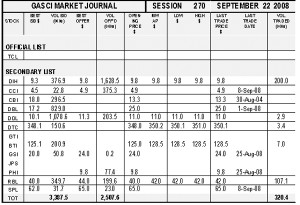

GASCI (www.gasci.com/telephone Nº 223-6175/6) reports that session 270’s trading results showed consideration of $8,576,098 from 320,404 shares traded in 13 transactions as compared to session 269 which showed consideration of $15,106,832 from 385,390 shares traded in 7 transactions. The stocks active during this week’s session were DIH, DDL, DTC, BTI and RBL.

Demerara Distillers Limited’s (DDL) two trades totalling 2,878 shares represented 0.90% of the total shares traded. DDL’s shares were traded at a Mean Weighted Average Price (MWAP) of $11.0, which showed no change from its previous close. DDL’s trades contributed 0.37% ($31,658) of the total consideration. Both of DDL’s trades were at $11.0.

Demerara Tobacco Company Limited’s (DTC) two trades totalling 3,384 shares represented 1.06% of the total shares traded. DTC’s shares were traded at a Mean Weighted Average Price (MWAP) of $350.2, which showed an increase of $2.2 from its previous close of $348.0. DTC’s trades contributed 13.82% ($1,184,976) of the total consideration. DTC’s first trade of 264 shares was at $351.0, while its second trade of 3,120 shares was at $350.1.

Guyana Bank for Trade and Industry Limited’s (BTI) two trades totalling 7,000 shares represented 2.18% of the total shares traded. BTI’s shares were traded at a Mean Weighted Average Price (MWAP) of $128.5, which showed an increase of $3.5 from its previous close of $125.0. BTI’s trades contributed 10.49% ($899,500) of the total consideration. Both of BTI’s trades were at $128.5.

Republic Bank (Guyana) Limited’s (RBL) two trades totalling 107,142 shares represented 33.44% of the total shares traded. RBL’s shares were traded at a Mean Weighted Average Price (MWAP) of $42.0, which showed an increase of $2.0 from its previous close of $40.0. RBL’s trades contributed 52.47% ($4,499,964) of the total consideration. Both of RBL’s trades were at $42.0.

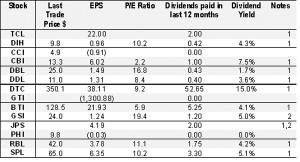

Notes

1 – Interim results

2 – Prospective

EPS: earnings per share for 12 months period to the date the latest financials have been prepared. These include:

2002 – Final results for PHI.

2005 – Final results for GTI.

2007 – Final results for CCI and GSI.

2008 – Interim results for TCL, DIH, CBI, DBL, DDL, DTC, BTI, JPS, RBL, and SPL.

As such, some of these EPS calculations are based on un-audited figures.

P/E Ratio: Price Earnings Ratio = Last trade price / EPS

Dividend yield = dividends paid in the last 12 months/last trade price.