By David Papannah

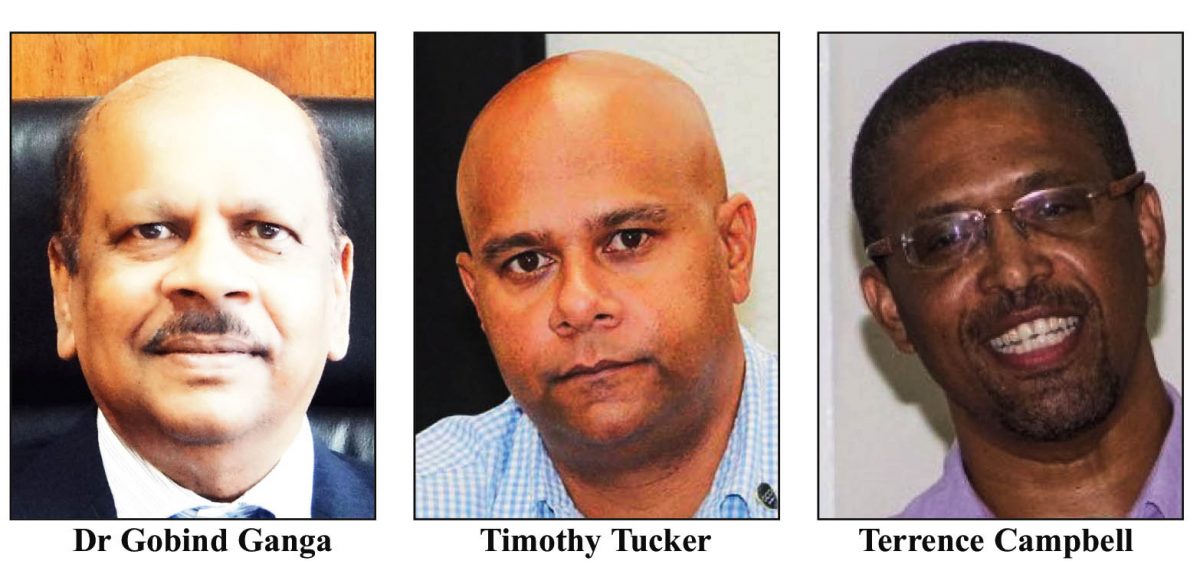

Central Bank Governor, Dr Gobind Ganga, has refuted reports of a shortage of foreign currency, specifically the US dollar, at local banks, following complaints from the business community. However, des-pite his assurances, businesspersons have called for a full-fledged investigation into why they are constantly faced with this issue.

“There is no shortage. What you will probably have is an instantaneous shortage but everyone has enough…” Ganga yesterday said in an invited comment. He noted that there might also be some hoarding at banks but there isn’t much that can be done to address it.

While businesses have been reporting to the Georgetown Chamber of Commerce and Industry (GCCI) of a shortage, President Timothy Tucker experienced it for himself last week while at the bank.

In a Facebook post Tucker stated, “Got to love doing business in Guyana. Bank of Guyana: There’s no USD shortage. Me: A waiting Two weeks for a Commercial Bank to get USD for a wire transfer to pay a supplier.”

His experience was similar to that of businessman, Terrence Campbell, who also said that just about a week ago, one of the local banks could not process a payment of just over US$90,000 to his supplier.

He said that he was forced to ask the supplier to release the goods with the understanding that the payment will be facilitated in a few days.

“The bank had to email the supplier giving them the assurance that the money will be paid in a couple days. This is what we had to do to get the supplies needed,” he pointed out.

Stabroek News understands that businesspersons have been reporting the shortage since last September, even at a time when the local banks were saying there was no shortage.

According to Campbell, at a time when Guyana is attracting foreign investment, specifically through the oil & gas sector, it begs the question, “What is contributing to the periodic shortages.”

“The Bank of Guyana has to stop being so defensive and say what is going on. I think some sort of investigation is warranted to determine what is causing this steady shortage. It is only after an investigation we can see policy changes and have this issue addressed,” Campbell posited.

He went on to say that if the shortages continue, the Guyanese people must know what the macro-economic implications we face are, and how they can be addressed.

Campbell added that he is concerned that while investors are coming and one would expect them to bring their money, they are borrowing from local banks, putting local businesses at a disadvantage.

Stabroek News was told that some banks are giving foreign investors priority and in some cases hoarding to facilitate large payments for clients. It was explain-ed that due to agreements with foreign banks, the local banks will honour the agreement to the benefit of the customer.

He questioned too, whether there is some sort of revenue leakage in the country given that billions were allegedly sent to China via money laundering.

Meanwhile, in an interview with Stabroek News, Tucker stressed that the matter is of concern to the GCCI as members have been repeatedly complaining of US currency shortages. He stated that during a meeting with the Bankers Association last year, there was a seasonal shortage as businesses were wiring transfers for the purchase of goods to be imported for the Christmas season.

“At the pre-budget meeting with the private sector they admitted there was a shortage but the Bank of Guyana has said that there is no shortage currently.”

Within the last six months, Tucker stated that the complaints of a shortage have been significant.

Off-season

“We are in an off-season, it is a week after the energy conference, when we had foreigners here conducting business and you would think the banks would have foreign exchange, but that is not the case. We are still being told there is a shortage,”

As such, he called on the Bank of Guyana to implement modern monetary policies that will address these shortcomings and facilitate the movement of cash among banks.

He also suggested that the Central Bank should monitor how banks are utilising their foreign exchange and whether they are using monies generated from Guyana to fund external operations and investments.

“The Bank of Guyana needs to look at the entire sector and its needs and develop monetary policies and monetary regulations. They cannot be a reactive body.”

Tucker called on the Bank of Guyana to encourage the interbank market sale of foreign currencies and make regulations specific to this.

However, Ganga in rebuttal said they have already been facilitating interbank markets and the banks have been utilising the mechanism to facilitate the sale of foreign currencies.

The shortage of US$ is even more puzzling as large amounts of that currency from oil proceeds were tapped from the Natural Resource Fund last year and the beginning of this year. This year roughly US$1b will be filtered into the economy from this Fund.

Analysts have said that that there are clear imperfections in the foreign currency market here and greater interventions by the Central Bank may be needed.

Businessman, Frank Sanichara, in a recent Facebook post also complained of not being able to clear his goods due to the shortage of foreign currency.

In his post he wrote, “My products are stuck at the wharf until the supplier receives payment… banks can’t do wire maybe next week… plus a local company is demanding we pay local shipping and handling charges in crisp US dollars …”

Ganga, in response to the demand for US currency from the local company, said it is an illegal act as local businesses require an approval from the Bank of Guyana and the Ministry of Finance to conduct trade in foreign currency.

Under Tucker’s post, Financial Analyst, it stated, “The bank is aware but denying it for some strange reasons. I can’t get into the details but I’ve personally been fighting this. Been monitoring since 2017. I’ve raised it at the highest level. The buck stops at the regulator and the regulator, instead of doing its job, have been transferring key functions it ought to carry out, to the commercial banks. The BOG needs to step up.”

Last September when Ganga dismissed claims that there was a shortage of United States dollars locally, he stated that the country’s net reserves stood at over US$120 million.