Introduction

As it enters its forty-second year as the workers’ retirement and short-term insurance fund, the National Insurance Scheme is facing one of its most serious crises ever. For several years during the Burnham Administration which set up the Scheme in 1969, its surplus funds were treated it as a source of cheap borrowings by the Government. I recall first looking at the finances of the Scheme with trade unionists Lincoln Lewis and Nanda Gopaul in the mid-to-late eighties and our shock at seeing all the investments in long-term, low-interest (5%) government paper when the inflation rate was considerably higher. Now, with seemingly more investment freedom, the Scheme is actually doing worse, partly a measure of the absence of quality investment opportunities in the economy.

In the context of its current travails, it is more than ironic that its 2009 annual report tabled belatedly in the National Assembly along with its 2008 report, has a creative cover design with the words “Embracing the Future….. Reaching New Heights!” As part of its near-term challenges, the Scheme’s directors must ponder about the safety of more than $5.8 billion the NIS has tied up in the collapsed insurance giant CLICO Life and General Insurance Company (SA) Inc. Readers will recall that the Guyana courts last year ordered the company to be liquidated after its parent in Trinidad and Tobago had over-extended itself and sought the protection of the Central Bank in that country. Within months, all the CLICO subsidiaries, from The Bahamas in the north to Guyana in the south, fell like pins at the bowling alley.

The CLICO fiasco

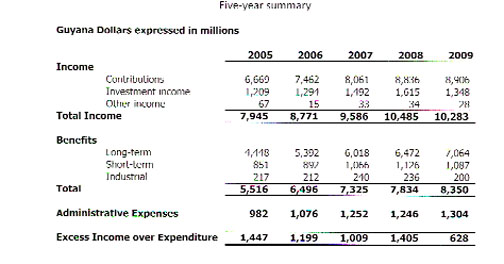

The Scheme derives its income from contributions and investments. Mature Schemes expect that as contributors retire, investment income from the accumulated savings would account for an increasing share towards the heavy cost of long-term pensions. That did not happen in 2009 when long-term benefits increased by 9.2% while investment income fell by 16.5%, from $1,615 million to $1,348 million. Total expenditure, mainly on benefits and administration costs increased from $7,835 million to $8,351 million, or 6.6%. This does not mean the Scheme is in immediate danger of collapse. It is not. On an annual basis benefit payments are still covered by contributions and the Scheme has liquidity cushion in the form of billions in fixed deposits in the commercial banks.

What is happening though is that partly as a result of CLICO, net income is falling at a rate that even the actuaries could not anticipate when they did their last review in 2006. Moreover, the viability of a Scheme is measured not by traditional cash flow models but by long-term considerations since a worker pays today to receive pensions well into the future. And if the Minister of Health is right about life expectancy increasing, the amount the contributor will receive in long-term benefits also increases. To deal with that danger, consideration has been given to increasing the NIS pensionable age but that is unlikely to go down well with the public.

Five-year summary

Section 37 of the National Insurance Act requires an actuarial review at least every five years, although the better view is for triennial reviews. Ever since the 2006 review, the financial statements consistently note that the Board is “reviewing and implementing the above actuaries’ recommendations.” That slothfulness is a luxury the Board cannot afford given that the actuaries had warned that using an intermediate scenario projection the Scheme’s expenditure would exceed its income in 2015. It now seems that even before taking any loss on the CLICO investment, the critical point will arrive long before 2015, and possibly in this very year.

The President and Vaitarna

One hopes that the directors will wake from their slumber and that there is a reversal of fortune. But for the government to make good on President Jagdeo’s pledge that the “NIS has not lost a cent because …they will be paid back”, taxpayers will be carrying the can for all those individuals and entities who got taken in by CLICO’S Ponzi-like interest policy to attract money to finance its parent’s Bahamas operations. The President, willingly or unwittingly, for reasons which we can only speculate, is prepared to compensate risk-takers in CLICO at the expense of the pensioners, workers and the NIS, one of the country’s most important and enduring institutions.

The President at the National Cultural Centre fifteen months later backpedaled and committed his government only to very specific sums for the CLICO recovery efforts – $3 billion from the Petroleum Fund and another $600 million from a source he did not then identify. It now seems that that money has been unlawfully diverted from the Guyana Forestry Commission in a transaction with Vaitarna Holdings Private Inc. which took over a Timber Sales Agreement previously held by Caribbean Resources Limited, a CLICO subsidiary. On that occasion, the President spelt out how the money was going to be used – to pay CLICO’S 4,366 holders of Executive Flexible Premium Annuities and 39 policyholders with balances in excess of $30 million who he said would receive the remaining $900 million, “up a maximum of $30 million each, with priority being given to non-institutional policyholders.”

Chicken feed

Not only did this exclude the NIS as an institutional policyholder, but $30 million is chicken feed to the $5.8 billion it has in CLICO. And there was worse coming from the President when he indicated that for purposes of the payout, “the balances outstanding would be those as of the time that the judicial management commenced, that is, February 2009.” Taken literally, that means that there will be no interest after February 2009 when CLICO went bust. If that is the case, then the NIS will have to write-off all the income it has taken up in its books from that date.

For some inexplicable reason the auditors of the Scheme appear to have misinterpreted a letter from Dr. Roger Luncheon as a guarantee on the basis of which they gave an unqualified opinion on the Scheme’s financial statements. If they were aware of all that was taking place around CLICO, they would have insisted on no income from the investment in CLICO being recognised and for the investment to be marked down. If the directors refused to do that, the auditors should have qualified their opinion rather than take the soft option of an emphasis of matter.

There are two favourable possibilities. Although the President’s remaining term can now be counted in months, if his Party is re-elected it is likely to feel compelled to pay the NIS the full principal and interest it has outstanding in CLICO. In this quasi-legal liquidation, there are only a few pension funds to challenge for parity of treatment. Second, with those pension funds paid off, the NIS will be the only entity entitled to the proceeds from disposal of CLICO’s remaining assets. For the NIS, the CLICO’s investment could be a major stumbling block in the 2011 actuarial review unless it is resolved by that time. I repeat however: any sums paid out of the Treasury constitute a cost to the taxpayers, plain and simple. Yet those very taxpayers and their representatives are completely in the dark about the various ways that the government will bail CLICO and its directors out of the illegal mess that they have created.

Valuable statistics

The NIS maintains some excellent statistics on its contributors and beneficiaries and I believe that it has been making real effort to address the weaknesses in its contribution records, some of which may never be resolved as employers have gone out of existence. Some of the statistics seem counter-intuitive or hard to explain. For example, is it credible that in 2010 there is less than half the number of self-employed contributors as there were in 1997 or that the number of active employed contributors is less than it was 20 years ago? I think not.

The future

The next actuarial study will be most instructive and will give an indication of what the future holds. Failure to act on the 2006 recommendations will make the 2011 recommendations that much stronger. The future calls for fresh ideas, boldness at the Cabinet level and new blood in the Board. Several of the directors – who are very much part of the problem – have been there since 1992 and most of the new appointees are due to ex officio changes, so for example Ms. Doreen Nelson replaced Mr. Patrick Martinborough on his retirement as the Scheme’s General Manager and Ms. Linda Gossai replaced Mr. Edward Layne on the Board after she succeeded him as Accountant General. The Board may even need individuals with paranormal qualities to exorcise the ghost of CLICO. Only then can they start thinking of a future.