An alarm has been raised about the availability of foreign currency in Guyana within the last three or so months. The alarm was sounded by the commercial banks as they reportedly were unable to fulfil the demand for foreign currency by their customers. The situation caught the public by surprise as it apparently did the public officials who are responsible for managing and overseeing the foreign currency market in Guyana. The sudden spike in demand for foreign currency has also led to claims by those opposed to the government of capital flight induced by a growing lack of confidence in the economy. While the data do not bear that out,

The bank cambios are the largest participants in the foreign exchange market, controlling about 96 per cent of the market. Amidst the uncertainty, the one thing that we need to be clear about is that the commercial banks must be reporting the correct experience about foreign currency availability. What the commercial banks say is very important to maintaining confidence in the banking system. This article attempts to examine the likely validity of the assertions of capital flight and that of hoarding referred to above.

Fact based

As we examine the foreign currency situation, it is important to keep in mind that reaching a conclusion about the various assertions must be fact based. The management of the foreign currency of a country is not a trivial matter. It is one of the most important aspects of the domestic monetary system and the global financial system. The foreign exchange policy of a country is such an important element of the international financial structure that it attracts the close attention and scrutiny of the International Monetary Fund (IMF). The IMF assesses the condition of the foreign currency market by conducting surveillance activities of the foreign exchange and other macroeconomic policies of a country. The Executive Board of the IMF completed its most recent review of the surveillance of the Guyana economy in May 2016. They observed that the exchange rate was in line with the fundamentals and supported Guyana maintaining a flexible exchange rate regime. This means allowing people to buy and sell foreign currency freely.

The confidence expressed by the IMF leads one to believe that there should be positive trends observable in the foreign exchange and foreign trade arena. The tendency is to consider the behaviour of certain variables such as the months of import cover from international reserves and the monthly balances in the cambios. These will tell if Guyana has enough foreign currency or if the market was sufficiently strong to meet the needs of market participants in the ordinary course of business. It is accepted here that shock interventions into the market are possible and that they would be clearly identifiable. It is also accepted here that any exogenous force that is not the consequence of the improper behaviour of internal monetary factors should be met with special intervention, even if that intervention consists of artificial and not market techniques.

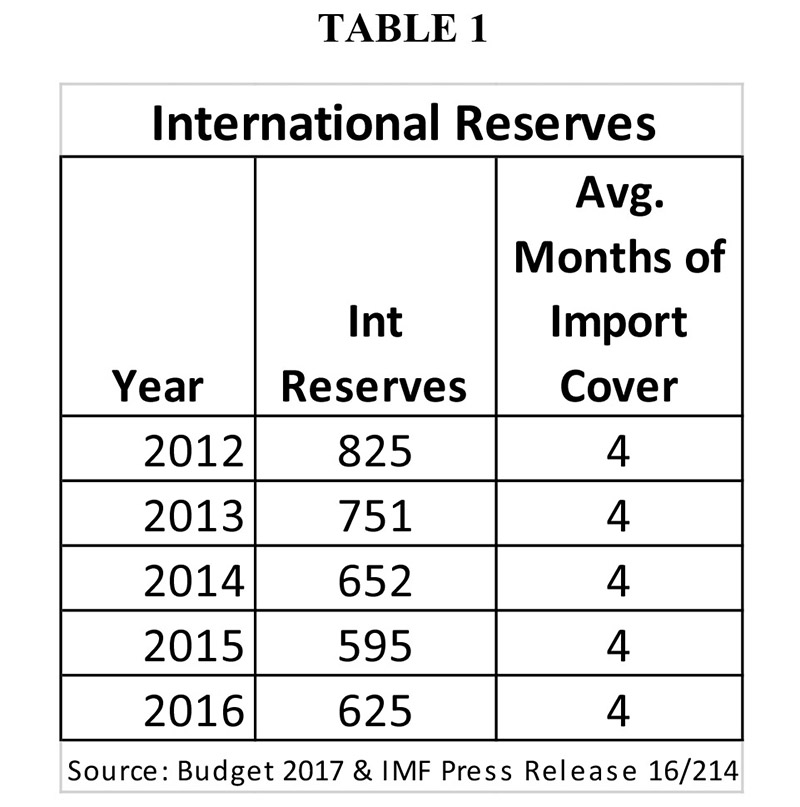

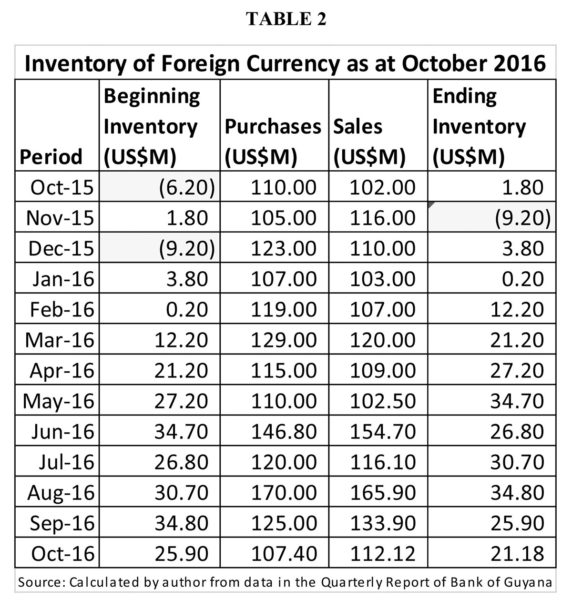

Import cover

An examination of Table 1 below will reveal that the months of import cover at the end of 2016 provided by international reserves were essentially the same as they were for the past four years. The economy was able to position itself to provide more or less the same amount of import coverage as in previous years despite the poor export performance of a few key industries. Forestry, rice and sugar all saw lower revenues from export activity. However, the poor performance of these industries was offset by the revenues obtained by the mining sector which did exceedingly well. In addition, the price of oil was lower and Guyana did not have to spend as much of its export revenues as in past years to meet the demand for fuels and lubricants. Even though the international reserves varied annually, the variable movement in demand for foreign goods also enabled the import cover to remain more or less constant. Consequently, such a situation should trigger no alarm about the ability of the foreign currency market to supply the commodity, particularly since there was no major surge in import or general economic activity.

