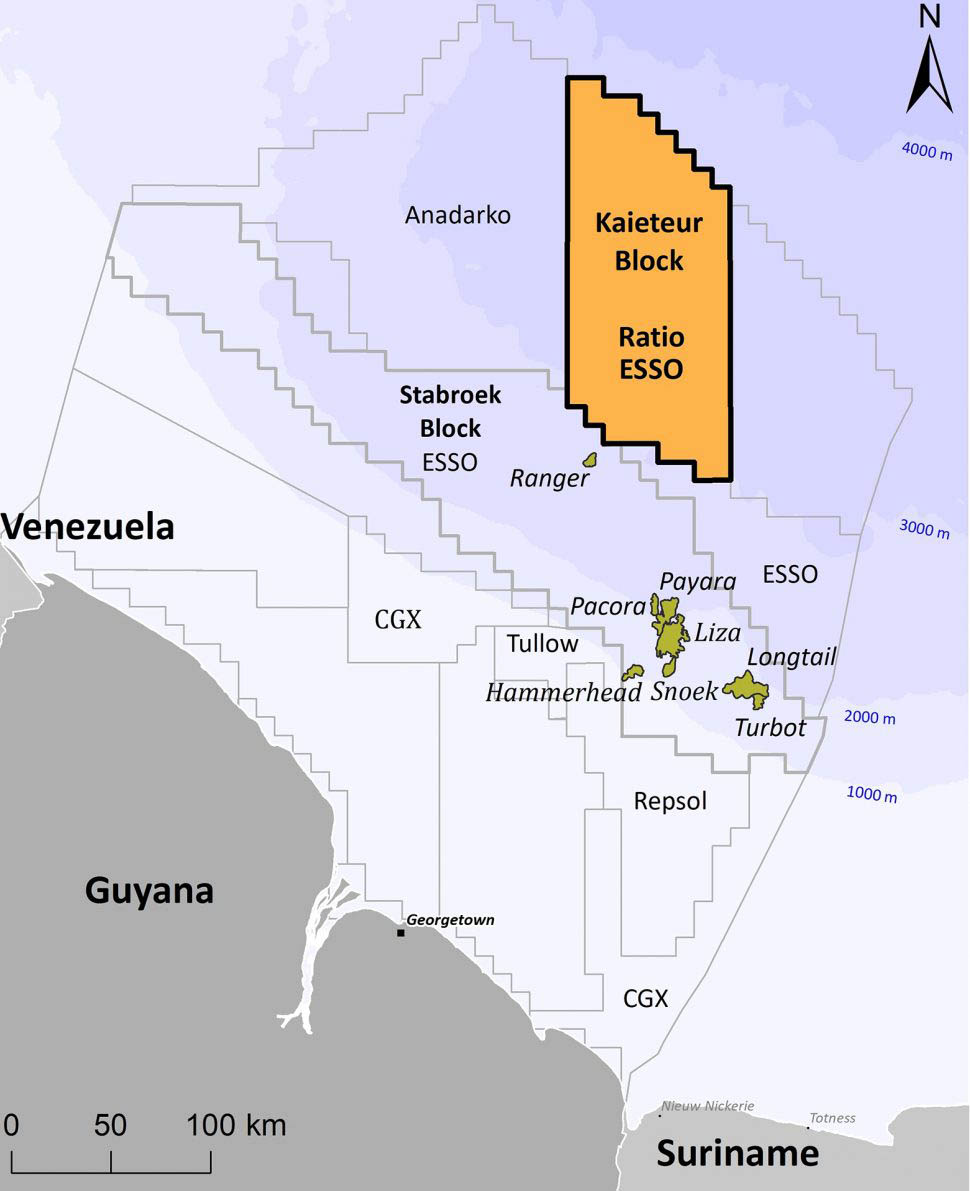

In a decision to focus on its Stabroek and Canje Blocks here, ExxonMobil yesterday announced that it has withdrawn its interests from the 3.3 million-acre (13,535 square kilometers) Kaieteur Block.

“ExxonMobil Guyana has exited the Kaieteur block offshore Guyana, with participating interest assigned to Ratio Guyana Limited and Cataleya Energy Limited; Ratio is anticipated to assume the role as operator,” the company said in a statement yesterday.

“Our exploration efforts and discovery of oil in the Kaieteur block have highlighted Guyana’s offshore potential. Our withdrawal from the Kaieteur block has no impact on our commitment to seeking further exploration and development opportunities and to generating additional value for the government and people of Guyana. This includes our accelerated development and production in the Stabroek block, where we are targeting six FPSOs by the end of 2027, bringing Guyana’s production capacity to more than one million barrels per day,” it added.

