WASHINGTON, (Reuters) – Urgent efforts to avoid an unprecedented U.S. debt default hit another snag yesterday when some rebel Republican lawmakers refused to back a budget deficit plan proposed by their own congressional leaders.

After hours of trying to get enough votes, the Republicans who control the House of Representatives put off action for the night, further delaying any compromise with Democrats to stop the countdown toward the government running out of money to pay all of its bills from next Tuesday.

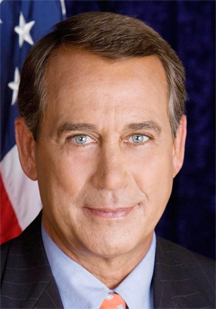

The delay resulted from House Speaker John Boehner’s need for more time to try to overcome objections from conservative rebels in his own party.

It was not immediately clear what Boehner intended to do regarding the legislation or when a vote might be held.

He has been grappling with Republican lawmakers such as Mick Mulvaney, a supporter of the Tea Party movement that wants deeper spending cuts than Boehner has proposed.

“I’m still a no,” Mulvaney said before the vote was canceled for the night.

Lawmakers must lift the government’s $14.3 trillion borrowing limit by Tuesday or risk a devastating default and downgrade of the top-notch credit rating that helps make U.S. debt a pillar of the global financial system.

Many Americans are outraged that Washington cannot reach a deal after many weeks of polarized and acrimonious debate.

World markets, unnerved by the risk of a U.S. default or downgrade, watched anxiously. The U.S. stock market’s broad S&P 500 index fell for a fourth day and interest rates soared on some Treasury bills that mature in August.

The dollar sunk to a fresh four-month low against the yen at 77.48 yen after the announcement that the House would not vote on Thursday evening.

Even with a deal to lift the debt limit, a downgrade of the U.S. credit rating is likely unless a big dent is made in the deficit. A downgrade would raise U.S. borrowing costs, hurting an already weak economy, and rattle global investors.

International Monetary Fund chief Christine Lagarde warned of the risks of Congress failing to raise the debt ceiling, which would mean the U.S. government runs out of money to pay all of its bills after Aug. 2.

“One of the consequences could be a decline of the dollar as a reserve currency and a dent in people’s confidence in the dollar,” Lagarde told PBS NewsHour in an interview.

U.S. financial executives added their voices to calls from the business community for Congress to strike a deal that would banish the specter of default.

“A WHOLE NEW STAGE”

Once the House acts one way or the other, action will move to the Democratic-controlled Senate. Boehner’s plan is doomed in the Senate, where Democratic Leader Harry Reid is pushing his own deficit reduction plan.

But after both chambers have their say, frantic talks are expected this weekend to seek a compromise to permit a vote on raising the debt ceiling and staving off a default on Tuesday.

“I think there will be a whole new stage of the Senate and House having to come together to avoid August 2nd as being a day that has never happened in the U.S.,” White House chief of staff William Daley told CNN.

Republican leaders were engaged in arm-twisting as they tried to secure the 217 votes needed to pass the bill in the House and avoid a humiliating defeat.

A stream of lawmakers who had decided to vote against the plan came and went from Boehner’s office. Whatever was said did not seem to be changing many minds.

Republican Representatives Louie Gohmert and Joe Walsh said they would still vote against the bill. Trent Franks and Jeff Flake would not say where they stood.

Boehner’s plan would pair about $900 billion in cuts with a short-term debt ceiling increase. Lawmakers would have to come up with further spending cuts to raise the debt ceiling again in several months — just as the campaign heats up for the congressional and presidential elections in November 2012.

Reid’s plan, backed by Demo-cratic President Barack Obama, would cut $2.2 trillion from the deficit over 10 years without raising taxes and extend the debt ceiling through next year.

Jared Bernstein, a former economic adviser to Vice President Joe Biden, said the chances of a compromise could be boosted by the likely failure of Boehner’s legislation.

“What has been missing from House Republicans all along is the spirit of compromise … and if their bill were to pass they would have considerably more leverage than they will otherwise if it fails,” said Bernstein.

At the White House, Obama and his team worked late into the evening as well to avert a default that would scar his presidency no matter who was at fault.

Despite the gridlock, Congress could kick into higher gear as pressure to reach a deal mounts before Tuesday. “The markets are going to be on tenterhooks until we get an understanding of what the quality of the package is,” said Kevin Caron, market strategist at Stifel, Nicolaus & Co.

White House senior adviser Valerie Jarrett told Reuters Insider the Treasury secretary would face very difficult decisions if the deadline is not met.

“Do we say to our servicemen and women serving abroad that we’re not going to pay them and support their families? Do we say to the 70 million, 80 million people who receive Social Security that we’re not going to pay them?” she said. “Or small businesses who are vendors of the United States government?”