Universal subsidies

On December 9, 2013, the International Monetary Fund (IMF) concluded its most recent Article IV Consultations with Guyana. In its report, the IMF advised the government to stop using universal subsidies to achieve public policy goals and to use a more targeted or selective approach to the redistribution of resources. The allocation of pension support to the elderly or the transfer of resources to alleviate poverty among the indigenous population, for example, makes sense. Under those circumstances, equity in the tax system takes advantage of the benefits principle. Though the transfers could still be contentious, one could see the benefit to be had from it by the beneficiaries.

The government has obviously chosen to ignore the advice of the IMF in pursuit of what now seems to be very narrow political interests with the disbursement of its $10,000 grant to each child attending public school in Guyana. This conclusion was reached against the backdrop of the education objectives that the government committed itself to pursue under the Millennium Development Goals which are to be achieved by 2015. This article raises for readers the public policy concerns of redistributing the tax revenues of Guyana through the use of a universal $10,000 grant to all public school children against the backdrop of the MDGs. It also raises the concerns in the face of alternative resource transfer mechanisms which lend themselves to greater accountability and public financial management than the direct transfer method being used by the government.

Millennium Development Goals

Several factors are used to measure the success rate of reaching universal primary education. One is the net enrolment rate of boys and girls in school. A target of 90 per cent of net enrolment of boys and girls across Guyana was required by 2015. This target was to ensure also that there was gender parity in primary education and that the emphasis was not being placed on boys only or on able-bodied kids exclusively. Net enrolment by itself does not provide evidence that schooling was being sustained. As such, another measure was the survival rate of schooling of students. This measure considered the percentage of enrolled students who entered Grade 1 and were able to complete Grade 6. The government has the added obligation under the MDGs to ensure that students receive quality primary education. This goal which impacts literacy rates will be affected not only by the quality of teachers but also by the extent to which students are attending school to receive the required instruction.

Evidence

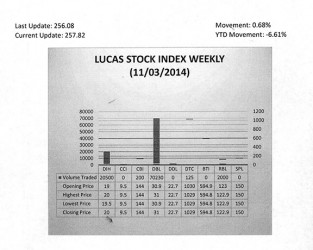

The Lucas Stock Index (LSI) rose 0.68 per cent in trading during the first period of November 2014. The stocks of five companies were traded with 93,555 shares changing hands. There were two Climbers and two Tumblers. The value of the stocks of Banks DIH (DIH) rose 5.26 per cent on the sale of 21,000 shares while the value of the stocks of Demerara Bank Limited (DBL) rose 0.32 per cent on the sale of 70,230 shares. The value of the shares of Demerara Tobacco Company fell 0.10 per cent on the sale of 125 shares while the shares of Republic Bank Limited (RBL) declined 0.08 per cent on the sale of 2,000 shares. In the meanwhile, the value of the shares of Citizens Bank Incorporated (CBI) remained unchanged on the sale of 200 shares.

When the evidence is examined, one has to be concerned about the need for granting every public school student a grant of $10,000 instead of using a more targeted approach. According to a report of the United Nations Development Programme (UNDP) on the Millennium Development Goals, Guyana has surpassed the 90 per cent net primary school enrolment rate, and has consistently achieved a rate above 95 per cent since 2000. That ratio indicates there is a five per cent problem and not a 100 per cent problem. In addition, the survival rate has been above 90 per cent since 2006. It is eight years now that Guyana has been able to keep over 90 per cent of its children in primary school without having to bribe them to act responsibly.

The problem has been the extent of government and parental interest in the children’s education as reflected in the large number of students who do not attend school. Attendance rates are reported to be 74 per cent. In other words, even though children are enrolled in large numbers, they are not showing up consistently in equally large numbers. The problem is more severe at the secondary level. The government’s handling of this issue ought to be of major concern to all Guyanese. Based on the data contained in the 2002 Census Report, Guyana had already surpassed the MDG targets for net enrolment in primary school. The problem has always been attendance and the quality of education. Both remain major concerns today 14 years after the commitment in 2000 at the Millennium Summit to improve them.

