By Rawle Lucas

Rawle Lucas is a Guyanese-born Certified Public Accountant and Assistant Vice-President of the Lending Services Division.

Mr. Lucas has agreed to serve as a columnist with the Stabroek Business and will be contributing articles on economic, financial and development matters.

Comeback

Greece is known for its mythology about superhuman feats by gods and goddesses, as the cradle of democracy, and as the originator of the Olympic Games. These are all accomplishments that placed Greece in high esteem and gave it a prominent place in history. But it is Greek mythology that seems to be making a comeback in modern times. The myth of a budget surplus instead of producing supernatural achievements has left the nation with angst and chaos. Greece only forms two percent of the European Union’s (EU) population and two percent of the European Union’s GDP. A great power in its ancient history, it is now a shadow of its former self, long since overshadowed first by the Roman Empire, then by Western Europe, which itself is now outdone by the United States.

Simmering

Additionally, Greece never created anything like a colonial empire — in fact, it was once a possession of the Ottoman Empire until 1829. Unlike other European nations, Greece did not venture out into far-flung lands snatching up colonies, probably because it was too busy looking after its own survival and pursuit of independence. Even though Greece did engage in some local expansion under its independent government, by and large, it has been quite unimportant for most of modern history. Yet this tiny nation is at the centre of a simmering economic volcano and threatens to do tremendous harm to the European economies much like Eyjafjallajökull, a natural volcano of Iceland, is doing to the western part of the continent.

Economic Frailty

Against the backdrop of historical significance, Greece is now a picture of economic frailty. Its economy, driven in large part by tourism and shipping, has encountered stormy weathers and for weeks has been the subject of gloomy economic forecasts and the target of angry citizens. Not even its greatest god, Zeus, had bothered to protect or forewarn the nation of the deceptive behaviour of the mortals that were chosen to lead it in more recent times. Instead, it looks as if the Great Gods that Greece revered in folklore had returned with a vengeance to discipline a nation that had gone astray. The country was hardly prepared for the financial bombshell that was dropped on it by a new administration.

Mythical Accounting

The problem that Greece has is a budget deficit that is real, but caused by mythical accounting practices. Unlike the Greek gods, whose existence was a fantasy, the budget deficit of modern Greece actually exists. Its budget deficit is estimated at 13.6% of gross domestic product (GDP). At that level, Greece’s budget deficit violates the EU’s Growth and Stability Pact more than four times over. Adding fuel to the fire is a debt that currently hovers around 120% of GDP, a situation equally untenable as the deficit. This conundrum arose from nothing more than fiscal malpractice on the part of both the government and the citizenry. Many sources have reported that Greece has been underreporting its budget deficits. It did it to convince the EU that it was qualified to join its ranks. This underreporting of the deficit appears to have continued over the years and is linked to an inadequate tax collection regime.

No Worse

What is fascinating about this is that Greece’s spending is no worse than other EU countries, including countries like France and Finland, which are looked upon as responsible member states. Though its spending relative to other EU countries is rather average, it has had great difficulty collecting revenue from its skilled tax dodgers. Consequently, Greece resorted to sleight-of-hand tactics on revenue disclosures, leading to a crisis of confidence in government statistics.

Self-employed individuals tend to keep two sets of books – one with the true revenue received, and the other to show the government. To make matters worse, government tax inspectors appear to facilitate the practice of tax evasion by accepting bribes. Now the myth has been uncovered, and it has wreaked havoc on the euro, Greek bond prices, and borrowing ability, now that the Greek government was forced to come clean about its fiscal condition. But it is not only the financial markets taking blows; the public has given the crisis physical form by rioting in the streets.

Veto

The current financial difficulties have forced Germany, “controller of the euro”, to make the unpopular decision to bail the Mediterranean country out. In return, Germany demanded massive spending cuts and insisted that Greece accept IMF terms for managing its finances. Since these cuts would mean less money for Greece’s very large public sector and fewer benefits for the citizens themselves, the IMF medicine is tasteless to the citizens and politicians. There is a likelihood that Greece might never have to drink the tasteless medicine. The US Congress is enacting legislation to prevent the IMF from lending money to countries which might not be able to repay the loan. The proposed law seeks to give the US the right to veto an IMF loan for any country that appears unable to repay the debt. Right now it looks as if the threshold for triggering the veto is a proposal that aims to resolve debt conditions that are 100% or more of GDP.

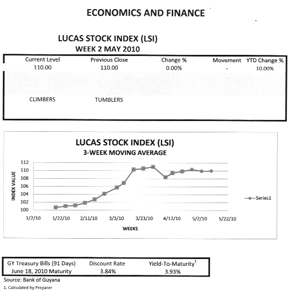

LUCAS STOCK INDEX

In week two of May, the Lucas Stock Index (LSI) saw no change in value. Trading was light during the current period of assessment. None of the stocks in the index, including those involved in trades, showed any positive movement. With the index unchanged, the LSI remains in positive territory for the year and again reflects a 10 percent increase in value since the start of trading in 2010. At its current level, the index continues to show a yield 2.5 times higher than the returns to be obtained from the risk-free Treasuries that will mature in June 2010.