Illusion

Notwithstanding the energy and miscellany of programmes it trots out each year, the administration, like other governments, simplifies its achievements by showing how gross domestic product (GDP) has changed from one year to the next. That figure is usually broken down into per capita income to show the Guyanese people how well the country is doing. That per capita income says how much money each person has received as a result of the goods and services that were produced and sold in and out of the country. Because of what it represents, the per capita income figure also helps to create the illusion of belonging and participation in the economy. It is easy to believe that each person got a slice of the income generated even though they might not have even held a job or did not earn as much as the per capita figure said they did. So, in Guyana, as elsewhere, when GDP goes up as it usually does when presented in current prices things look good. Usually, governments and economists talk about GDP and per capita income in real terms. What they do is they remove the effects of the change in price from a given year to the current year and present GDP and per capita income in what they call real terms.

Taxes

When presented in real terms, the GDP and per capita income are telling us how much goods and services people were able to acquire within the year in reference. When per capita income in real terms goes up, that means people ate and drank more or enjoyed more of whatever it is that they like having. When it goes down, it means that people ate and drank less or enjoyed less of their favourite purchases. But in Guyana where the government hogs nearly half of the goods and services produced in the country an increase in real per capita income means more for the government and less for the people. A few more things need to be said about real income before moving on. The GDP figures that the administration quotes represent the money that people get before income taxes are deducted. The GDP figure also contains the profits that businesses, big and small, generate. The profits of small businesses are rolled into their personal income and are taxed at the individual rate. In the case of the larger businesses, most of its profits are kept by the companies and are not available to the rest of the country to spend. Adjusting for business profits and income taxes brings us to the reality of the cash flow that Guyanese face with every paycheck, their disposable income.

Cash Flow

By focusing on per capita income, we tend to forget that there is another side to the equation, money that is spent. The better concept to assess what is going on in the lives of Guyanese is the cash flow. The cash flow is about money coming in and money going out of the hands of the households in the country. Even though real income says Guyanese might be able to buy an extra loaf of bread or an extra gallon of rice, it does not mean that they were able to buy all the goods and services that they really needed. For example, even if house rents went up by just one percent, it does not mean that all Guyanese could afford to pay the rent on the income that they have. That has been happening to many Guyanese for a long time now, but nearly the entire nation became victims of this cash flow problem in 2005. That cash flow problem continues until today and shows no sign of stopping. Guyanese are proud people who cherish their privacy; it takes a lot for them to admit willingly in public that things are tough. Many have done a good job of concealing their pain and suffering, yet there is no point to hiding the truth since the evidence exists in the public data published by the administration. The good thing is that the data does not identify Guyanese by name or address, so people can still remain anonymous while being better informed and facing up to the truth.

Decline

Those who take the time to sort through the data that appear in the Bank of Guyana Reports or that are published by the Bureau of Statistics and put the picture together would be able to tackle the reality about their lives and would be able to put the stories that the administration tells in its budget presentations in proper context. One of the first things Guyanese would see upon rearranging the data on income is that cash inflows to each household declined by six per cent from 2001 to 2009. This finding reveals that if the issues that keep money out of the hands of workers are not addressed simultaneously with salary increases, the latter would be of little consequence to the recipients. The second thing that Guyanese would notice is that they were able to save some money in 2001, but by 2009, they appear to owe everybody under the sun.

Floods

A more formidable challenge to Guyanese households appeared in 2005 and that challenge has not gone away. The administration could present various budget scenarios but it cannot deny that Guyanese households came up about G$22 billion short after the floods of 2005. Guyanese found themselves spending more than their income could handle to recover from a problem that was not their fault. Not a single year after the floods have Guyanese households been able to return to a positive cash flow situation. In 2007, the shortfall rose to G$48 billion and in 2008, Guyanese spent G$69 billion more than they earned. In 2009, Guyanese substantially cut back on their consumption but still could not bring their household budgets out of the red. However, they were able to cut their income shortfall to G$34 billion, half of what it was in 2008. The flood might have precipitated the downslide but the introduction of the value-added tax (VAT) at the rate of 16 per cent might have accelerated it. The rate of the VAT was too high for the financial condition in which Guyanese found themselves at the time. As a consequence, from 2005 to 2009, Guyanese households accumulated a shortfall in excess of G$184 billion

Miracle

That had never happened before. Yet, it is the future facing Guyanese households and there is little hope that they will emerge from under this debt burden that has fallen on them without a miracle or better leadership. It is not clear how long it will take to repay the debt but unless incomes increase substantially, the income that Guyanese receive in the future will belong to someone else. It is for this reason Guyanese should not be ashamed to take the free laptop, and to continue taking the free lunch, the free uniforms and the other free stuff from the administration. It is no fault of yours if you could not acquire these items on your own and you owe the government no favours for taking them.

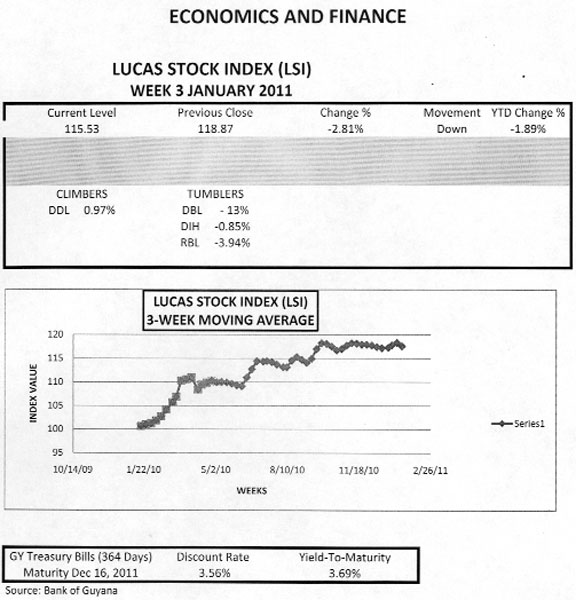

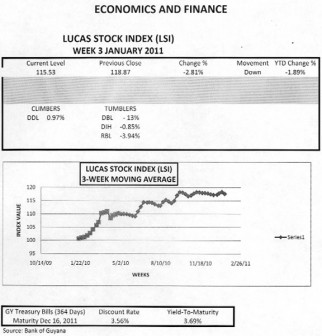

LUCAS STOCK INDEX

After three weeks of trading in 2011, the Lucas Stock Index (LSI) is down nearly two per cent. The index is in negative territory owing to the 13 per cent decline in the value of the shares of Demerara Bank Limited (DBL) and a nearly four per cent drop in the share price of Republic Bank Limited (RBL) from last week. Additional pressure came from the shares of Banks DIH (DIH) which gave back all the gains of the previous week. The only stock that traded in positive territory this week was that of Demerara Distillers Limited (DDL), but its one per cent gain was insufficient to alter the direction of the index. The index currently lags behind the yield on the risk-free Treasuries that will mature in December 2011.