Low: `The fact is, if they have to change the rules so quickly, they didn’t have a realistic plan in mind of how to spend government revenue. What they are saying is, presumably, they see more and want more to spend’

The Opposition APNU+AFC will not be supporting proposed changes to the Natural Resource Fund Act if it means amendments to merely increase withdrawal amounts, Opposition Leader Aubrey Norton says.

The Opposition believes it will be to allow for more monies to be withdrawn and to increase this country’s debt ceiling, with this only adding to “wanton spending,” “wild borrowing,” “recipes for corruption,” and “less funds for intergenerational savings.” Accordingly, in view of this perspective, it will also not support an increase in the external and domestic debt ceilings.

And while the government hastens to assure that both the proposed Natural Resource Fund (NRF) changes and the increase in Guyana’s debt ceiling will not negatively impact this country’s economy or contribute to the Dutch Disease affecting the country, the Opposition holds a different view.

With regard to NRF changes, Norton told the Sunday Stabroek that the NRF Act remains “fundamentally flawed” as to date “no one can say how much monies have been spent from the fund on specific projects.”

“We have a problem with the NRF [law] to begin with because, as I said, it is designed in a way that it is transferred to the Consolidated Fund, yes, but to say $1 million of it went to this road or that bridge… that does not happen,” he added.

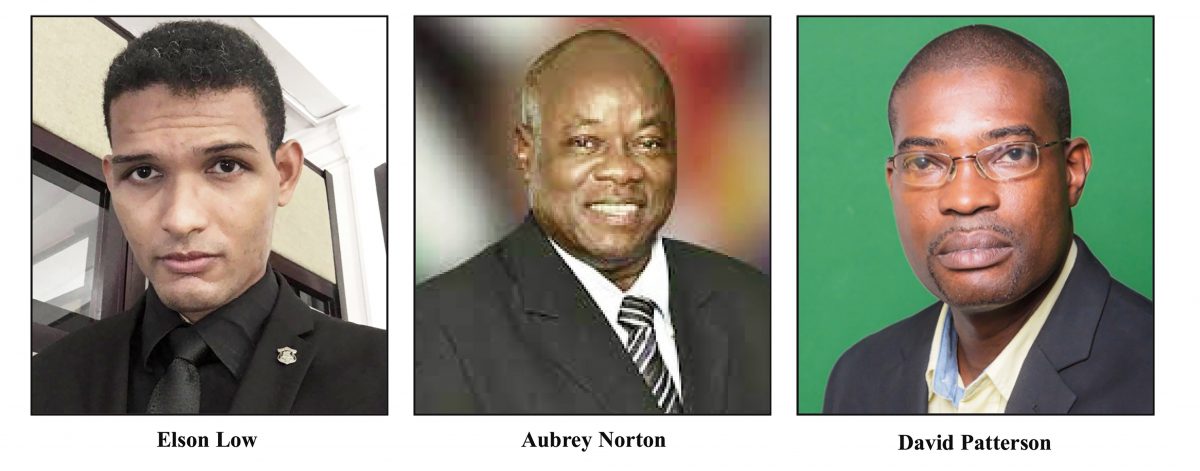

He echoed the views proffered by fellow parliamentarian and economist, Elson Low, who Norton says shares the view of the APNU+AFC.

“There are a couple of considerations which I think many Guyanese should find troubling. Only after a couple of years after this law was passed, they are coming back to change it. This demonstrates that the government has no plan or financial structure in mind when it comes to managing the finances of Guyana,” Low told this newspaper.

“As far as the NRF is concerned there has not been a sudden change here in Guyana that warrants an increase for monies and the need to change the law. The fact is, if they have to change the rules so quickly, they didn’t have a realistic plan in mind of how to spend government revenue. What they are saying is, presumably, they see more and want more to spend,” he added.

Alliance For Change parliamentarian and Opposition point person on oil and gas related matters, David Patterson, also expressed concern at the intent by government to change the NRF laws. He too believes it will be to increase spending so that from this year there will be more monies disbursed from the funds into the state coffers, giving government an opportunity to spend without scrutiny.

“The main reason, you will see, is to get their hands on more money from the NRF…,” Patterson opined.

