International trade is very important to the growth of the world economy accounting for about 60 per cent of world gross domestic product (GDP). Total world exports amounted to US$21 trillion in 2015. The bulk of it was in merchandise trade. However, trade in services has grown significantly over the years to reach nearly US$5 trillion or 20 per cent of global exports in 2015. Trade is important to Guyana also. About half of Guyana’s GDP comes from foreign trade. Nearly two-thirds of the output of the Guyana economy comes from services but services are not a significant part of Guyana’s export trade. On the other hand, Guyana does import many services which by one estimate amounted to some 16 per cent of total imports in 2015. The issue of trade in services has been around a long time but is not often talked about the way people speak about trade in goods. Indeed, services do not give one the same opportunity to exhibit conspicuous consumption as goods do. Perhaps one of the difficulties about services is coming to grips with what activities qualify for such trade and what activities do not. Many services can easily get mixed up with the goods that they might be associated with. An example of that situation involves computer software which was traded with the computers that were bought. This article will explore some of the issues relating to trade in services and what make trade in services so inconspicuous.

Differences

It is best to start by explaining what activities are described as services. For the purpose of national accounting, services are usually recognized in two ways. One way is to determine if the performance of the service produces a change-effect. A service is performed when the activity changes the condition of the unit consuming the service. For example, when a person takes a motor car to a mechanic to have it maintained or repaired and any defects are fixed, a service would have been performed. Similarly, when a person goes to a doctor for medical treatment and it is successful, the service changes the condition of the person for the better.

The other way in which a service is recognized is if it can be regarded as capturing knowledge which can be accessed repeatedly by the consuming unit. In other words, a service that is able to capture knowledge qualifies as a service. Some of the ways in which a service is knowledge-capturing include producing, storing, communicating and disseminating information. Books, inventions and entertainment products such as compact discs and music videos form part of the knowledge capturing service. A person who holds the copyrights, patents or trademark to some output of written or recorded work has some control over the knowledge.

Ownership

An important distinction between a service that produces a change-effect and one that captures knowledge is the issue of ownership. In cases where the service produces a change-effect, ownership of the consuming unit does not change hands. A patient does not become the property of the doctor or the hospital after receiving treatment. Nor does a motor vehicle become the property of the mechanic merely as a consequence of the repairs performed. At the same time, the mechanic or medical personnel keeps the skill set that he or she used to produce the change.

The consuming unit does not take the skill away. It merely leaves with the benefit of the skill. The knowledge-capturing type of service has a different effect. The skill that is responsible for the creation of information, entertainment or advice remains with the person producing it. However, many of the creations can be stored in books and other types of storage devices. Consequently, unlike in the situation of the change-effect, the consuming unit can actually own the creative output by buying it in stored form. The knowledge-capturing form of services is normally talked about in international trade as trade related aspects of intellectual property rights or TRIPS.

Only recently a Guyanese company was accused of violating the knowledge-capturing services of a US company. This type of problem has been occurring in many parts of the world as a consequence of unsecured technologies that make it possible for people to acquire and disseminate knowledge for a fee without the permission of the owners. Opportunities that did not exist for trade in services have now become possible.

Many services, which had been preserved for domestic operators, have increasingly become tradable internationally. This trend was likely to continue, owing to the introduction of new transmission technologies such as electronic banking, online education services, and the opening up of voice telephony, postal services and transportation. Companies too have now been able to separate computer services such as software from the hardware. For example, software application such as Microsoft Suite and many tax software can be purchased online separately from the hardware on which it will be used.

Electronic means

International trade in services is governed by the General Agreement on Trade in Services (GATS) in the framework of the World Trade Organization (WTO). The GATS covers all services with the exception of those exercised by governmental authorities and most air transport services. The services include business and professional services such as accounting services, computer services, legal services; communication services such as audiovisual, postal and courier services and telecommunication services. They also include distribution, educational, environmental, energy, financial and tourism services. As observed above, e-commerce is a method of ordering or delivering products by electronic means through the Internet. Charges for electronically delivered products are included in services.

Not always easy

Notwithstanding the ease with which one could identify a list of activities that would qualify for trade in services, actually determining what activities to include in a given type of service is not always easy. For example, construction services involve the creation, renovation, repair, or extension of fixed assets in the form of buildings, land improvements of an engineering nature, and other such engineering construction as roads, bridges and dams. Construction also includes related installation and assembly work, site preparation and general construction as well as specialized services such as painting, plumbing, and demolition.

