In order to enhance public knowledge of the financial services industry and its significance to the economy, Stabroek Business has agreed to partner with the Guyana Association of Securities companies Intermediaries Incor-porated (the Guyana Stock Exchange) to publish a series of articles on the subject.

The articles are tailored to enhance the knowledge of persons who are not necessarily specialists in the business and finance sector.

Introduction and Overview

The financial services industry is an important part of modem economy. It plays a critical role in providing resources for the productive sectors and also in helping to mobilize savings, moving it from those who have excess to those who need. It also promotes economic efficiency by producing an efficient allocation of capital, which increases production. Additionally, it improves the well-being of consumers. In so doing, it helps with the growth and development of the economy. There are three components of the market:-

a) financial instruments – of which there are two main ones, debt and equity;

b) financial markets which may be divided into different segments; and

c) financial intermediaries

a) Financial instruments fall into two major categories, debt and equity.

Debt instruments include bank loans, commercial paper, treasury bills, mortgages, bonds, debentures and other instruments.

Equity instruments include mainly common shares, preferred shares, and derivative instruments such as futures and options contracts.

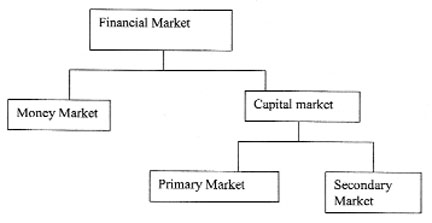

b) One of the most important divisions in the financial system is between money and capital markets. The money market is designed to deal with short term instruments and the capital market is the sum of all providers and users of long-term capital. In it are traded a number of financial products. The intermediaries who serve to improve the efficiency of the markets include financial institutions such as banks, trust companies, credit unions, insurance companies, etc.

c) A number of different financial intermediaries exist to facilitate the flow of funds between those who have and those who need. Intermediaries specialize in different areas of the market. Among the intermediaries are commercial banks, investment companies, pension funds, insurance companies, finance companies, trust companies etc.

This course is designed to expose students to the operations of the financial market but more specifically the securities market and to give you an appreciation of the issues that are involved. The course must be taken seriously, as at the end there will be an examination, which will determine your ability to participate in the industry in Guyana. It is an introductory course but assumes that you are familiar with certain basic terms used in the industry. We will not be studying the basics as it is assumed that there is a certain body of knowledge possessed by you but instead we will focus on both the bond and equity markets and the interaction with the rest of the economy. It is essential that you revise your basic investment and economics, as those are the foundations on which we will build. You cannot be in the industry and not be familiar with the workings of the macro economy.

The Financial Services Industry

In order to understand the financial services industry we will begin by describing a market, something with which we are all familiar. A market is a place where people gather to buy, sell and trade commodities. A good example of a market is a Saturday morning market in most Caribbean countries and in particular, that found in the capital of most countries such as Coronation Market in Kingston, Jamaica, and Stabroek Market in Georgetown, Guyana. There are many other such markets scattered throughout the Caribbean. If you take a walk down the main street in the capital city of most Caribbean islands on any Saturday morning, you will experience the thrill of a market. You will witness the haggling over prices and_ quality and sometimes, quantity.

You will also observe that the price of the commodity is almost the same moving from one vendor to another. By shopping around though, you might be able to get a bargain but most times that takes a lot of hard work and diligence. The same is true with participating in the financial markets, you can get bargains but you must be diligent.

In a market, buyers have a wide choice of commodities. The more commodities there are, the wider the choices available to the consumer. The consumer is therefore only constrained by his budget. At the same time, as a commodity gets scarce, the price tends to increase and when it is plentiful, the price tends to fall. There is however, very little price differences for the same commodity in the same market, each vendor knows what the other is selling for and each buyer knows the going price and that knowledge is based on the free flow of information .

The financial market works in much the same way. People who have funds to invest are brought together with people who are looking for money to borrow. Such funds are needed for a myriad of things and borrowers are prepared to pay for the privilege of having access to those funds. As an economy advances, the number of financial products increases and so too does the sophistication and taste of the investors.

FINANCIAL MARKETS

What is the role of a financial market?

In general, to bring together suppliers and demanders of capital. Equities and debt are traded in financial markets. Thus, financial markets serve not only as a source of capital, but financial markets also value corporate securities.

Money vs. capital markets – money markets involve short-term, highly liquid and relatively safe securities. .Capital markets are markets for longer term, less liquid and riskier securities, such as the bonds and stocks, which corporations issue.

