Mark Twain said, “there are three kinds of lies: Lies, damned lies, and statistics.” I won’t be allowed to say that in these hallowed columns, particularly in relation to the National Accounts announced by Senior Minister of Finance Dr Ashni Singh in Budget Speech 2010. But I do draw attention to that speech and specifically paragraph 4.146 in which the Minister announced that the Bureau of Statistics had completed the technical work required “towards the rebasing of our National Accounts framework as well as updating the basket of goods and services underlying computation of our Consumer Price Index (CPI).” As if to lend some authority to that work, the Minister announced that this was done “with external assistance and support.” The National Accounts presented by the Minister are now “rebased to 2006 prices” and are introduced from January 2010, along with the new CPI.

Singular control

It is fortunate for Dr Singh, but less so for the country, that directly or indirectly, he either influences or controls the spending (as keeper of the Consolidated and Contingencies Funds), the record-keeping (the Accountant General Department) and the measurer (the Stats Bureau). In addition, he has the potential to influence the auditor (the Audit Office). Each of these entities is headed by an employee on contract, which is not an arrangement conducive to demonstrations of independence.

This column supports rebasing which is recommended by the UN and is done routinely across continents. But it would have been useful if we had used the expertise of the University of Guyana in the exercise and done it with some form of consultation, explanation and information. With so much of the information on consumer spending empirical, anecdotal and incapable of precise measurement, it would have been helpful to have the widest possible engagement on its construction, but this is simply not this Minister’s style.

The justification for rebasing is simple enough. As the Minister explained, up till 2009, the base year for Guyana’s National Accounts was 1988. He further explained that as the years progressed, there was increased likelihood of errors in measuring the level of growth and other components of the National Accounts.

This is because the prevailing price and cost structures in the base year become progressively less relevant for calculating volumes of output and for estimating value added. Also of relevance, is what is called the industry cycle as new products, technologies, and industries take the place of, or add to, those prevailing in the base year.

Never was so good

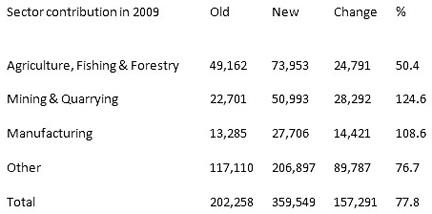

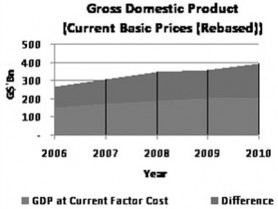

Adjusted for the rebasing, this is how the economy’s performance appears for the years 2006 to 2010 projected.

But rebasing has other consequences. In addition to the economy being larger, it means that other figures, like the amount of debt to the size of the economy, are better, while tax to GDP or government spending as a fraction of the economy, are lower. Based on his rebased numbers, Guyana is now one of the least taxed countries in the region, despite having the highest corporate tax rates and the most punitive system of personal taxation. It is true that many major sectors – like sugar, bauxite and forestry – make only a small contribution to the tax revenues of the country. Rusal and BOSAI enjoy generous tax concessions in bauxite while Barama’s capacity to make losses and still survive goes down in the business folklore of Guyana, and perhaps the world.

The private sector’s understanding

The concept of transfer pricing, one of the most common forms of exploitation by multinationals, clearly does not apply to Guyana. And what seems not to be understood by our captains of industry – who are also the beneficiaries of tax concessions and a liberal interpretation of the tax laws – is the difference between the nominal rate of tax and its effective rate.

But let us for one moment accept the Minister’s new numbers. It means that tax evasion by the business community is taking place on a scale previously unimaginable and/or the incidence of loss-making and tax exempt operations is much bigger than we think. The Auditor General (ag) simply ignores the law that requires him to do an annual audit of concessions under the Tax Holidays Act. But there is no ambiguity or uncertainty that the workers are taxed at close to 50%, taking income tax, VAT and NIS into account. On the other hand, the business community as a whole probably bears tax at less than 10%! Yet, the Minister of a government that claims working-class roots could not see it fit to reduce the personal tax rate of 33⅓%, or increase the measly US$175 per month personal allowance.

Know only mistrust

While I know a little about taxation, I confess that economics is not my field, and I therefore called several entities to help me understand the re-basing. The Minister of Finance Dr Ashni Singh, as usual, did not take my call; the head of the Stats Bureau, also as usual, was out of the office and at the Ministry of Finance, while relevant academics at the University of Guyana claimed no participation in the exercise by the Stats Bureau.

With mistrust everywhere it is sad, but not unexpected, that official statistics and reports of transactions are not well regarded by Guyanese. Think of the ‘now you see them now you don’t’ state-owned properties that are sold off; or of the conflicts of interest among important state institutions; or of the violations of the constitution and the Fiscal Management and Accountability Act; or of the incestuous relationships between the politicians and some members of the business community; or of the government’s unwillingness to entertain MP Raphael Trotman’s Freedom of Information Bill. It would be hard not to be cynical and distrustful.

And those who care only about the bread and butter or rice and curry issues, are hardly likely to be impressed by the announcement that her/his personal GDP has jumped to US$2,308.50 but s/he still cannot find a job, or is in receipt of a pension of $6,600 per month. And even for those who have jobs, their food basket costs easily exceed their income. These issues do not seem to matter to the Minister of Finance or his Bureau of Statistics.