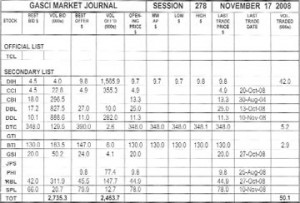

GASCI (www.gasci.com/telephone Nº 223-6175/6) reports that session 278’s trading results showed consideration of $2,605,758 from 50,124 shares traded in 10 transactions as compared to session 277 which showed consideration of $5,717,168 from 43,445 shares traded in 12 transactions. The stocks active during this week’s session were DIH, DTC and BTI.

Banks DIH Limited’s (DIH) five trades totalling 42,000 shares represented 83.79% of the total shares traded. DIH’s shares were traded at a Mean Weighted Average Price (MWAP) of $9.7, which showed no change from its previous close. DIH’s trades contributed 15.70% ($409,175) of the total consideration. DIH’s first four trades totalling 24,255 shares were at $9.7, while its last trade of 17,745 shares was at $9.8.

Demerara Tobacco Company Limited’s (DTC) three trades totalling 5,231 shares represented 10.44% of the total shares traded. DTC’s shares were traded at a Mean Weighted Average Price (MWAP) of $348.0, which showed no change from its previous close. DTC’s trades contributed 69.87% ($1,820,493) of the total consideration. DTC’s first two trades totalling 1,050 shares were at $348.1, while its last trade of 4,181 shares was at $348.0.

Guyana Bank for Trade and Industry Limited’s (BTI) two trades totalling 2,893 shares represented 5.77% of the total shares traded. BTI’s shares were traded at a Mean Weighted Average Price (MWAP) of $130.0, which showed no change from its previous close. BTI’s trades contributed 14.43% ($376,090) of the total consideration. Both of BTI’s trades were at $130.0.

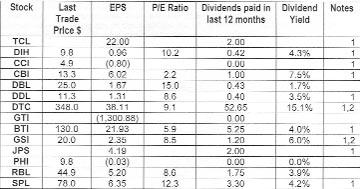

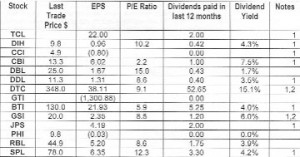

Notes

1 – Interim results

2 – Prospective

EPS: earnings per share for 12 months period to the date the latest financials have been prepared. These include:

2002 – Final results for PHI.

2005 – Final results for GTI.

2007 – Final results for and GSI.

2008 – Final results for DBL.

2008 – Interim results for TCL, DIH, CCI, CBI, DDL, DTC, BTI, JPS, RBL, and SPL.

As such, some of these EPS calculations are based on un-audited figures.

P/E Ratio: Price Earnings Ratio = Last trade price / EPS

Dividend yield = dividends paid in the last 12 months/last trade price.