The capital markets often involve physical exchanges, such as the New York Stock Exchange, Jamaica Stock Exchange, Guyana Association of Securities Companies and Intermediaries (GASCI). Corporations enter the capital markets to obtain long-term funds, either debt or equity. Most large corporations are unable to generate enough funds internally to satisfy their needs, so they raise additional funds externally in the capital- markets.

Primary market – A primary market is where securities are originally issued, and capital raised by corporations or the government. Primary market issues consist of:

(1) New offerings of companies that have sold securities to the public before and

(2) Initial Public Offerings (IPO’s), where a company is selling securities to the public for the first time.

Primary market transactions increase the supply of securities. Newly issued securities usually have to be registered with the regulator (and the regulator goes by different names – in Guyana it is the Guyana Securities Council, in the USA, it is the Securities and Exchange Commission). After a security is offered in the primary market, it becomes part of the secondary market.

Equity Markets

A stock market is a common place where stocks are actively traded, especially in most market-oriented economies. For example, in the United States, the New York Stock Exchange (NYSE) and NASDAQ have huge daily volumes amounting to billions of dollars in transactions. In London and Tokyo, they have similar levels of transactions in their stock market. There are two basic types of stock markets: an exchange and Over-the-Counter (OTC). An exchange is an organized market where buyers and sellers meet. On the other hand, NASDAQ is not an organized market and is run by computers.

There is no floor where the buyers and sellers meet and trade. GASCI is an organized market where buyers and sellers meet to trade equities.

What benefits are derived from having an exchange? For example, if I want to buy 1,000 shares of EEBIS without an exchange, I would have to look for all the stockholders of EEBIS shares and ask each of them whether or not they are willing to sell me 1,000 shares. This results in a lot of wasted time, money, and other resources.

“Thus, without an exchange, it would be costly, less efficient, and stocks would become less liquid. With a stock exchange, all I have to do is place an order through my broker, who would then match that order with anyone that is willing to sell his or her shares on the exchange.

Firms raise cash to fund their real assets by selling financial assets. Financial assets are mainly stocks and bonds, which are sold in the financial markets. When the stock or bond is sold and the issuers receive cash, that is said to be a primary issue and the transaction takes place in a primary market. The primary markets include all types of securities, but are distinguished by the fact that the security is being sold for the first time. After a security is offered in the primary market, it becomes part of the secondary market and is traded among investors. The securities offered in the primary market consist of:

(1) New offerings of companies that have sold securities to the public before; and

(2) IPOs, where a company is selling securities to the public for the first time.

Aside from being able to raise cash, financial markets also allow existing stakeholders to trade stocks or bonds with one another or with new investors. For example, if I wanted to buy 1,000 shares of EEBIS, I would go to my broker to place an order. That order would be matched with someone who is willing to sell 1,000 shares of EEBIS.

When a seller is found, the trade is completed. Such purchases and sales are known as secondary market transactions and they take place in the secondary market, usually a stock exchange.

A secondary transaction may take place outside of the stock exchange. For instance, if you sold to John Brown 1,000 shares of your EEBIS stocks, then a secondary transaction has taken place even though it did not take place on the stock exchange.

Some financial assets have a less active secondary market than others do. For example, in Guyana and some other Caribbean countries, the bond market is not very active and the only fixed-income securities that are regularly traded are Government Treasury Bills.

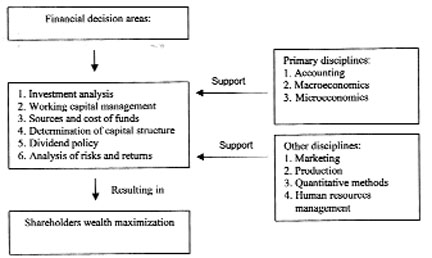

There are a number of factors that affect the financial markets and we will attempt to identify some of them in the chart at right.

Overview of Secondary Equity Markets

The smooth functioning of the money market depends on financial intermediaries such as brokers and dealers, who play a key role in marketing new issues of money market instruments and in providing secondary markets where outstanding issues can be sold prior to maturity. These intermediaries between buyers and sellers play significant roles in the buying and selling of securities.

So we can say that financial markets are vehicles through which financial assets are bought, sold and traded. These markets are generally classified as money or capital markets and primary or secondary markets. Recall that the money market deals in short-term securities having maturities of one year or less, while the capital market deals in long-term securities having maturities greater than one year.