– Make information on beneficial ownership of companies open to all;

– Ensure that politicians work for all and not only for some; and

– Strengthen the voices of the unrepresented, especially those of women.

For further details, please refer to article at https://voices.transparency.org/ogp-summit-fighting-corruption-and-promoting-inclusion-this-is-how-b9172fcd8264.

The Government has indicated that the signing bonus of US$18 million received from ExxonMobil’s subsidiaries has since been paid over to the Consolidated Fund. There was no official announcement at the time the money was transferred more than two years after it was deposited into a special account at the Bank of Guyana. Neither the State Assets Recovery Agency (SARA) nor the Transparency Institute Guyana Inc. (TIGI) appeared to have been aware of the transfer, based on statements they have issued recently. Nonethe-less, this is good news for those who over the years have fought so hard to ensure strict adherence to the constitutional provision requiring ‘all revenues or other moneys raised or received by Guyana’ to be paid into the Consolidated Fund. Section 38(1) of the Fiscal Management and Accountability Act offers no discretion in relation to the timing of any payment to the Fund since it uses the words ‘fully and promptly’. We must now move to the next stage and arrange for the renegotiation of the agreement with Exxon to enable Guyana to obtain a better deal for the exploitation of its oil resources for the benefit of all of its citizens, as belaboured in several of our previous articles.

The Auditor General has announced that his office would be conducting a special investigation/ value-for-money review of the Cheddi Jagan International Airport (CJIA) Expansion Project which initially started in 2011 but is yet to be completed. Today, we provide readers with some useful information about the Project.

Historical Background

In the 2011 Estimates of Expenditure, the sum of $150 million was allocated for the upgrade, expansion and modernisation of the CJIA. The total project cost was $4 billion to be financed from a grant and a loan from China. However, no expenditure was incurred in that year, presumably because funding arrangements had not yet been finalised.

In November 2012, the Government of Guyana and the Exim Bank of China entered into a loan agreement in the sum of $28.290 billion to finance the cost of the CJIA Expansion Project. The loan is repayable in 31 equal semi-annual installments commencing 21 March 2018 and ending on 17 December 2032. Government funding was estimated at $4.1 billion, giving an overall project cost of $32.390 billion. The planned duration of the project was five years, ending 31 December 2015.

The scope of the Project was vastly expanded from that envisaged in 2011 and included: (i) construction of a new terminal building, aprons and taxiways; (ii) extension of the main runway; and (iii) design and construction of a new car park, internal roads, and handling equipment area. The contract, which included both design and construction, was awarded on 11 November 2011 to China Harbour Engineering Company (CHEC). It was signed in Jamaica by the then Minister of Public Works, following a visit to the Caribbean by a high-ranking official from China. This is unusual, considering that the Permanent Secretary is the accountable officer and not the Minister. That apart, there was no official announcement locally, raising questions about the apparent secrecy of the whole arrangement.

The basis of the award of the contract could not be determined as there was no evidence that competitive bidding procedures were followed, as required by the Procurement Act. There are only two situations where the provisions of the Act are not applicable: (1) if ‘they conflict with any provisions made applicable by virtue of an international agreement’; and (2) in relation to

procurements for national defence and national security. Needless to mention, there was no evidence of any conflict relating to the award of the contract to CHEC. The Act also prohibits any form of discrimination against suppliers and contractors, based on nationality. By Section 5(4), ‘a procuring entity shall establish no criterion, requirement or procedure with respect to the qualifications of suppliers or contractors that discriminates against or among suppliers or contractors or against categories thereof on the basis of nationality’. Therefore, the argument that the authorities were obliged to select a Chinese contractor for the CJIA Expansion Project is without merit.

One recalls the disastrous Skeldon Sugar Modernisation Project that was financed by the Exim Bank of China and involving a Chinese contractor. The same can be said of the failed E-Governance Project, including the One Laptop Per Family Project; and the undue delays in the execution of East Coast Demerara Improvement Project. The aborted Specialty Hospital project financed by the Exim Bank of India and involving an Indian contractor suffered a similar fate where the mobilisation advance of US$4.1 million was not recovered. That contractor had also supplied defective irrigation pumps to the Ministry of Agriculture.

The loan agreement with the Exim Bank of China for the CJIA Expansion Project was not signed until approximately one year after the contract award, which is highly unusual procedure that would have left the Government exposed if the loan had not materialised. The works also did not commence until some 15 months after the contract award. In addition, there was no evidence that a feasibility and other related studies were conducted before the decision was taken to proceed with a project of this magnitude, more especially since borrowed funds are involved. Under normal circumstances, before a loan is granted for a project, whether in government or in business, a feasibility study is usually undertaken to determine the project’s viability. Why this was not done in the case of the CJIA Expansion Project appears inexplicable.

