Giving an overview of the Wales Gas to Shore Project, the government yesterday emphasised profitability while announcing that $400 million has been set aside for land compensation and that ExxonMobil will be repaid US$55 million per annum for 20 years from cost oil, for its US$1.1 billion infrastructure input.

“The Government of Guyana’s payment to Exxon coventurers for its US$1 billion investment in the pipeline will be US$55 million per annum over a 20-year period. This payment is fixed over the 20-year period and will have no adjustment. It is calculated to allow Exxon COV’s (coventurers) to recover their investment of US$1 billion over the 20 years,” head of the Gas-to-Energy Taskforce, Winston Brassington yesterday revealed during a PowerPoint presentation on the project, as the Guyana Energy Conference entered day two .

“The US$1 billion includes all costs to construct the pipeline offshore and on-shore, to end at the Wales Power Plant; enabling works… laydown yard, site prep on 100 acres; supervision by Exxon, and contingency…,” he added.

Positive that “this is a very good deal,” Brassington gave a breakdown of conversion on the annual payment. He said it “is converted to a unit price per gas, calculated at 50 MMCFD [one million cubic feet per day] x $2.40 for MMBTU [one million British thermal units] x 365 [number of days in a year] x 1.26 [conversion factor of MMBTU to MMCFD] and that is how we came up with the US$55 million.”

“We are paying US$55 million and getting a value of about 10 times that.”

And pointing to the project structure, the Task Force Head said that a special purpose company – Guyana Power and Gas Inc – would be set up to manage the project for government.

ExxonMobil has projected that the MMBTU/MMCFD will remain stable over the 20-year delivery period.

Brassington informed that the completion of commercial agreements and a Final Investment Decision on the project will be completed by the end of next month, as he emphasised the project will be completed in the scheduled timeframe of end of 2024.

“We agreed we would have the project online by end of 2024. We agreed on the broad financial framework, with the pipeline being funded from cost oil.”

All of the various contractors and subcontractors for the project will be paid from the US$1 billion. “We believe that this US$1 billion will be adequate to get the project done, particularly that all of the works have almost been awarded.”

And as at the end of December 2022, progress details showed that an Engineering, Procurement and Construction model had been selected and a contract was signed in the same month.

The supervisory contractor had also been selected based on a competitive tender and that contract as executed in Jan 2023. The ESIA (Environmental and Social Impact Assessment) process is completed and this included public scoping exercises on Terms of Reference (TOR) for ESIA; submitting the ESIA submitted; having the review of the ESIA completed, and getting an environmental permit issued to Exxon. An Interim Construction Permit has also been issued to the special purposes company that will be set up to manage the project in the Guyana Power and Gas Inc.

Sizing of the pipeline remained fixed at 12” with 50 MMCFD, which Brassington referred to as “rich gas” that will be guaranteed initially. He said that the pipeline capacity will be no less than 120 MMCFD but it was still to be decided what amounts would be transported.

Set aside

On-shore, he said that the pipeline route has been selected, route survey completed, and private lands acquired under the Acquisition for Public Purposes Act at end of 2022 giving right of way for the on-shore pipeline.

“We completed the pipeline route and we went through a process of surveying that out and completing the acquisition of land that we needed from private persons. We had 75 acres of land from about 66 persons. We have set aside about $400 million to pay these persons. The good thing about this is that there were only two structures along the route.”

Turning to expected savings from the project, he compared current and past costs of heavy fuel oil this country uses to that of the gas from the project. He stated that in 2022, GPL spent over 15 cents per kWh (kilowatt hour) on Heavy Fuel Oil (HFO). At this price, GPL would pay US$390 million… The new 300 MW (megawatt) power plant, he reasoned, will use gas instead of HFO to generate power. “If we take a look at this power plant using gas what we would pay for the price of fuel it would cost us close to US$400 million… that is what we would be paying in 2022.”

If one excluded the additional value of the NGL (natural gas liquids), the US$55 million annual payment will convert to approximately 2 cents per kWh, Brassington explained, saying that the figure for the gas can be compared to US15 cents with HFO. “Even if we were to use lower prices for the NGL we still are getting multiple returns from this. And of course, the transformational impact this would have on Guyana, cannot be understated,” he contended.

