Citing increased reinsurance rates to the Caribbean market, the Insurance Association of Guyana (IAG) today said that property premium rates will rise on all new applications with effect from April 1st, 2023.

In an advertisement in the Stabroek News, the IAG said that rates will also be increased on all policies being renewed beginning June 1, 2023.

It said that these increases will come with “absolute minimum rates for residential, light commercial, medium to heavy commercial and industrial risks”.

The IAG comprises:

*Assuria General (GY) Inc

*Caricom General Insurance Company Limited

*CG United Insurance Limited

*Demerara Mutual Fire and General Insurance Company Limited

*Diamond Fire & General Insurance Inc

*The Guyana and Trinidad Mutual Fire Insurance Company Limited

*North American Fire and General Insurance Company Limited

*Premier Insurance Company Inc

*The New India Assurance Company (Trinidad and Tobago) Limited

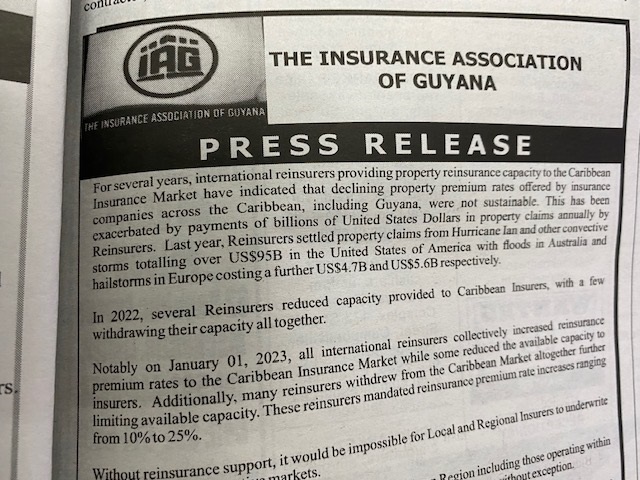

The IAG noted that reinsurers had been affected by the payment of billions of US dollars to settle claims for hurricane and storm damage. In 2022, several reinsurers reduced capacity provided to Caribbean insurers with a few withdrawing capacity all together. Then on January 1st, 2023, the IAG said that “all international reinsurers collectively increased reinsurance premium rates to the Caribbean Insurance Market while some reduced the available capacity to insurers. Additionally, many reinsurers withdrew from the Caribbean Market altogether further limiting available capacity. These reinsurers mandated reinsurance premium rate increases ranging from 10% to 25%”.

As a result, the IAG said that all insurance companies across the Caribbean are compelled to hike premium rates without exception.

“Though your Insurers are implementing measures to absorb some of the increase in reinsurance premiums, it would not be possible to absorb the full amount”, the IAG stated.