Projected

During his presentation of the 2024 Budget, Senior Minister in the Office of the President with responsibility for Finance, Dr Ashni Singh, disclosed plans for a revision of the NRF withdrawal rule and a hike in the domestic and external debt ceilings.

He announced that for the year 2023, the Fund received US$1,398.9 million in profit oil, US$576.6 million from Liza Destiny and US$822.3 million from Liza Unity. With respect to royalty payments, US$218.1 million was received from the Stabroek Block operator. Further, in keeping with stipulations in the NRF Act, he said that with the amount approved by the National Assembly to be withdrawn in 2023, US$1,002 million was extracted to finance national development priorities.

“In 2023, US$1,617 million in petroleum revenue was deposited into the Fund, and at the end of the year the overall balance, inclusive of interest income, stood at US$1,973.5 million. Mr. Speaker, the sale of our carbon credits will contribute $43.7 billion to Budget 2024, in addition to a $240.1 billion transfer from the NRF to the Consolidated Fund this year,” Singh stated.

“Mr. Speaker, this year, with three production platforms operationalised, it is projected that there will be 202 lifts of crude oil from the Stabroek Block, 25 of which are estimated for Government. Consequently, earnings from the Government’s share of profit oil are estimated at US$2,078.9 million in 2024, while royalty payments for the year are projected at US$319.9 million. Additionally, based on 2023 deposits, an estimated US$1,154.3 million or $240.1 billion can be withdrawn from the NRF in 2024 and transferred to the Consolidated Fund to support the country’s development agenda,” he added.

The Finance Minister then spoke about optimising the financing mix and said that the government will be proposing changes to the NRF law.

“Mr. Speaker, this Government is firmly committed to safeguarding the gains we have made in achieving fiscal sustainability and in managing the public finances prudently. In this regard, in a global environment where interest rates have climbed by over 500 basis points in the last three years, it is imperative that we maintain a flexible approach to financing the accelerated transformation agenda, which includes a ramped-up PSIP [Public Sector Investment Programme] and accelerated delivery of social services and social safety nets to improve the lives of all Guyanese. These circumstances require an optimal and dynamic financing mix, taking into consideration the volume of financing mobilised with the cost of that financing,” he said.

“With this in mind, our Government will be proposing the following for consideration and approval by this Honourable House: An increase in the domestic and external debt ceilings, which will provide the flexibility needed to optimise on the financing mix while at the same time safeguarding our debt sustainability. A revision to the NRF withdrawal rule which, once approved, will result in an upward revision to the NRF withdrawal amount to take effect from this fiscal year. The revised withdrawal rule will retain the important feature that, as production and revenue ramp up further, an increasing share of the inflows into the NRF will be saved relative to the share transferred to the Consolidated Fund to finance national development priorities.”

Hikes

On August 3 last year, the government approved massive hikes in the external and domestic debt ceilings – the second time in 30 months – signalling an aggressive borrowing campaign for infrastructural and other spending.

After heated debate, the current limit on external loans was lifted from $650,000,000,000 ($650 billion) to $900,000,000,000 ($900 billion) and domestic debt from $500,000,000,000 ($500 billion) to $750,000,000,000 ($750 billion).

In February of 2021, the government pushed through an increase in the external debt ceiling from $400 billion to $650 billion and the domestic debt ceiling from $150 billion to $500 billion. It means that in the span of 30 months, Guyana’s external debt ceiling had more than doubled and its domestic ceiling has been increased five-fold.

The formula in the National Resource Fund Act for withdrawals from the Fund sets out the total that could be applied to the next year’s budget. According to the First Schedule of the Act, 100% of the first US$500 million paid into the fund in the immediately preceding year can be tapped; 75% of the second US$500 million, and 50% of the third US$500 million, 25% of the fourth US$500m and 5% of the fifth US$500m.

Lack of planning

The Opposition says that the increase in the debt ceiling is directly tied to plans for an increase in the NRF annual withdrawals. “It is similar when it comes to the debt ceiling, they are changing it again within a year. Which again highlights a lack of planning, as they should have known what size of Budget in the future… as a result, when you see the government increasing the debt ceiling, it has to be seen in the light of a government without a plan,” Low opined.

