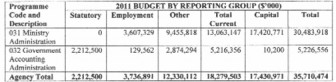

Today’s column resumes the review of the 2011 budgetary allocations to the principal ministries of government. Two of the ministries covered so far were the Ministry of Education on February 27 and the Ministry of Education on March 6. Today we turn our attention to the Ministry of Finance which in 2011 was allocated $18.3 B on the recurrent budget and $17.4 B on the capital budget, making a total of $35.7 B.

As a percentage of the national budget, the Ministry of Finance accounts for 18.4% of the recurrent budget and 28.0% of the capital budget. This makes it the single largest spending ministry in the government, and it is perhaps surprising that its capital budget is bigger than that of the Ministry of Public Works and Communication.

What is also significant is the increase over 2010 – a massive 64.3% increase with the bulk of it on the capital side. This is largely due to the proposed spending on LCDS projects including equity spending on the Amaila Falls Hydro-electricity project.

The Ministry

Like the Ministry of Health, this ministry has two ministers, with the junior minister Ms Jennifer Webster playing a more low-key, back-room role while the senior minister Dr Ashni Singh, brought in after the 2006 general elections as a technocrat is increasingly copying the style and language of his mentor, President Bharrat Jagdeo. That style has not endeared him to the diplomatic and multilateral financial community, and many observers think that that may be responsible for the closing of the development agencies DFID and USAID as well as the relocation of the office of the head of the World Bank mission in Guyana.

His shutting out of critical views by draconian legislation on the New Building Society, his refusal to approve proposals by micro-projects for EU funding and his refusal to canvass views prior to his annual budgets all demonstrate an intolerance for opposing views that is inconsistent with a true technocrat.

Staffing

This is another of those ministries where the percentage which the number of contract employees bears to the total number of employees exceeds 40%. It is in fact 43.4% but it accounts for 72% of the total wages and salaries of that ministry. If one excludes the junior staff who according to Labour Minister Manzoor Nadir, were recently shifted to the category of contract employees, the share of the wages budget that is paid to contract employees is huge, very huge.

In the current budget of the Ministry’s Administration, three line items account for 94.06 % of the total as follows:

$B

Revision of wages and salaries 3.5

Electricity charges 2.5

Subsidies and contributions to local organisations 6.3

12.3

In the Government Accounting Administration two line items – statutory pensions and gratuities ($2.2B) and Pension Increase ($2.1B) – account for 82.4% of this programme’s activity.

Subsidies and contributions

The entities in receipt of the largest contributions were the Guyana Revenue Authority ($3.1B) and LINMINE for community power ($2.2B). It is of some interest that notwithstanding a decision of the court, the GRA is treated for the purposes of its expenditure as a separate entity while its entire income goes into the Consolidated Fund.

Other significant subsidies and contributions were made to organizations, some of which are of doubtful legal status, while that of their audits is even less clear. The principal ones are:

$M

Customs Anti-Narcotics Unit 99.2

Ethnic Relations Commission 89.1

Kwakwani Utilities Inc. 253.5

State Planning Secretariat 130.1

Statistical Bureau 172.0

743.9

Capital programme

Under the capital programme are such hazy projects as:

$M

Road Support Project 150

Basic Needs Trust Fund 650

LCDS Projects 14,350

Student Loan 450

Poverty 717

GuySuCo 440

16,607

The projects earmarked for funding under the LCDS programme are “Amaila Falls equity” which can surely mean anything and everything, Amerindian Development Fund and Land Titling, and Fibre Optic Cable.

Conclusion

But for the interventionist style of the President, this would easily be the most important ministry in the government. In addition to his several functions and duties under the Fiscal Management and Accountability Act 2003 which he sometimes conveniently ignores, Dr Singh is also the subject minister responsible for the Bank of Guyana, the Guyana Revenue Authority, the Bureau of Statistics, the National Insurance Scheme (NIS) and the Office of the Commissioner of Insurance. Under the Bureau of Statistics Act, 1991 unless he appoints a chairman of the bureau he is automatically the chairman, making him the scorekeeper of his own performance. And as subject minister, he seemed blissfully uninformed about the failure of the Office of the Commissioner of Insurance which allowed Clico Guyana to conduct its affairs in the most reckless manner and caused the NIS to have a yet-to-be filled hole of $6 billion.

Even though the major bungling and the public pronouncements on the tax concessions to the Ramroop group by Mr Jagdeo took the spotlight off Dr Singh, he was in fact at the centre of the fiasco, having had to look at it from three different perspectives. To his further discredit, Dr Singh also chairs the board of NICIL, the state-owned company that simply refuses to conduct its affairs in accordance with the law.

The Minister regularly publishes the mid-year report with misleading dates. He was cited by an opposition MP in the $4B transaction with GuySuCo in which his colleague in the Ministry of Housing was found to have a prima facie case made against him for misleading the National Assembly. There can be no doubt that Dr Singh would have known and went along with the transaction. But if there is a single issue for which this Minister will always be remembered is that while he served as Senior Minister of Finance, his spouse was effectively the Auditor General. That is an extremely convenient arrangement, but one over which few would be prepared to risk their reputations, and which will overshadow Dr Singh’s tenure as Minister during which he reported growth in each year.

Next week I will review the annual report of the Guyana Bank for Trade and Industry Limited which has published a notice of its AGM.