Very little is said

The Massy Group of Companies, formerly Neal and Massy before the rebranding exercise in 2014, has been in existence for 83 years. The company, which has its principal headquarters and operations in Trinidad and Tobago, came into being in 1932 following the merger of Neal Engineering Company and Massy Limited. The success of the merger after 26 years eventually led to the bolder move of creating a public company in 1958. The evolution of the company continued with the consolidation of its operations in Trinidad and Tobago, the diversification of products and services offered to its customers, and the expansion into other territories in the Caribbean. As a consequence, the Massy Group is a large conglomerate that is organized as business segments or business units that cover the range of products and services offered by the company in several countries in the Latin American and Caribbean region. Despite being in Guyana for 47 years, very little is said or discussed about a company that has been integral to the expansion and alteration of the Guyana economy for a very long time. This article seeks to provide an understanding of the role and place of this organization in Guyana.

Complex business

Today, the Massy Group is a complex business that is made up of six business units, six subsidiaries and three associate companies. The business units which are the core of its operations cut across several economic sectors. For example, there is the Automotive and Industrial Equipment unit that supplies capital equipment to the mining sector and the agricultural sector in Guyana. The diversified nature of the operation is seen from the multiple companies serving a variety of industries that exist under each business unit. The Automotive and Industrial Business Unit controls eight separate companies that sell cars to consumers and heavy equipment to businesses. The Energy and Industrial Gases Business Unit controls 18 companies with a similar market focus while the Integrated Retail Unit has control over a similar number of companies. The Insurance Unit comprises one company while the Information Technology and Communications Business Unit has control over 10 companies. The Finance segment also has several companies in its portfolio. The six business units not only reflect the structure of the organization, they also reflect the business strategy of the entity. The Group has dissected its market into business and consumer segments and uses its business units to service those markets.

One of the things that the Massy Group has done is to develop two sets of markets. One market is for business customers while the other is for consumers. The dual market strategy is employed in all the country markets except Jamaica, where emphasis seems to be placed on the business to business market. The automotive, finance, insurance and retail businesses were directed at consumers while the industrial equipment, industrial gases, distribution and logistics and the technology businesses were directed at other businesses. That market configuration could be found in almost all the countries in which Massy operates. For the Caricom region, this would be Barbados, Antigua and St Lucia, Trinidad and Tobago, and Guyana. For Latin America, this would be Colombia.

One might ask how do the Massy operations in Guyana fit into the very large and complex structure of the Group. The control of the Massy Group spans several countries in which it controls a variety of companies, subsidiaries or associates. The principal business units have companies in Barbados and the Eastern Caribbean, Colombia, Guyana, Jamaica, and Trinidad and Tobago. Those countries host the bulk of the business activities of the Massy Group, even though some distribution activity takes place in the Miami market. Guyana is one of the five countries in which Massy has substantial investments. In fact, it is the third most important geographic market for the company when measured in assets, sales revenue and profits. Before discussing Guyana’s importance to the company, it would be useful to understand how Guyana fits into the overall Massy structure.

Guyana was the earliest market into which Massy ventured as a foreign investor. The company came to Guyana in 1968 as Neal and Massy 10 years after it went public. At the time of Neal and Massy’s entry, Guyana was two years into its independence. The arrival of Neal and Massy saw the establishment of Associated Industries Limited (AINLIM). In a short history of itself, Massy reported that after its first 20 years in Guyana, the entity had control of four businesses. These were AINLIM, Demerara Oxygen Company (DOCOL), Transport Services and Demerara Property Investments. In its second 20 years, Massy made further adjustments to its portfolio in Guyana. During this latter period, Massy added Complete Computer Services, NM Services and NM Security. The Massy organization went through a rebranding exercise which resulted in all its companies carrying the Massy name alone. As such AINLIM is now known as Massy Industries, DOCOL is now known as Massy Gas while Transportation Services is now known as Massy Trading and Distribution. Complete Computer Services is known as Massy Technologies and NM Services is called Massy Services. One other company, NM Security, is now called Massy Security.

