Things like assets, capital, and inventories might be exciting to talk about in the classroom in pursuit of an A grade or in the boardroom of a company to ensure that company profits are heading in the right direction. It is hardly the thing to generate excitement in the news reports, except if it is attached to some scandal involving someone that the reader knows or might otherwise have an interest in. A good rule of thumb is to avoid discussing such dry items to avoid turning off readers. Yet, these things matter and there are occasions when talk about assets, capital and inventories is unavoidable. This occasion is one of those times because of the question that arises from the review of some data sitting in the World Development Report that is produced by the World Bank. The World Development Report noted that the rate of capital formation in Guyana amounted to 40 percent of its gross domestic product or GDP in 2008. Another report by an agency of the US Government indicated that the capital formation of Guyana in 2009 was 37 percent of GDP. These levels of capital formation are pretty impressive because Guyana was identified as having the sixth highest rate of capital formation in the world last year.

The people who track these statistics often expect to see impressive levels of economic growth from a country boasting such high rates of investment because economic wisdom says that the higher the level of investment in the capital stock of a national economy, the higher will be the economic output. Those who own or manage private businesses would understand this line of thinking very well because they know that if they have a good return on assets, they had a good year of business. When referring to the economy of a country, this perspective of economic growth is often described as gross capital formation or gross fixed capital formation depending on how confident the compilers of the national accounts are about the data on business inventories.

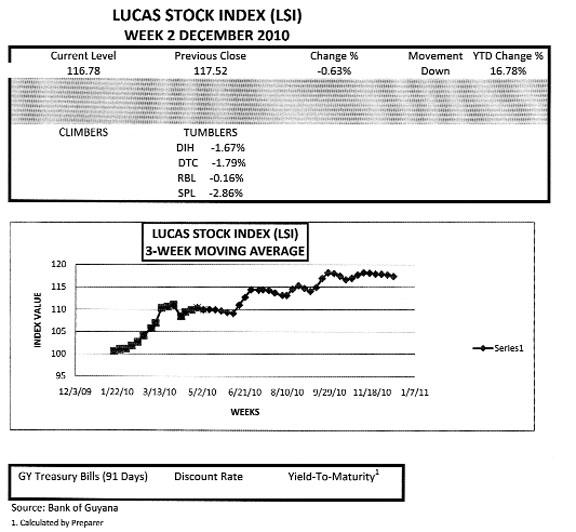

LUCAS STOCK INDEX

In week two of December 2010, the Lucas Stock Index (LSI) declined further by 0.63 percent from the previous week. The index ended the period at 116.78, its lowest level in 14 weeks. Trading this week involved the stocks of Banks DIH, Demerara Distillers Limited (DDL), Demerara Tobacco Company (DTC), Republic Bank Limited (RBL) and Sterling Products Limited (SPL). DDL recorded no change in its stock price while the stocks of the other five companies recorded losses.

In the tool kit of economic models, there is a way of determining how large the economy of Guyana should have grown in 2009 and 2010 with the reported level of capital formation in the preceding years of 2008 and 2009. Reaching back into the 20th century for the Harrod-Domar economic growth model, the expectation is that the Guyana economy should have grown by 13 percent in 2009 and by 12 percent in 2010.

But, Guyanese know from the budget presented to the nation this year that the economy grew by less than three percent in 2009 and, from the third quarter report of the Bank of Guyana, that it would do no better in 2010. This gap in performance that looks as wide as the mouth of the Essequibo River must make Guyanese wonder where all the expected growth has gone. The difference between expectation and reality is usually explained by factors other than the amount of money invested in the economy. One issue that comes to mind and that most economists would agree with is the weak institutional support for entrepreneurial activity and important public services. Many examples of the nonexistent or slow pace of institutional support abound, but one with direct impact on the effectiveness of our capital investment stands out.

Guyanese would recall that Parliament passed the Small Business Act in 2004. That Act made provision for the establishment of a small business council, a small business bureau and a development fund for small businesses. The administration created the small business council and did nothing else after. Consequently, six years have passed and an important legislative decision of Parliament that could have helped Guyana to increase economic growth faster has not been fully implemented.

This failure to act stymies entrepreneurship and the benefits from capital investments. In June this year, instead of carrying out the wishes of the people of Guyana, the administration opted to go in a different direction, creating a single parent micro-credit scheme that functions outside the agreed legislative framework. This initiative, with a G$500 million price tag, focuses primarily on women and does not necessarily capture the development needs of the wider business community as would be possible if the development fund had been created. Add the unwillingness of the administration to create the Public Procurement Commission and the magnitude of the institutional weaknesses enlarges. So, while the administration could make the claim that it is helping the people of Guyana, it also reveals, by disregarding legislative decisions, that it is thumbing its nose at them.