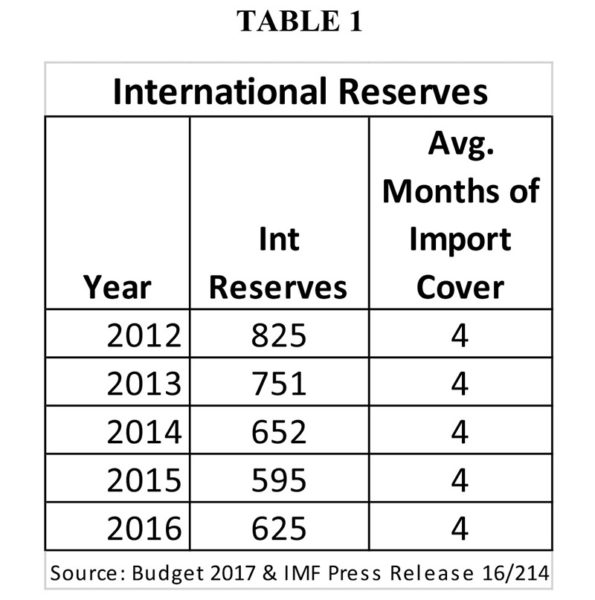

Monthly inventory

Another key metric is that of the size of the monthly inventory of the cambios. This is perhaps the most significant of the two measures being considered in this article since it provides readers with the magnitude of foreign currency available in the market. To appreciate the point, one could treat the foreign currency purchased by the cambios as representing the stocks or supplies on hand and the sale of the foreign currency as representing the consumption or disposal of the stocks or supplies. Table 2 below offers a very interesting comparison of two time periods and their monthly balances as calculated from the inflow and outflow of the inventory. Guyanese can see that there was nothing abnormal about the market before October 2016. Even a slow economy was not spooking anyone and should not lead to panic buying of foreign currency.

It could be seen also from the Table that as at October 2015, the cambios would have had an estimated US$1.8 million in stock or supplies of foreign currency. Even without full information, one could spot from the data in the Table that the cambios would have been about US$6.2 million short at the start of October 2015. That negative figure represents the supposed condition in the market that cambios are crying out about now. The beginning inventory for October 2015 was presented as a negative figure and not as zero to show that at a time when the cambios should have had a crisis there was no alarm. The cambios were able to replenish their stocks by either obtaining foreign currency from the Bank of Guyana or by delving into money that was stashed away somewhere. The point being made here is that at a time when the cambios needed to find foreign currency to carry on their business, they did and there was no fuss being made about availability.

Fast forward to October 2016, the inventory of foreign currency with the cambios was vastly different from what obtained in October 2015. The cambios would have had at least US$21 million on hand or almost 12 times more foreign currency available than at October 2015. Further, in 2015, foreign currency that was in the market made up less than half of one per cent of the international reserves of the country in contrast to October 2016 when it made up three per cent. Yet, persons are trying to insinuate that the foreign currency market in Guyana does not induce or even exude confidence.

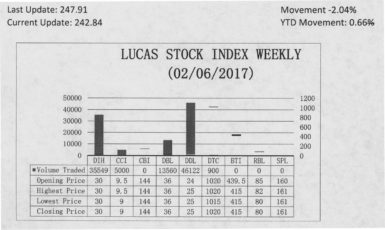

The Lucas Stock Index (LSI) declined 2.04 percent during the first period of trading in February 2017. The stocks of five companies were traded with 101,131 shares changing hands. There were no Climbers and three Tumblers. The stocks of Banks DIH (DIH) fell 6.33 percent on the sale of 35,549 shares. The stocks of Demerara Bank Limited (DBL) also fell 1.39 percent on the sale of 13,560 shares while the stocks of Demerara Distillers Limited (DDL) fell 4.0 percent on the sale of 46,122 shares. In the meanwhile, the stocks of Caribbean Container Inc. (CCI) and Demerara Tobacco Company (DTC) remained unchanged on the sale of 5,000 and 900 shares respectively.

Something unusual

That the bank cambios are complaining should make it clear that something unusual is happening in the foreign currency market. The data presented above reveal that the Guyana economy, with all its challenges, has been generating enough foreign currency to support business transactions. With the internal variable behaving orderly, the situation does not call for devaluing the currency or allowing its value to depreciate since the level of business transactions is generating acceptable amounts of foreign currency. Raising the interest rate to limit the level of economic activity and, as a consequence, the demand for foreign currency is also unacceptable for it would generate unnecessary economic distortions and set the economy back further. The shock intervention is coming from an external force either in the form of political instigation or sales that are not linked to the activities or condition of the domestic economy.