The Government of Guyana has publicly stated that the price of generation including the pipeline payment, the operating cost of the power plant, and the recovery of the US$759 million capital cost of the pipeline and NGL plant, will deliver power at less than 5 cents per kWh.

With Guyana’s import price in 2021 averaging over US$1.6 per gallon of cooking gas, and over US$2.3 per gallon of LPG (liquid propane gas), he said that it is more than feasible to invest in the project.

Government believes that the annual payment of US$55 million to the COVs will allow Guyana to generate power that would have cost almost US$400 million, using 2022 prices, and deliver approximately US$100 million in liquids using 2021 prices.

It is why Brassington said that at any reasonable range of price possibilities and demand possibilities, the economic savings for the nation is considerable. In any event, government can reduce electricity prices to less than half. Currently the cost is around US 24 cents per kWh. “Should we look at what our projected cost for generation in 2026 would be, we are looking at costs of about .4cents… the cost of generation will be less than five cents,” he projected.

ExxonMobil last week said that it will be selling the 50 million cubic feet of gas (50 MMCFD) per day it brings onshore to either the government or the private sector company that will distribute the power at the Wales gas-to-shore facility.

“We will be selling the full 50 million cubic feet a day to the government or a government entity that is being established, in order to receive the gas and put it through the power station,” Routledge told a press conference hosted by his company at its Duke Street, Georgetown office.

An agreement was signed last July with government for the project, he disclosed, saying that while the pipeline infrastructure has been estimated to be around US$1 billion, his company awaits a shared review with government before making a Final Investment Decision (FID).

Routledge explained that the cost recovery mechanism for his company’s investment in the infrastructure for this country is outlined in the framework of the agreement. He explained that ExxonMobil was making an investment in order to transport the gas onshore and it is incidental to the original developments offshore.

Government has said that the project is expected to be completed and delivered by the fourth quarter of 2024, to achieve commissioning and testing of the 300 MW power plant by the end of 2024. It aims to employ approximately 800 workers during the peak construction stage and 40 full-time workers during the operation phase.

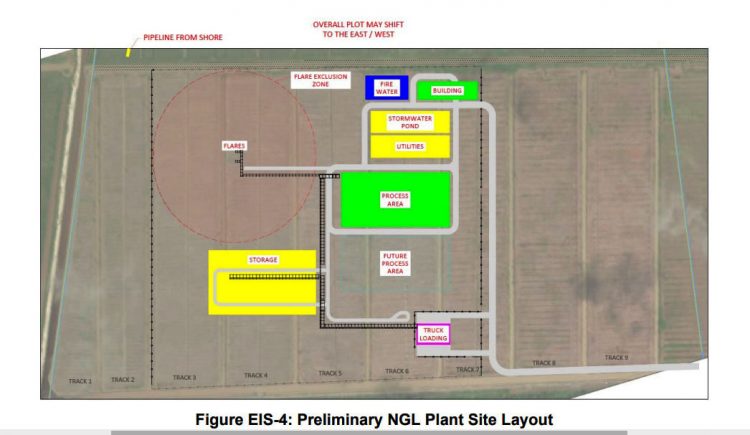

The project will be executed in three phases – construction, operation and decommissioning. It entails three aspects as well – 1) an offshore pipeline which is approximately 220 kilometres of a subsea pipeline extending from new subsea tie-ins at the Destiny and Unity FPSOs in the Stabroek Block, to the proposed shore landing located approximately 3.5 kilometres west of the mouth of the Demerara River; 2) onshore pipeline that is a continuation of the offshore line and extends about 25 kilometres from the landing site to the NGL plant; and 3) the NGL plant and associated infrastructure that will be located about 23 kilometres upstream from the mouth of the Demerara River on the west bank.

Both the Liza Destiny and Liza Unity floating production storage and offloading vessels, which are operating in the offshore Stabroek Block, have pre-installed facilities to allow for the export of the associated gas along with crude production.