HOUSTON/ST JOHN’S, Antigua, (Reuters) – Flamboyant Texas billionaire Allen Stanford and three of his companies were charged with “massive ongoing fraud” yesterday as federal agents swooped down on his U.S. headquarters.

In a civil complaint filed in federal court in Dallas, the U.S. Securities and Exchange Commission accused Stanford, who sponsored international cricket matches, and two other top executives at Stanford Financial Group of fraudulently selling $8 billion in high-yield certificates of deposit in a scheme that stretched from Texas to Antigua and around the world.

“We are alleging a fraud of shocking magnitude that has spread its tentacles throughout the world,” said Rose Romero, regional director of the SEC’s office in Fort Worth, Texas. The SEC complaint names Stanford International Bank, based in Antigua with 30,000 clients in 131 countries and $8.5 billion in assets, as well as broker-dealer and investment adviser units based in Houston, with 30 U.S. offices. In all the company claims to oversee $50 billion in assets.

Stanford’s assets have been frozen and a federal judge has appointed a receiver “to take possession and control of defendants’ assets for the protection of defendants’ victims.”

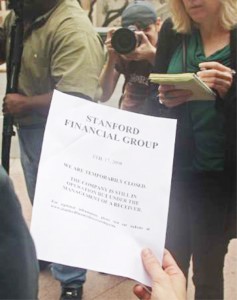

Yesterday morning, about 15 federal agents, some wearing jackets identifying them as U.S. marshals, entered the lobby of Stanford’s office in the Houston Galleria area, a Reuters eyewitness said.

Stanford Financial remained open for business but was “under the management of a receiver,” according to a sign taped to the door of the firm’s Houston office. Stanford spokesman Brian Bertsch referred press inquiries to the SEC.

Stanford, a 58-year-old Texan running the firm that his grandfather founded, has denied any wrongdoing. His location remained a mystery after the SEC said yesterday he had failed to respond to recent subpoenas seeking testimony and did not produce “a single document.”

Stanford’s real estate holdings and celebrity associations have drawn comparisons with Wall Street investment manager Bernard Madoff, charged in an alleged $50 billion fraud.

Stanford has endorsement relationships with golfer Vijay Singh and England soccer star Michael Owen as well as involvement in polo.

Last year Forbes Magazine estimated Stanford’s personal fortune at $2.2 billion.

Stanford’s website showed no apparent cause for distress yesterday, touting a motto of “hard work, clear vision, value for the client.” The website highlighted its sponsorship of the 2009 Sony Ericsson Open in Key Biscayne, Florida in March.

According to the 25-page SEC complaint, Stanford International Bank (SIB) sold $8 billion in CDs “by promising high return rates that exceed those available through true certificates of deposits offered by traditional banks.”

There were no signs of imminent criminal charges against Stanford, and a Justice Department spokesman would not confirm or deny the existence of a criminal investigation.

But Peter Henning, a professor at Wayne State University Law School in Michigan and a former federal prosecutor, said U.S. prosecutors have likely already filed a sealed criminal indictment against Stanford to be unveiled at a later time.

“The amount of money involved indicates that there will be criminal interest in this, as well as the number of potential victims involved,” Henning said.

Investors like Kelly Dehay, a Realtor, showed up at Stanford’s Houston office yesterday to inquire about their funds, only to be turned away at the door.

Dehay said his Stanford broker sold him a CD held by the Antiqua-based SIB and promised returns above 8 percent. “I started planning for my retirement a long time ago,” Dehay said. “I feel very betrayed.”

The developments come as investors, politicians and regulators focus on the returns promised and provided by investment firms, following the alleged Madoff scheme.

Stanford’s investment companies were exposed to losses from the alleged Madoff scheme but falsely reassured investors otherwise, the SEC charged.

The SEC outlined the Madoff link in its charges against Stanford, and said his firm had sought to remove nearly $200 million from its accounts in recent weeks.

The SEC also alleged that Stanford falsely told at least one customer earlier this month that he could not withdraw a multimillion-dollar certificate of deposit because the SEC had frozen the account.

“Recently, as the market absorbed the news of Bernard Madoff’s massive Ponzi scheme, SIB has attempted to calm its own investors by claiming the bank has no ‘direct or indirect’ exposure to Madoff’s scheme,” the SEC said. “These assurances are false.”

SERIES OF

ALLEGATIONS

The SEC also alleged that:

— SIB reported identical returns of 15.71 percent in 1995 and 1996, which the SEC called “improbable” and suspicious.

— Ninety percent of SIB’s claimed investment portfolio was in a “black box” shielded from any independent oversight, and only Allen Stanford and aide James Davis, also charged, knew details of the bulk of the portfolio.

— Stanford failed to cooperate with the SEC probe and continued to mislead investors by falsely saying the SEC had frozen accounts or the company had ordered a moratorium on CD redemptions.

— A major, unidentified clearing firm stopped processing wires to SIB for purchase of SIB-issued CDs after the clearing firm was unable to obtain information about the company’s financial condition.

— Stanford used false information to promote a mutual fund program separate from the CDs. The program grew to more than $1.2 billion from less than $10 million in 2004.

James Dunlap, an Atlanta lawyer representing about a dozen investors who bought CDs from Stanford Financial Group, said he planned to sue the financial firm and would likely allege the company breached its contract.

Dunlap is representing several investors who tried unsuccessfully to get back their investments with Stanford in recent days.

Several investors have told lawyers they assumed the CDs they bought were safe short-term instruments that were insured, two lawyers said. But when an investor working with Dunlap tried to get $250,000 out of a CD that came due last week, she was told she would have to wait.

ANTIGUA

Stanford came to prominence in the cricket world following his private Twenty20 competition in the Caribbean and, in particular, the $20 million game in November between England and his own team, made up of West Indian players.