Census Report

It is against this background one has to examine the $10,000 grant being given to public school students and in particular the mechanism for its transfer. At a 74 per cent attendance rate, it means that more than a quarter of registered primary school children are not going to school on a regular basis. Guyana knew this over 12 years ago and only now it appears that the government is trying to boost attendance. The 2002 Census Report revealed that the problem was evident in every region with the problem being more acute in Regions 1 and 8. In terms of secondary education, persons with a limited or poor secondary education were unlikely to earn a living wage. They were likely to be a greater charge on the public purse than someone better qualified. Such persons with limited education were also likely to be involved in crime. The evidence indicates that the problem of attendance is far more severe at the secondary level than at the primary level.

The problem of course starts with enrolment. The 2002 Census Report shows a net secondary enrolment rate of 61 per cent. The truth is Guyanese do not know how much worse the problem has gotten after the government has been aware of it for at least 12 years. Given the magnitude of the problem of participation in school, something ought to be done.

Unfortunately, the government has not provided the results of any study that indicate the causes of the low enrolment in secondary schools and the low attendance at both the primary and secondary levels. One does not know therefore the basis for granting every student the education relief. However, the government is privy to the 2012 Census results and probably already knows how bad the problem is and is attempting to get ahead of it before the magnitude becomes public knowledge.

The government advertisements of the disbursement of the grant claims that it cares. It is likely therefore that the government is implying that it does not care about those students whose parents pay taxes and send their children to private schools. Those children with their private education will provide a positive benefit to this country, but are being denied access to the taxpayer money simply because their parents care more about their education. Or might it be that the government is admitting that the level of poverty is higher than what is publicly disclosed. The public policy rationale for the near $2 billion of tax expenditure is not clear and the advice of the IMF is being ignored.

Four options

Be that as it may, the method of disbursing the grant can also be called into question. Over the last couple of weeks the government has been giving out vouchers which it contends are intended to help children attending public schools in Guyana. The government had at least four ways in which to deliver the money to qualifying students. It could have, as it is currently doing, given the money directly to the parents of the children involved. Another approach was to include the money as part of the current expenditure of the Ministry of Education and supply students with the resources that were needed for their education. The third approach was to refund parents for purchases that they would have made on presentation of proper evidence of the expenditure. The fourth approach was to pass the money through the tax system and make parents claim the money as part of the refund or tax credit arrangement.

The direct disbursement of the grant to the parents acts like a stimulus to the economy. The assumption is that the beneficiaries would have to spend the money in some form or fashion. If there is a marginal propensity to consume of 80 or 90 per cent, then the grant could result in an expansion of the economy by $9 to $18 billion or between two and four per cent. It is reasonable to wonder therefore if the grant also has the goal of helping to shore up the economy, especially in light of the trend of falling revenues in the extractive industry. While this approach has positive benefits, it lacks full accountability and exposes the policy to political manipulation.

Alternative approach

In an alternative approach, the government could have asked the Ministry of Education to make the purchases and distribute the in-kind resources to students. That approach is consistent with the free education option in which children of the public school do not pay the true cost of their education. Like the remaining two options, this ‘free education’ option slows down the economic impact considerably. However, it subjects the spending to both procurement rules and the scrutiny of the Auditor-General, unlike the first method which only has to show that the money was given out.

Asking the parents to spend the money and apply for reimbursement was another way to provide the education benefit. But it is a slow and cumbersome process. Yet, it has the advantage of monitoring the spending of beneficiaries and ensuring the goal of the expenditure was being met. Under this method, both parents and the government share in the responsibility of implementing the resource redistribution programme. Both parents and government have the responsibility of ensuring children attend school because parents can follow up notices given to them by teachers of their children’s absence from school.

Final approach

The final approach, obtaining the benefit through the tax system, gives every student a chance to receive the expenditure benefit. It helps to satisfy equity aspects of the tax system by taking advantage of the benefits principle. The education relief could be claimed as a tax credit which is added to any refunds due the taxpayer. The mortgage interest relief to homeowners is applied in this manner. As a credit, it would have the same impact as a direct transfer since there would be no personal tax liabilities (costs) to the taxpayer associated with the credit, and it could be spent as the taxpayer sees fit. Those who are unemployed could still file a tax return to obtain the credit. The benefit would get to all those persons who are acting as responsible citizens. However, as with the other indirect transfer methods, it delays the impact of the spending on the economy since parents would have to ensure existing funds can be used to meet all necessary expenditure. Not only is the tax return method fair, it also imposes obligations on beneficiaries and could possibly help to reduce wasteful spending. Though universal, this tax return method avoids the pitfalls of granting universal subsidies as warned by the IMF.