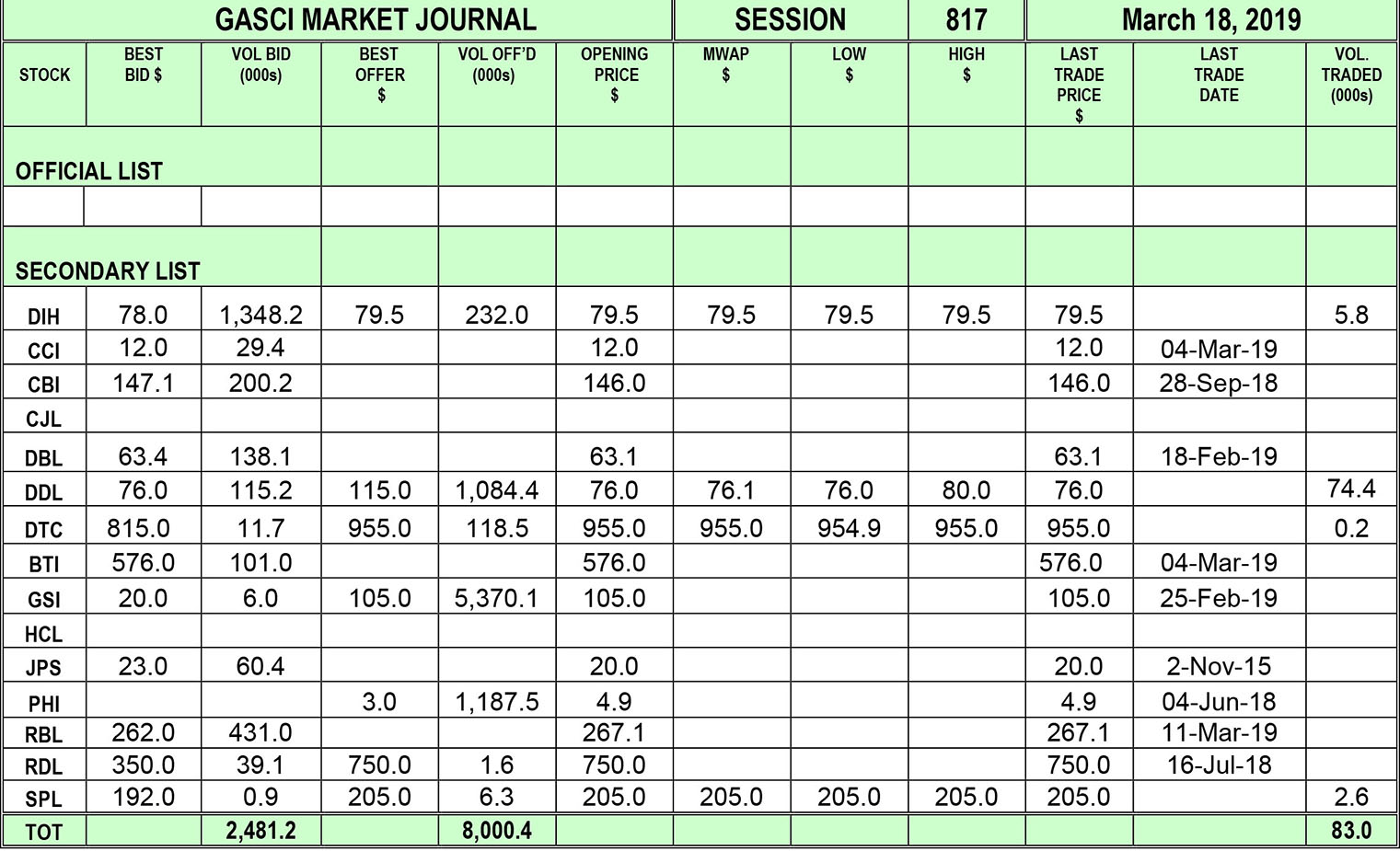

GASCI (www.gasci.com/telephone Nº 223-6175/6) reports that session 817’s trading results showed consideration of $6,848,357 from 82,991 shares traded in 17 transactions as compared to session 816’s trading results which showed consideration of $33,041,257 from 191,293 shares traded in 23 transactions. The stocks active this week were DIH, DDL, DTC and SPL.

