By Rawle Lucas

Rawle Lucas is a Guyana-born Certified Public Accountant and Assistant Vice-President of the Lending Services Division.

Mr Lucas has agreed to serve as a columnist with the Stabroek Business and will be contributing articles on economic, financial and development matters.

First Quarter

As Guyanese move through the second quarter of the year, there are signs that lending by commercial banks expanded in the first quarter of 2010 over the similar period in 2009. In the first quarter of March 2009, outstanding debt to commercial banks in Guyana stood at G$60 billion. That debt has grown to G$63 billion a year later in March 2010.

The change represents an estimated 4 percent increase in the loan portfolio of the financial institutions. This performance, while positive, does not compare favourably with the first quarter change between 2008 and 2009 when the loan portfolio of the lending institutions grew by 14 percent. The private business sector led the way with a nearly 17 percent increase in its debt to the commercial banks.

Such positive developments augur well for economic growth, but Guyanese must ask if this news is enough to start a celebration. Guyanese could wait to hear from the Bank of Guyana when it releases its first quarter report or they could try to figure out for themselves what is going on.

The task of figuring out what is happening is not an easy one since information on the behaviour of the economy is not widely available. Some variables help and credit creation is one of them since it plays a big role in determining the money supply and economic activity. Examining the behaviour of three of the biggest borrower groups – manufacturing, distribution and households – could provide a glimpse of the direction in which the Guya-nese economy might be heading in 2010.

Slower Growth

A restraining factor is the behaviour of the loan balances within the last year compared to the previous year. The year to March 2010 has seen much slower growth in the loan portfolio of the banks. Based on data contained in the recently released Statistical Abstract of the Bank of Guyana, in the year from March 2009 to March 2010, the loan portfolio of the financial institutions grew by just over four percent. The private business sector led the way in borrowing from the banks. They increased their leverage in the period between March 2009 and 2010 by 9 percent. At the same time, households which grew their portfolios by nearly 12 percent between March 2008 and March 2009 have been reducing their debt. Within the last year, households have reduced the claims of the commercial banks on their assets by nearly 6 percent. It is not clear if the debt reduction by households is the residual effect of the bad economic times of 2008 and 2009 and their reluctance to over indulge or if it is the actual continuation of that conservative trend.

A second discouraging signal is the behaviour of households. The decline in borrowing by households could spell trouble for the Guyanese economy as the fall in outstanding debt could mean that Guyanese are unwilling to spend more than their means. Guyanese consumers account for over 60 percent of the spending in the economy and cutbacks by them could hurt economic growth. The trend in consumer behaviour is an important barometer of the economy’s strength. An increase in borrowing supports an increase in spending and this helps spur growth, whereas a decrease in borrowing suggests a decline in spending with the likelihood that the economy will slow down, unless increased government spending replaces consumer demand.

Corroborating Evidence

Among private businesses, the distribution sector – made up of retailers, wholesalers, importers and exporters – borrows the most. This group has much interaction with households, especially through the activities of retailers. They are the ones who sell the books, games and computers to facilitate learning and fun; the food items that end up in the pot and lunch kits; the furniture and fixtures that decorate the houses; the clothes, shoes and jewelry that enhance appearances; and the soap and perfume that aid good hygiene and good odour. The behavior of that sector, when combined with that of households, provides corroborating evidence about the direction in which the economy might be heading.

Paying Down Debt

The distribution sector accounted for 34 percent of the money owed by private businesses in March 2008 and 35 percent in March 2009. The sector grew its debt by 21 percent between March 2008 and March 2009, no doubt in anticipation of an increase in consumer spending. The distribution sector was among those sectors that reportedly made a positive contribution to the Guyana economy in 2009. Within the year between March 2009 and March 2010, the distribution sector reduced its debt by five percent. Paying down the debt means that less borrowed money is being used by the sector for investment. This could have negative consequences for economic growth, unless investment is being financed with internally generated resources.

No Comfort

The trend in the manufacturing sector provides no comfort to the skeptics. This sector struggles perennially and delivers a performance that is either sluggish or uninspiring. However, even with its poor track record of performance, this sector holds a substantial share of private businesses’ debt to the banking industry. In March 2008, the manufacturing sector held 30 percent of the private sector debt to the banks. By March 2009, that share had fallen to 28 percent and as of March 2010, that share stood at 26 percent, having grown by less than one percent during the period.

The decline in borrowing might be necessary and households and businesses could be replacing debt with their own funds. Households tend to rely on remittances as an alternative source of money and businesses tend to rely on households to generate equity spending. Data on remittances are not available just yet, but a growth in remittances would be favourable to the economy. Otherwise, with falling debt, the Guyanese economy could be running aground.

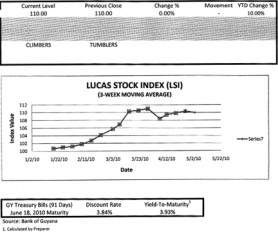

LUCAS STOCK INDEX

In week one of May, the Lucas Stock Index (LSI) saw no change in value even though a larger volume of transactions occurred in the current period of assessment as against the previous period. None of the stocks in the index, including those involved in trades, showed any positive movement. With the index unchanged, the LSI remains in positive territory for the year and continued to reflect a 10 percent increase in value since the start of trading in 2010. At its current level, the index continues to show a yield 2.5 times higher than the returns to be obtained from the risk-free Treasuries that will mature in June 2010.