It also includes management of construction projects. Yet, if one was not careful, it would be easy to believe that installation services for telephone networks and equipment would fall under telecommunication services when in fact they are treated as part of construction services.

Additional complications to determining if certain activities should be counted as trade in services arise from the duration of the contract and the sourcing of inputs. If a contract will last more than one year, it would be unlikely to be counted as trade in services. To qualify as trade in services, the construction activity being undertaken abroad has to be of a short-term duration. In cases where the duration of the contract does not matter, other issues arise. For example, a Guyanese company that does construction work abroad would record the activities that it performs as an export to that country.

Any materials that are imported from Guyana to the host country would also count as part of the export of the construction service from Guyana and not as part of the merchandise trade. However, if the materials are gotten from the host country, then they count as an import to Guyana under trade in services.

Some amount of rerouting might be necessary if the importing Guyanese company wanted to take advantage of bulk purchasing and decided to buy more goods than were needed for the project in the host country. The excess goods sold could no longer count as trade in services as a consequence of the project. Instead, the excess should be treated as merchandise trade.

Another type of service that reveals the complexity in determining and measuring trade in services is the operating leasing service.

Operating leasing services cover the leasing of ships, aircraft without crew and the leasing of other equipment such as telecommunication equipment and computers without an operator. At the same time, leasing of telecommunications lines and capacity cannot be included in a leasing service. It has to be treated as telecommunications services. Similarly, when a ship that comes with a crew is leased, the service amounts to importing transport services. It should be obvious from the foregoing that care has to be taken when determining if something should be traded as goods or services.

Physical proximity

Despite the tradability of services, doing so is not easy. Experts have observed that in most cases, the suppliers and consumers of services have to be in physical proximity for services to be traded easily. GATS identifies four methods or modes which could be used to enable trade in services to take place. Mode one is services supplied from one country to another. This mode is often described as cross-border trade in services. An example of that mode is architectural services provided through telecommunications or mail. The second mode refers to consumption abroad. This mode involves cases where consumers or firms make use of services in a country by being in that country. An example of that is international tourism.

A third mode is cited as the commercial presence. This mode involves a situation where a service provider sets up a subsidiary to provide services in another country. The commercial presence envisages situations in which foreign direct investors enter the country. The fourth mode refers to individuals travelling from their own country to a third country to provide services. An example is consultants travelling abroad to provide IT services.

Limited market access

Notwithstanding the recognition and desirability to trade, services that have been included in GATS are not automatically open for trading. Market access is limited. Many countries still protect their domestic markets in an effort to ensure that they have room to create employment opportunities for their people. Consequently, countries have guaranteed access to their markets only in those sectors and modes of supply that they have specified in their schedules of commitment. Even there, care has been taken to impose limitations if there was too much uncertainty of the benefits to be had from liberalization of trade in services.

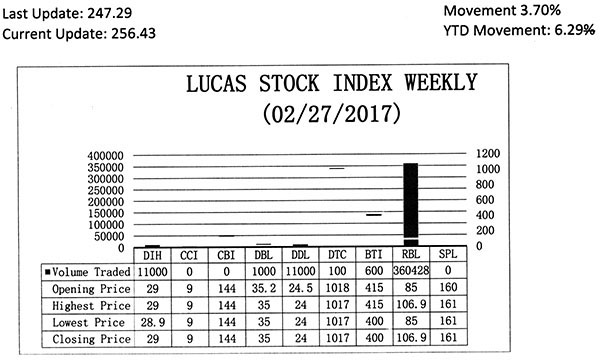

LUCAS STOCK INDEX

The Lucas Stock Index (LSI) rose 3.70 per cent during the final period of trading in February 2017. The stocks of six companies were traded with 384,128 shares changing hands. There was one Climber and four Tumblers. The stocks of Republic Bank Limited (RBL) rose 25.76 per cent on the sale of 360,428 shares. The stocks of Demerara Bank Limited (DBL) fell 0.57 on the sale of 1,000. The stocks of Demerara Distillers Limited (DDL) fell 2.04 on the sale of 11,000 shares. The stocks of Demerara Tobacco Company fell 0.10 per cent on the sale of 100 shares and the stocks of Guyana Bank for Trade and Industry (BTI) fell 3.61 per cent on the sale of 600 shares. In the meanwhile, the stocks of Banks DIH (DIH) remained unchanged on the sale of 11,000 shares.