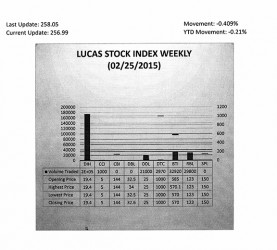

The Lucas Stock Index (LSI) fell 0.409 per cent in trading during the final period of February 2015. The stocks of six companies were traded with 262,239 shares changing hands. There were no Climbers and one Tumbler. The Tumbler was Guyana Bank for Trade and Industry (BTI) whose stocks fell 2.56 per cent on the sale of 32,920 shares. In the meanwhile, the value of the stocks of Banks DIH (DIH), Caribbean Container Inc. (CCI), Demerara Distillers Limited (DDL), Demerara Tobacco Company (DTC) and Republic Bank Limited (RBL) remained unchanged on the sale of 174,549; 1,000; 21,000; 2,970; and 29,800 shares respectively.

Part of a larger business unit

Each of the above companies is part of a larger business unit. Massy Industries is part of the Automotive and Industrial Engineering business unit. Its market focus is on other businesses in Guyana and it provides capital assets. Massy Industries therefore serves the business community in Guyana. Massy Gas operates under the Energy and Industrial Gases business unit. Like Massy industries, it serves the business community. Massy Trading and Distribution operates under the Integrated Retail (IR) business unit. Despite being under the IR business unit, the annual report lists it as a company that focuses on serving other businesses. In fact, it is the automotive component of the Automotive and Industrial Engineering business unit that serves the consumer market. The services provided through MoneyGram and Sure Pay, which are under Massy’s Finance unit, are also directed at the consumer market.

Monstrous company

As could be expected, a company with that many parts and locations controls lots of assets. The Massy Group by Guyana’s standards is a monstrous company. According to the 2014 Annual Report of the Group, it had approximately G$300 billion in assets under its control. The Group also had G$326 billion in revenues. Taking the comparison to the wider Guyana economy, as a company, Massy controls assets and generated revenues equivalent to almost half of the gross domestic product (GDP) of Guyana. That one organization could dispose of all its assets and buy half of the Guyana economy. Despite the enormity of the Group’s size, its operations in Guyana are modest compared to companies of similar if not equal stature. For example, Banks DIH was incorporated the same year that Neal and Massy came to Guyana and started Associated Industries Limited. Banks DIH has been able to grow its assets to where it is now five times that of the value of the assets of the collective Massy enterprises in Guyana.

Plenty weight

Yet, the Massy operations in Guyana remains a vital part of the Group’s success. For example, the Massy operations in Guyana account for four per cent of the assets of the Group. This share is minuscule but it carries plenty weight. That share of assets was responsible for eight per cent of the revenues and 14 per cent of the profits that the entire Massy Group had over the last two years. The company admits in its annual report that the good fortunes that the gold and rice industries enjoyed contributed immensely to the economic success reported by the company. Emboldened by the business prospects in Guyana, the Massy Group in Guyana opened a 75,000 square foot warehouse facility with modern inventory and warehousing facilities. But the operations in this country are not without problems. Two things are of great concern to the organization. One is safety and the other is customer service. Any Guyanese could understand why the company would be concerned about safety, particularly as it relates to road safety. The company in Guyana had many near misses and two fatal accidents in less than two months in 2014.

The other problem that the Group is concerned about is the poor level of customer service found in the retail industry. This problem is common throughout the retail industry in Guyana. One cannot be certain if it is lack of interest on the part of the workers, lack of training in customer service or some other factor, but entering a retail establishment and expecting to receive good service is wishful thinking. Massy is conscious of this failing and has placed emphasis on seeing that the brand in Guyana was not tarnished by poor customer service performance.

Diversified portfolio

Unless something extraordinary happens, the Massy Group was expected to be a part of the Guyana economic landscape. The operations in Guyana have shown strong performance and would get stronger once the economy is able to take off. Massy was expected to keep a diversified portfolio of businesses to manage business and other types of risk that could occur in domestic and foreign markets. Massy believes that an intense application of its health, safety, security and environment performance standard would help it to overcome the safety and customer service concerns that it has about the Guyana market.