The company told Stabroek News that “the handover is still in progress with final documentation being sorted” and the decision was taken because “we’re looking to focus on Stabroek and Canje [operations].”

The Canje Block in which the company has a 35% interest, is adjacent to the Stabroek Block, and it has already scheduled drillings. The remaining stakes in the block are with French oil major, Total, with 35%; JHI Associates 17.5%; and Mid Atlantic Oil and Gas 12.5%.

ExxonMobil’s statement followed a report on Wednesday from shareholder in Ratio Petroleum – Westmount Energy – which said that “ExxonMobil has now decided not to commit to drilling a second well on the Kaieteur Block 1 and that both ExxonMobil and Hess Corporation have elected to withdraw from the Kaieteur Block and return their participating interests to the original Kaieteur Licence holders, Ratio Guyana Limited, and Cataleya Energy Limited.

“The parties will now seek government approval to reassign the participating interests, so that Ratio Guyana Limited and Cataleya Energy Limited will each retain a 50% participating interest, and appoint Ratio Guyana Limited as the operator of the block,” the statement added.

The statement pointed out that the current Kaieteur Block participating interests are as follows: Esso Exploration and Production Guyana Limited 35% (operator); Ratio Guyana Limited 25%; Cataleya Energy Limited 20% and Hess Guyana (Block B) Exploration Limited 20%.

It said that after reassignment of the participating interests, the revised Kaieteur Block interests will be: Ratio Guyana Limited 50% (operator), and Cataleya Energy Limited 50%.

It is also noted that the announcement by Ratio Petroleum states that under the terms of the Kaieteur Petroleum Agreement, and upon submission of an application to enter the second extension, Period 2, the participating interests on the block will have until February 2025 to commit to drilling a well. Furthermore, it is noted that Ratio Petroleum is seeking a farm-down of participating interests and operatorship and in this context, is already in discussions with major oil companies with a view to bringing a new entrant or entrants to the block.

“In this regard, it is also of note that the two deepwater blocks (D1 & D2), immediately adjacent to the Kaieteur block, have been the subject of at least one application during the recent Guyanese Bid, Round 3, which offered acreage under less benign fiscal terms than the original Kaieteur Block terms,” Westmount said.

Tanager-1

Noted was that in 2020, the first well drilled on the Kaieteur block, Tanager-1, evaluated a number of plays – encountering 16 metres of net oil pay (20° API oil) in high-quality sandstone reservoirs of Maastrichtian age and confirming the extension of the Cretaceous petroleum system and the Liza play fairway outboard from the prolific discoveries on the neighbouring ExxonMobil operated Stabroek Block. The well was reported as an oil discovery which is currently considered to be noncommercial as a standalone development. Tanager-1 also encountered high quality reservoirs in deeper Santonian and Turonian plays, though interpretation of the reservoir fluids in these intervals was reported to be equivocal and required further analysis.

Westmount holds approximately 5.26% of the issued share capital of Cataleya Energy Corporation, the parent company of CEL and circa 0.04% of the issued share capital of Ratio Petroleum, the ultimate holding entity with respect to Ratio Guyana Limited.

It said that previous announcements by Ratio Petroleum indicate that under a farm-in agreement executed with ExxonMobil in 2016, the original Kaieteur second well prospect nomination date was 22nd August, 2021, with any drilling consequent to this decision to commence within nine months of the nomination date. The prospect nomination date was subsequently extended twice by agreement to 22nd March, 2022, and again to the 2nd October, 2023.

The Kaieteur Petroleum Agreement is currently in the first extension period, which began on February 2, 2021 and lasts for 3 years.

Circumstances of its buying into the operations of both the Kaieteur and Canje blocks have come in for much scrutiny. This is because months after the signing of its renegotiated Stabroek Block Production Sharing Agreement (PSA) in June 2016, the company bought shares in both the Canje and Kaieteur blocks. The Canje and Kaieteur Blocks had been controversially awarded in 2015 just prior to Exxon’s first major oil strike in the Stabroek Block. The small companies that snagged the rights did not have the required capital and expertise to explore the blocks.

Of note, according to Guyana Geology and Mines Commission (GGMC) records, was that ExxonMobil and its then partner in the Stabroek block, Royal Dutch Shell, relinquished the area that subsequently became the Canje block in two separate transactions in June of 2010 and June of 2012.

The Canje Block was part of the total acreage awarded to ExxonMobil in the original 1999 PSA when the areas were simply named after the first four letters of the alphabet. Shell had first given up its share in 2010 indicating to the Government of Guyana that it was changing its investment strategy.

ExxonMobil would in 2012 also let the area be returned to the state as part of the relinquishment agreement under the 1999 PSA. ExxonMobil is now back in the Canje Block as a result of a farm-in deal.