Budgetary Allocations and Expenditure: 2011 to 2019

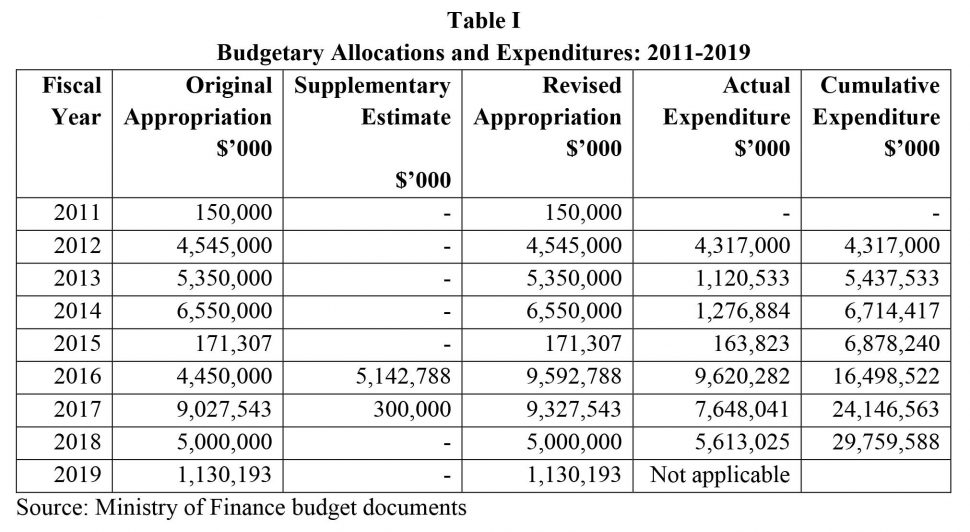

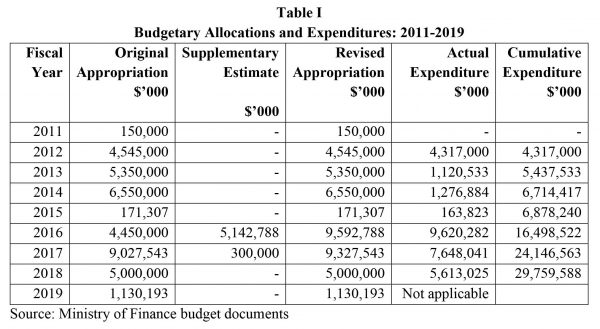

As indicated above, no expenditure was incurred in 2011. In 2012, an amount of $4.545 billion was budgeted for the Project, comprising $4.245 billion to be financed from Exim Bank of China and $300M from the Government of Guyana. Amounts totalling $4.317 billion were expended. Table I shows details of budgetary allocations and expenditure from the commencement of the project to 2019:

Judging from the expenditure incurred in 2015, little work was undertaken during that year due to a change in Administration and doubts as to whether it should proceed with the Project. However, given that almost $6.8 billion, or 21 percent of the estimated cost, had already been expended in addition to other liabilities, the Administration decided to continue with the Project within the framework of the existing cost structure. The Project is expected to be completed this year which means that it would have taken nine years to complete, instead of five years. This delay would have had significant cost implications. In 2019, the cost of the Project was revised from $30.9 billion to $32.664 billion.

Auditing arrangements

Like all government projects, the Auditor General is responsible for the audit of the CJIA Expansion Project and for reporting to the National Assembly and, by extension, to the public at large in relation to his findings and recommendations. Since no expenditure was incurred in 2011, there was no mention of the Project in his 2011 report to the Assembly.

In his 2012 Report, the Auditor General briefly referred to the Project and gave a breakdown of how the $300 million of government funding was expended. However, there was no mention of the basis of the award of the contract and whether any feasibility or other studies were carried out before proceeding with the Project. In relation to his reports for the years 2013, 2014, 2015 and 2016, there was no mention of the Project, raising serious questions as to whether or not audits were carried out for these years. If indeed any such audits were undertaken, it would indeed be exceedingly surprising that there were no findings and recommendations. In his 2017 Report, the Auditor General briefly referred to loan agreement with the Exim Bank of China and gave a breakdown of the expenditure for that year without any further comments.

The Auditor General has now announced that he would be carrying out a special investigation/Value-For-Money review of the Project which both the Government and the Opposition welcome. Concerns have, however, been raised whether his office is the appropriate agency to undertake such a study, considering that it has been providing oversight (or ought to have done so) from the very inception of the Project and there were no adverse comments; and whether his office has the technical/professional competence to evaluate a project of this nature and magnitude.

One recalls the recommendation in the 2015 forensic audit report of the National Industrial and Commercial Investments Ltd. (NICIL) that a transaction audit be undertaken of the entity covering the period 2003 to 2014. The Cabinet had mandated that the Auditor General undertake the audit which would have meant re-opening the audit of the accounts he had undertaken and certified to be in order. Is it any wonder that we are yet to hear from the Auditor General? And was the Cabinet serious in asking the Auditor General to undertake the transaction audit?

The Auditor General has to be realistic about the prospect of whether he can undertake such a complex assignment and whether he can deliver this time round in terms of comprehensiveness, quality and timeliness. If the Auditor General is unable to do so, he should inform the authorities so that alternative arrangements can be made to have an independent, experienced and competent individual or firm with civil engineering background to undertake the assignment.

Conclusion

We fully endorse the view of ‘Stabroek News’ that ‘[g]iven that Guyana has signed on to China’s Belt and Road Initiative, it is imperative that the airport expansion project be rigorously investigated and the lessons learned from it applied to future offers of assistance and projects of this type’. While we may need overseas financing from time to time for certain major developmental projects, it must not be at the expense of compromising on our constitutional and legislative arrangements, in particular, our procurements laws and regulations.