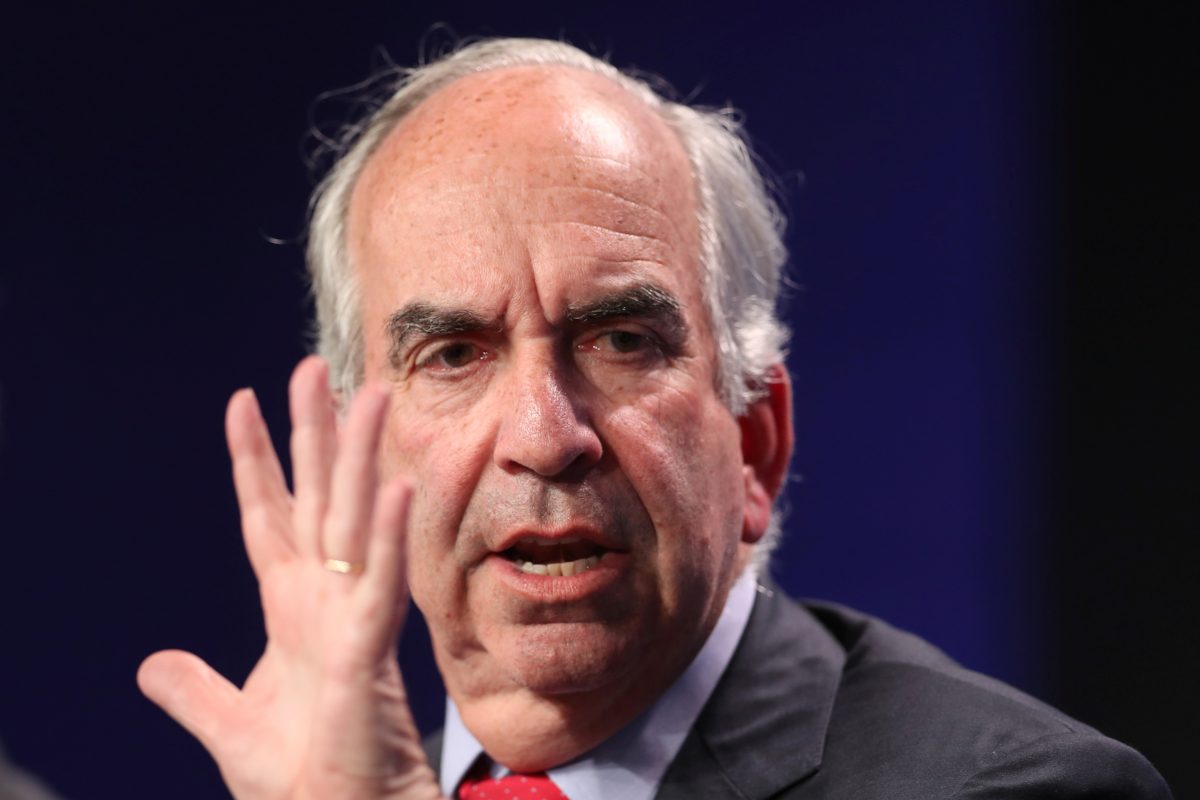

HOUSTON, (Reuters) – U.S. oil producer Hess Corp. (HES.N) expects an increase in cash flow of 25% per year for the next five years with oil remaining about $75 per barrel, Chief Executive John Hess told an investor conference on Thursday.

The increase will stem primarily from its low-cost oil production in Guyana and in the Bakken shale field in the United States, he told investors at the JP Morgan Energy, Power and Renewables conference.

Up to 75% of that annual free cash flow will be returned to shareholders, he said.

The company, which holds a 30% stake in Guyana’ Stabroek block operated by Exxon Mobil Corp. (XOM.N), expects oil production from the next three platforms planned for Guyana to exceed designed capacity.

The first two production vessels can reach a combined peak production of 400,000 barrels per day (bpd) of oil and gas, against a designed capacity of 340,000 bpd, thanks to reservoir performance, he said.

If the expectation for the next three platforms is confirmed, total production would exceed the 1.2 million barrels per day of oil and gas projected by 2027.

The consortium, in which Exxon has a 45% stake and Chinese CNOOC a 25% stake, is negotiating with Guyana’s government for a one-year extension to 2027 of the oil exploration license for Stabroek block, Hess said.

The group is planning to move exploration to the Northwest of the block in the next 12 to 24 months, away from the big oil accumulation discovered so far in the Southeast, he said.

“We are going to be starting to lengthen our horizons to look at potential other Wildcats,” he said.

The partners also plan to explore natural gas in the Southeast region a few years down the road, he said.

Hess said the group is ready to relinquish 20% of the Stabroek block, a contract requirement and it will not impact to future production. Guyana’s government plans to put the areas back on the market.

“We pretty much already have identified the 20% acreage that we would relinquish and it’s nothing material, nothing prospective,” he said. “We are ready for that.”