Attorney Christopher Ram says the court challenge to the government’s failure to pay over funds obtained from the Guyana Lottery Company into the Consolidated Fund was dismissed on “procedural points,” and he is accusing Attorney General Anil Nandlall of misleading the public about the decision.

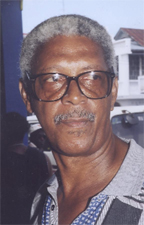

MP Desmond Trotman, who sought a declaration that government’s actions, which include disbursements without parliamentary approval, was unconstitutional and illegal, is now appealing the recent ruling by Justice Diane Insanally, which was made on December 28, last year.

Ram, who along with Senior Counsel Miles Fitzpatrick is representing Trotman, noted in a statement on Friday that in the absence of the written decision by the judge, Nandlall has “taken to the airwaves” and misrepresented its implications as “vindicating the government’s position.”

The Government Information Agency (GINA) had quoted Nandlall as saying that the court, in dismissing the matter, “found that the deposit of the monies in the Development Fund of Guyana (Lotto Fund) is in accordance with Article 216 of the Constitution, the provisions of the Fiscal Management and Accountability Act and the Lotteries Act, thereby vindicating the government’s position. The administration hopes that this would put this matter to rest.”

Ram, however, said “the truth cannot be more different,” noting that government’s lawyers, Ashton Chase SC and Pauline Chase, sought the dismissal of the legal challenge on the basis that Trotman had failed to comply with the rules of the court, had no right to seek redress from the court and that he had used the wrong procedure.

Trotman, he noted, asked the court whether the share of the revenue received by the government from the Guyana Lottery Company Limited, a private company incorporated under the Companies Act 1991, was required to be paid into the Consolidated Fund, in accordance with Article 216 of the Constitution and sections 21 and 38 of the Fiscal Management and Accountability Act 2003. Further, he sought to determine whether the expenditure by the government of those moneys, without the authority of the National Assembly, is unconstitutional and illegal.

On November 16, 2010, according to Ram, Counsel for the Permanent Secretary of the Ministry of Legal Affairs, on behalf of the Attorney General, denied the allegations and asked the court to strike out the matter on the main grounds of the failure to follow established practice and the failure to show that Trotman had any right to bring such an action.

Subsequently, on February 7, 2011, he added, attorneys for the Attorney General submitted “Skeleton Arguments” in which they emphasised what they considered breaches of the Rules of Court and procedures and the question of Trotman’s standing in the matter. They relied heavily on a judgment given by then Justice of Appeal Charles Ramson, in the case of Trotman et al v. The Attorney General (Civil Appeal No. 79 of 2006), he said, and they cited the “preliminary points” to ask the court to dismiss the action.

Ram said on April 5, 2011, Trotman’s lawyers submitted their own “Skeleton Arguments,” challenging the principal submissions made by the Attorney General. “Specifically Mr Trotman’s attorneys pleaded that the fiscal provisions of the constitution are not intended for the protection of parliamentarians alone and that where parliament will not act and the constitutional official responsible for the protection of the Consolidated Fund fails over years to seek the assistance of the court, any citizen has a legitimate interest in ensuring compliance,” he explained.

Ram added that Senior Counsel Chase, on April 28, 2011 submitted a “Brief Response to Arguments for Plaintiff,” stating that Trotman’s lawyers in their Skeleton Arguments had not addressed the important issue of his right to bring the action and he argued that the court was bound by Ramson’s judgment. In response, Trotman’s lawyers submitted an affidavit, dated June 14, 2011, from attorney Stephen Fraser, who was lead counsel in the case where Ramson’s ruling was delivered, seeking to establish that the part of the decision on which Chase relied had been wrongly arrived at.

“On December 28, 2012, Justice Diane Insanally in a brief hearing in Chambers delivered her decision on the arguments, ruling against Mr Trotman on the procedural points, but not on the merits of the case,” Ram said. He added that subsequent efforts by counsel to obtain a copy of the decision were unsuccessful, prompting Senior Counsel Fitzpatrick to write to the judge requesting a written decision.

Former Auditor General Anand Goolsarran had argued last year that “on a matter of principle, all public money should be deposited into the Consolidated Fund as the taxpayers’ fund, and no public expenditure should be incurred without the consent of the elected representatives of the citizens of Guyana, that is, Parliament.” He added, “If the laws are not clear on these matters, then let us amend them to make them clearer so that the above fundamental principle in public finance and administration is respected and observed.”

In the 2011 Auditor General’s Report, Auditor General Deodat Sharma said $3.214 billion had been spent from the Lottery Fund from 1996 to 2011. At the end of 2011, the balance in the account was $853.7 million and for the year 2011 a total of $134.8 million was used to meet expenditure for 2011. From 1996 to 2011, a total of $4.022 billion was received from the Guyana Lottery Company and deposited into account no. 3119 – the Lotto Fund account.

Sharma noted that in previous reports, the Audit Office had highlighted the Ministry of Finance’s failure to pay over government’s share of 24 per cent of the proceeds of the lotteries to the Consolidated Fund. He said that instead, the proceeds were paid into a special bank account 3119 and were used to meet public expenditure without parliamentary approval. He said the balance of this account was not refunded to the Consolidated Fund as required by Section 43 of the Fiscal Management and Accountability Act but was retained by the ministry.

“However the Attorney General [Ramson] provided an opinion in 2011 concerning the deposit and use of the fund which stated that there is no legal obligation to transfer money from the Lotto Fund into the Consolidated Fund and that the fund is however subject to an audit by the Auditor General under the provisions of the Fiscal Management and Accountability Act of 2003,” he noted. Goolsarran has described Ramson’s decision as flawed.