“They have not engaged, in any way, with IMF recommendations to deal with corruption… such as feasibility studies, better management of projects; procurement safeguards… or seeking better management expertise, to help us better execute our public sector investment programme. Given the scale of a programme which is in excess of $600 billion, it is very reasonable to expect hundreds of billions of dollars to be wasted or stolen. This means that a very significant share of the money the government is borrowing to fund the budget will be wasted or stolen. That is obviously a recipe for disaster when it comes to the management of your debt,” he added.

Buffer

One financial analyst told this newspaper that it is unclear why government is seeking to withdraw more from the NRF when it should be looking at a formula deigned to grow intergenerational savings and create buffers for when oil prices are low.

“People don’t understand but when oil prices are low, projects would have to be mothballed or cut back and if that happens you have an NRF that you could go to buffer savings and continue. The formula now is designed for just budget support. The withdrawal mechanism is designed for budget support and there is no identified project that you can say ‘this is from the NRF’,” the analyst explained.

“The spending currently occurs with a year’s lag and I think the proposed changes you will see is one where government will change the formula to allow them to draw out what is in the fund for the current year. Use current money in current year will be a formula and the haste in which they want to do it, suggests that they are having difficulties with certain international financing and they are required to pay contractors whom they have already contracted,” the analyst added.

On the proposed debt ceiling proposed rise, the analyst explained that it was tied in with the rapid rate of the increase in government debt. “That is a massive increase in borrowing. The scheme and the replacement suggests they are constantly going to have to move the borrowing limit. That is scary because all of this is being made with the assumption that there will be no disruption in oil production in your country and oil prices will be constant and you can repay with revenue inflow. But with oil, anything can happen. The producers can decide to cut back, say if prices are too low to mitigate their losses,” the veteran analyst said.

“Things change. If Saudi Arabia might decide since the non-OPEC countries don’t want to cut back and they glut the market with oil and send the market freefalling, what happens? Guyana has no locked in future long-term contracts that would see it getting a fixed price. Your country don’t hedge. If oil prices go up, you win. If it goes down you lose,” the analyst added.

And the analyst doesn’t believe that Guyana, which had a non-oil growth of around 11% would be able cushion the effects of reduced oil revenues.

“It has to be looked at holistically… if you say you had a 2% inflation and there is a seeming disconnect between the consumers price index and the quantum of money in circulation in the economy that grew by 25%, something is wrong… maybe a zero was missed,” the analyst expressed.

“There seems to be a disconnect of the inflation and the lived reality in Guyana, because no matter what anyone says, your checks will show that nothing for consumers went up by 2.5%; it was and is always more. Nothing! Not food, not transportation, not steel not cement, not sand. Checks with your country’s trading partners showed inflation in access of 2%. The US, UK, Euro Zone… all over 2%,” they added.

Best debt fundamentals

However, the government maintains that Guyanese need not be alarmed as it has crunched its own numbers and did analyses before putting forward their proposals.

Vice President Bharrat Jagdeo says that the changes will not negatively affect either the economy or the standard of living here. He said that the increase to the debt ceilings will be to cushion borrowings for large projects and signalled that there will be an increase to the NRF withdrawal amounts for which he said are currently “very conservative.”

“As I pointed out, we see this intended period of build-out of our infrastructure that is urgently needed…once they [large infrastructural projects] are completed, you would see a reduction in the Budget,” he said.

According to Jagdeo, “whether we will bring down in the future or not,” will be a decision to be taken then “ but right now it is only for that purpose”, he said while pointing out that “more rise in the debt ceiling doesn’t mean we will borrow to that amount of the ceiling”.

“This is for future here, you don’t want to go back and do it every year. We should have done it [raised higher] in the past, but we just raised a little bit and then you have to go back and go through the same arguments again and again. It is to facilitate that [not having to go back again and again]. Will our borrowing be unsustainable? The answer is clearly, No! We have some of the best debt fundamentals in the world in terms of our capacity to repay,” he said.

“Similarly with the NRF rule; we were very conservative at the beginning. Right now we are borrowing to invest and saving a higher portion. We made it clear that once we get up to a high minimum, say a US$3 billion threshold, you would see that reflected in the proposal that will go. Beyond that, the saving rates starts steeply up; the amount you save,” he added while saying the Opposition “should support this”.