Banks DIH Limited’s (DIH) four trades totalling 5,830 shares represented 7.02% of the total shares traded. DIH’s shares were traded at a Mean Weighted Average Price (MWAP) of $79.5, which showed no change from its previous close. DIH’s trades contributed 6.77% ($463,485) of the total consideration. All of DIH’s trades were at $79.5.

Demerara Distillers Limited’s (DDL) five trades totalling 74,356 shares represented 89.60% of the total shares traded. DDL’s shares were traded at a Mean Weighted Average Price (MWAP) of $76.1, which showed an increase of $0.1 from its previous close of $76.0. DDL’s trades contributed 82.64% ($5,659,856) of the total consideration. DDL’s first four trades totalling 2,200 shares were at $80.0, while its fifth trade of 72,156 shares was at $76.0.

Demerara Tobacco Company Limited’s (DTC) two trades totalling 200 shares represented 0.24% of the total shares traded. DTC’s shares were traded at a Mean Weighted Average Price (MWAP) of $955.0, which showed no change from its previous close. DTC’s trades contributed 2.79% ($190,991) of the total consideration. DTC’s first trade of 95 shares was at $954.9, while its second trade of 105 shares was at $955.0.

Sterling Products Limited’s (SPL) six trades totalling 2,605 shares represented 3.14% of the total shares traded. SPL’s shares were traded at a Mean Weighted Average Price (MWAP) of $205.0, which showed no change from its previous close. SPL’s trades contributed 7.80% ($534,025) of the total consideration. All of SPL’s trades were at $205.0.

Best bid: The highest price that a buyer is willing to pay for a security.

Best offer: The lowest price at which a seller is offering to sell securities.

TERM OF THE WEEK

Emerging Markets Clearing Corporation: A clearing house for emerging markets securities used by market dealers and brokers.

Source: Dictionary of Financial and Securities Terms.

Contact Information:

Tel: 223 – 6175/6

Email: info@gasci.com gasci@networksgy.com

Website: www.gasci.com

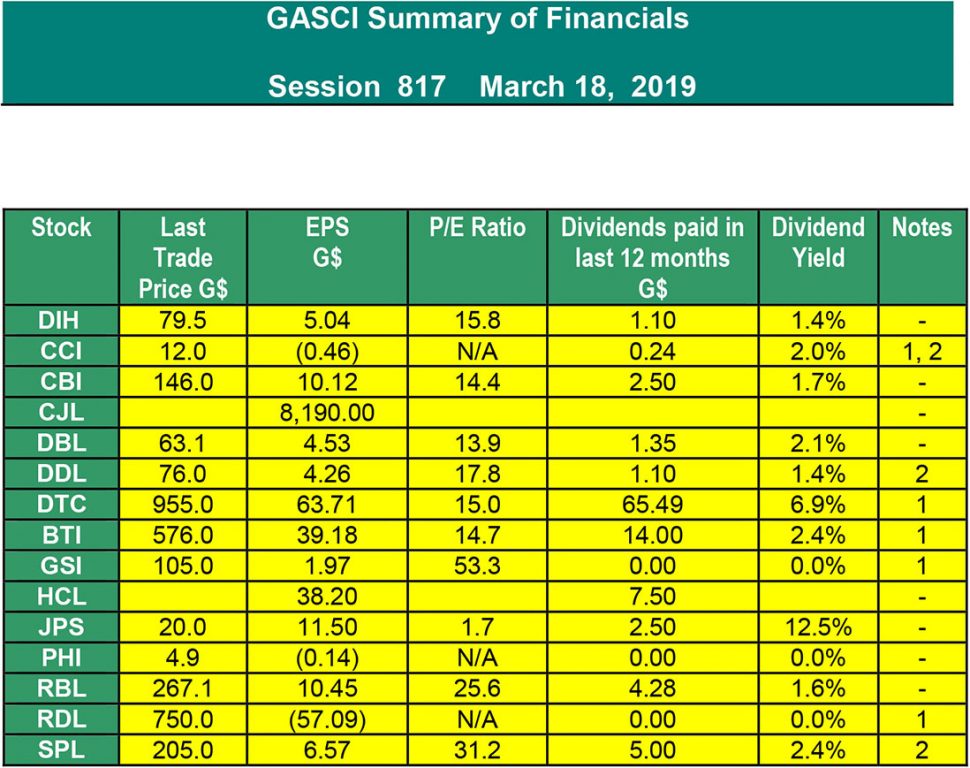

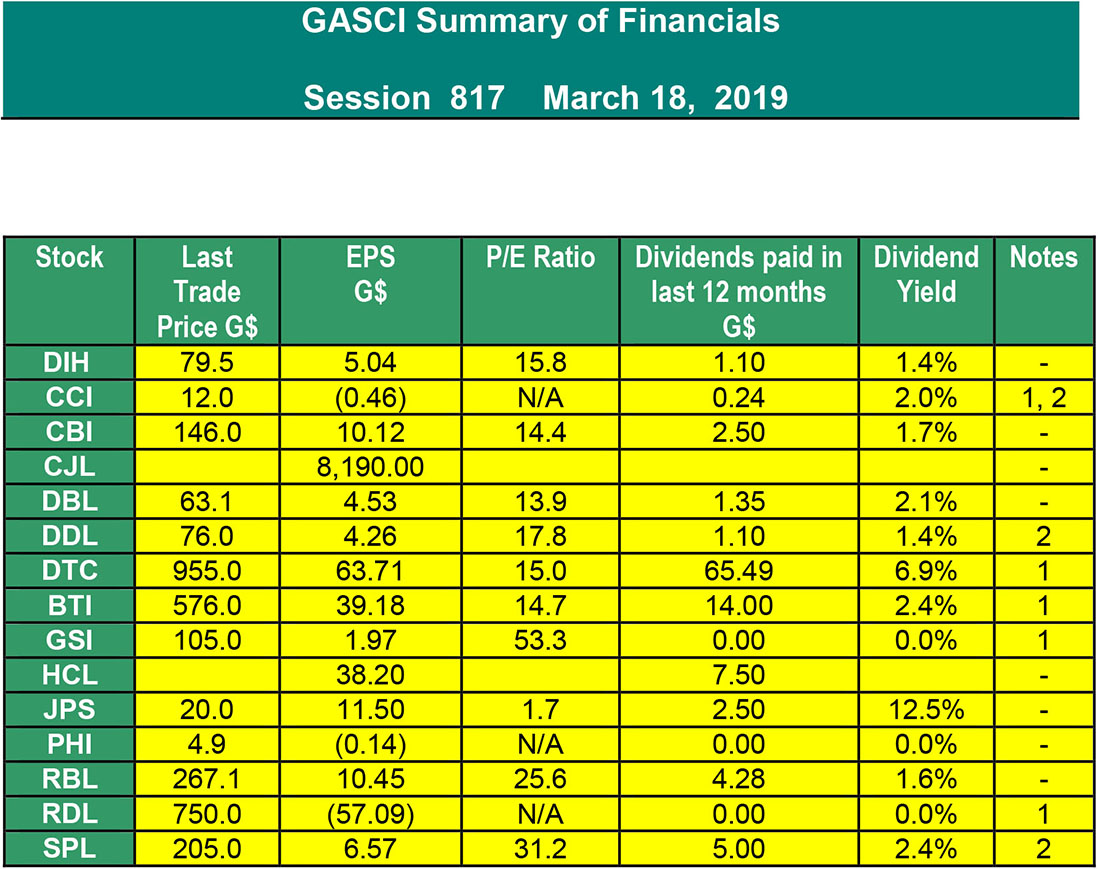

1 – Interim Results

2 – Prospective Dividends

3 – Shows year-end EPS but Interim Dividend

4 – Shows Interim EPS but year-end Dividend

EPS: earnings per share for 12 months period to the date the latest financials have been prepared. These include:

2016 – Final results for CJL and PHI.

2017 – Final results for HCL and JPS.

2018 – Interim results for CCI, DTC, BTI, GSI and RDL.

2018 – Final Results for DIH, CBI, DBL, DDL, RBL and SPL.

As such, some of these EPS calculations are based on un-audited figures.

P/E Ratio: Price/Earnings Ratio = Last Trade Price/EPS

Dividend yield = Dividends paid in the last 12 months/last trade price.

The market information provided here is provided for informational and educational purposes only and is provided on a time-delayed basis. GASCI does not guarantee the accuracy or completeness of any information contained on this page. Although the information has been obtained by GASCI from sources believed to be reliable, it is provided on an “as is” basis without warranties of any kind. GASCI assumes no responsibility for the consequences of any errors or omissions. GASCI does not make or has not made any recommendation regarding any of the securities issued by any of the companies identified here nor the advisability of investing in securities generally for any particular individual.