in the Canje Block, in an agreement it signed with both JHI Mid-Atlantic Oil & Gas Inc. The two companies, it said, will retain a shared 30% interest alongside operator ExxonMobil.

On the sidelines of the GIPEX summit held in February, JHI’s Cullen had told this newspaper that his company was “excited” to start works and that updates would be given on the company soon.

Efforts to contact Dookie were futile as calls to his mobile number went unanswered.

‘Appeal’

Ramotar said that while he understands that “the buck stops with me,” his then Minister of Natural Resources Robert Persaud had made a case for JHI and Mid-Atlantic Oil and Gas Inc.

“I don’t know if Robert felt sorry for Dookie but he appealed to me. No, don’t get me wrong—I don’t want anyone saying I’m trying to pass the buck –but he [Persaud] said that he [Dookie] would get reputable partners. He also appealed to me that for one, you know, the amount of work he did in the past here when no one was even having a conversation on oil and so forth. He appealed and explained that the man did a service to the country and he was sticking with it and even when he fall out CGX he stuck and gave us whatever help because this was new to us… and was that kind of appeal. So, I eventually gave in you know,” he said.

In the case of Ratio, Ramotar explained that the company was already registered here and had started negotiations since 2013 but those were suspended later that year following the seizure of an Anadarko vessel by Venezuela.

“The buck stops with me, so I don’t want to hide. They did a lot of work here, I understand, at the time. The section of [the ministry], well they thought they had a good proposal. It wasn’t like they just came just in. Negotiations began with them since 2013 but then the Venezuela issue came up and that had to be put on hold because the area they were looking at was also in deep water… So, they were favourable and I want to get it clear that we had their approval since in 2013. The reason I didn’t sign since then was because of recommendations. The other consideration was the issue with Venezuela. We had some of the hostility and they were making a lot of noises, the ministry of Foreign Affairs,” he said.

Ratio’s Director Ethan Eitan Eisenberg on Friday evening also told attendees at a lecture he gave that the company had interests here since 2013 and had started negotiations to acquire a contract but that had to be halted because of the Venezuela issue with Anadarko. He said that government had summoned all operators to a meeting in Miami to discuss Venezuela’s aggression and how it would affect their operations.

Legal

Officials of both the past and current governments, who did not want to be named, were asked about the granting of licences to companies that did not have the fiscal capacity to undertake oil exploration works. Both stated that once a company shows a financially strong proposal and assures that it will get established investors, there was nothing wrong.

“From the time Dookie came with his proposal, there was some amount of concern but because he when he came to the table with it was with their experts—people with repute that you could see professionally and academically—the team was sound, you understood. John Cullen has a lot of connections and his experience with CGX is testimony to that. They did what they said they would do… it is a pity he and Cullen got kicked out. So, doing business again with him, you knew his capabilities…,” an official of the past administration said.

“Companies are supposed to demonstrate to the state that they are strong financially and can undertake to do what they said they will and proposed to. However, there is nothing wrong with having financiers but they too go through a due diligence process. They can also farm in other big operators and there is nothing wrong with that, according to the law. So as to your question on if it is legal, yes it is legal but it has to pass the litmus test in terms of credibility and all the financial scrutiny and so forth,” an official of the current administration said.

The companies that have blocks in the deep water area, offshore Guyana, are: Repsol and Tullow Oil (the Kanuku Block); Tullow (the Orinduik Block); Anadarko (the Roraima Block); Ratio Oil (the Kaieteur Block); Esso, CNOOC Nexen and Hess (the Stabroek Block); Esso, Mid Atlantic and JHI (the Canje Block); CGX (the Demerara and Corentyne blocks); ON Energy; and Nabi. All were granted contracts during the PPP/C’s time in office.