Favours

As noted before, the service sector is a significant part of the Guyana economy and construction occupies a prominent portion of that sector. The growth trend in construction appears to be accompanied by a relatively slow movement in prices. It is not clear what contributes to this phenomenon, but there are obvious events that indicate that construction receives special attention from the administration in exchange for favours. Guyanese may recall that some hotel construction in Guyana obtained special funding arrangements from the administration with the hotel management being given the option to repay part of the loan with room nights, which it did. No one has ever given a clear indication of when the option was exercised by the administration or a proper accounting of the results of the option. Additionally, the myriad of infrastructural activities involving sea defence, drainage and irrigation, road and bridge construction and maintenance as well as property development enables contractors to benefit from a favourable application of the value-added tax (VAT).

Escape

The favours for the construction industry did not stop there for contractors. According to the Guyana Revenue Authority (GRA), anyone bringing in a large piece of capital equipment for the first time escapes the VAT with the prospect of repeating the feat on subsequent imports with the blessing of the Minister of Finance. The reach of the concession extends as well to locally-produced raw materials used in construction. Items of sand, stone, concrete blocks, lumber, or similar materials, of a type and quality used for construction are charged the value-added tax at the zero rate. In other words, even though the items are not exempt from VAT, buyers of these materials do not have to fork out the extra 16 per cent because the application of the tax rate has no effect on the total amount of money leaving the purchasers’ pockets. Unlike the special financing deal which the Buddy, now Princess, hotel construction received earlier in the last decade, this policy appears to be much more broadly applied.

Forgotten

Sometimes forgotten are the special concessions granted to commercial banks who participate in the low-income mortgage market. Participating banks get to keep all the interest earned from the loans that they make to low-income borrowers, providing these lenders an incentive to make additional loans for home construction activities. Seldom spoken about also is the exemption of mortgage lending from the reserve requirement imposed by the Bank of Guyana. This increases the amount of cash that is available to the commercial banks to lend for construction activities. But the impact of that policy might have reached a plateau with a look at the trend of lending for real estate mortgages in the financial industry.

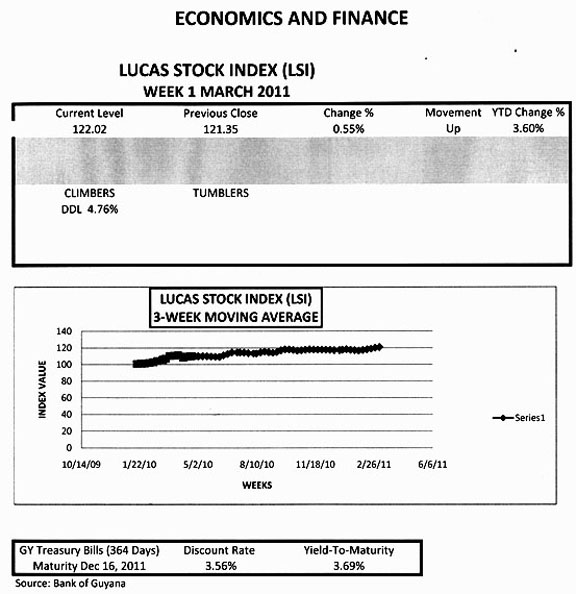

LUCAS STOCK INDEX

At the end of the first trading period of March 2011, the Lucas Stock Index (LSI) added an additional fraction of one per cent to continue its slow but positive movement for the year. The active stocks this week were Banks DIH (DIH), Demerara Bank Limited (DBL), Demerara Distillers Limited (DDL), Republic Bank Limited (RBL) and Sterling Products Limited (SPL). With the exception of DBL which recorded a gain of 4.76%, all the other active stocks showed no gain. Despite the positive movement, the value of the index continues to lag behind the yield on the risk-free Treasuries that will mature in December 2011.

The rate of growth in mortgage lending has dropped substantially from 2006, the first full year for banks to exercise the option, to 2010. Bank lending expanded by 36 per cent in 2006, but the rate of increase has steadily declined reaching 24 per cent in 2009 and, according to the 2011 budget data, appearing to stabilize at that rate in 2010.

Multitude of services

Financial services itself is an important hub of the Guyana economy with a nexus to more than the construction industry. Many types of institutions participate in this component of the service sector, and provide a multitude of services which includes creating money through credit, facilitating commerce, assisting with the management of risk and helping Guyanese to plan for the future. The principal players in this grouping of economic actors are the commercial banks who account for nearly 90 per cent of the activities of this component of the service sector. Insurance companies, cambios, micro-lending entities and asset-management companies all play important but minor roles in the financial services industry.

Sizable spread

Despite its importance and prominence, financial services account for four per cent of the economic output and income of the Guyana economy and six per cent of the activities of the service sector. Recent annual reports of the commercial banks reveal that lending rates range between five to eight times their borrowing costs. With commercial banks enjoying a sizable spread between their borrowing costs and lending rates, financial services generate about G$1.38 in income for every dollar of output. This makes it the third highest earner in the Guyana economy behind gold and the utility services of electricity and water.

Electricity and water

Like financial services, utility services of electricity and water are central to the operation of the economy and the quality of life enjoyed by Guyanese. Their minute contribution of two per cent to the Guyana economy belies their weight on, and importance to, the lives of all Guyanese. Even within the sector, electricity and water produce two per cent of the output and four per cent of the income. Without electricity and running water, life comes to a standstill.

Not even the many years of uncertain supply have conditioned Guyanese to cope without these utility services. Guyanese become uncomfortable and composure often gives way to fatigue and frustration when electricity and water are missing. Guyana has one principal supplier each of electricity and water and their monopoly position gives them an advantage over customers. The market power of the two utilities enabled them to earn an average of G$1.73 for every dollar of output, making the utility services the second highest income earner after gold.

(To be continued-Final part next week)