Normal Tendency

Not since 1999 has the index of departures from Guyana risen to such noticeable heights. According to the index, constructed from data published by the Bureau of Statistics, the number of people leaving Guyana has risen significantly, about 47 percent more, since 2006 and has surpassed the level that obtained in 1999. The index, which was developed on the basis of a 3-year moving average, shows the change in net departures from Guyana since 1999 utilizing 2006 as the base year. Since 2006, the net departure has grown by 10 percent annually in contrast to the years between 2000 and 2005 when it declined by four percent per annum. It is not clear what is causing the significant rise in the net departures from Guyana, but this trend is typically associated with heightened insecurity and unfavorable views about economic circumstances. The normal tendency is to assume that Guyanese are grabbing better opportunities abroad where they can and are opting out of the increasingly insecure environment in which they find themselves. It is a trend that ought to raise concerns about how well the administration is addressing issues of security and economic opportunity because it appears as if whatever favorable expectations Guyanese had about prospects for a good life in earlier years are rapidly evaporating now.

Meagre

This migratory trend contradicts the rosy description of the economic circumstances of Guyanese and makes it difficult to reconcile the claims of progress that the administration makes and the expressions of despair of the Guyanese who work hard to keep a roof over their heads, to put food on the table, and put clothes on their backs. The economy, as measured by gross domestic product (GDP), reportedly grew by two percent in 2008, by 3.3 percent in 2009, and by 3.6 percent in 2010. These returns are meager, considering that the country invested an estimated 32 percent of its resources during each of those three years. In addition, the administration often enhances its claims of progress with the assertion that credit by the commercial banks grew by 15 percent annually over the last four years. It also points to the accumulation of foreign assets in the banking system as added proof of the health of the Guyana economy. When suitable, the administration points to the reduction of the foreign debt and the distribution of house lots as additional evidence of improvements in the economy of Guyana. In other words, any combination of favorable looking or sounding events will emerge as part of its narrative of how well off Guyanese ought to be.

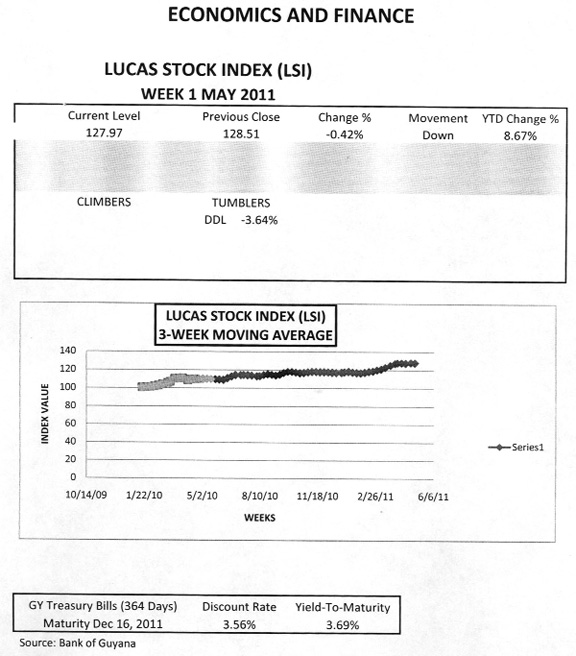

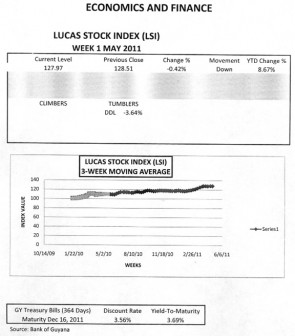

LUCAS STOCK INDEX

The LSI continued its mixed performance declining slightly this week on trading by three companies, Demerara Bank Limited (DBL), Demerara Distillers Limited (DDL) and Demerara Tobacco Company (DTC). DBL and DTC recorded no change in value, but the stocks of DDL declined by 3.64 percent, pushing the index down slightly by half of one percent. As a result, the index declined to less than five percentage points higher than the risk-free Treasuries due to mature in December 2011.

Indictment

The one thing that the administration has been unable to do is to provide tangible evidence of how Guyanese living outside the walls of “Pradoville” have benefitted as a result of its efforts and the foregoing developments. From the budget of 2011 presented to the country, it is evident that at least 50 percent of Guyanese enjoy less than 12 percent of the resources of the country. Despite the personal tax exemptions, their income makes up less than one-third of all wages earned and spent in the country. While additional evidence is required, it is not unreasonable to believe that the low levels of wages and disposable income of many Guyanese are driving them out of the country. The urgency to leave, particularly by skilled Guyanese, imposes severe limits on the ability of the economy to advance. Yet, the migratory trend could also be viewed as an indictment on the efficacy of the social and economic policies being pursued by the administration. Like the unfortunate fire in Kingston on Easter Monday, it also exposes severe flaws in the administration’s management of the economy.

Debilitating

As debilitating as the consequences might be, the outflow of Guyanese is showing signs of making a more positive contribution to the economy than any policy of the administration. The evidence for this claim shows up in the money sent home from abroad by migrant Guyanese. According to the 2011 Budget, Guyanese sent home an estimated US$368 million or G$74 billion in 2010. Remittances represented 20 percent of GDP, 50 percent of wages and 55 percent of disposable income that Guyanese had last year. That contribution is greater than the contribution of any single industry in Guyana. The best performing industry the Wholesale and Retail industry contributed 25 percent less than what remittances contributed to the Guyana economy. The contribution of whole sectors lags behind the contribution of remittances. The agricultural sector, for example, turned in five percent fewer resources than remittances. The mining sector recorded 19 percent less contribution than remittances and the manufacturing sector an enormous 174 percent less.

Intransigence

The importance of this source of income to Guyana is also seen in the statistics about foreign earnings and foreign reserves that are sometimes cited by the administration to show progress in the economy. Despite record gold prices in 2010 and extraordinarily high prices for rice, export revenues from none of Guyana’s major exports generated more foreign earnings than remittances. The best showing came from gold which brought in the equivalent of G$71 billion in foreign exchange in contrast to the G$74 billion brought in by migrant Guyanese. The combination of rum, molasses, shrimp, timber and sugar brought in half of what remittances contributed to foreign earnings last year. Migrant returns also made up 47 percent of the foreign reserves with which Guyana ended 2010. These compara-tive performances reveal how valuable remittances are to the Guyana economy and might well hold clues to the apparent intransigence of the current administration to create a climate more conducive to prosperity and security, and encouraging the resources to remain at home.