Part 6

By Janette Bulkan

Costs, values and profits

In the first five articles in this series I outlined the processes by which two large-scale forest concessions in Guyana were acquired by a Main Street coffee retailer in Karnataka, India, in 2010. I contrasted those processes with the national policies. In the sixth and last article in this series I show what Guyana has lost through allowing the export by Vaitarna Holdings Private Inc. (VHPI) of 50 containers of unprocessed logs of the best timbers, contrary to national policies which have been discussed and endorsed by the National Assembly.

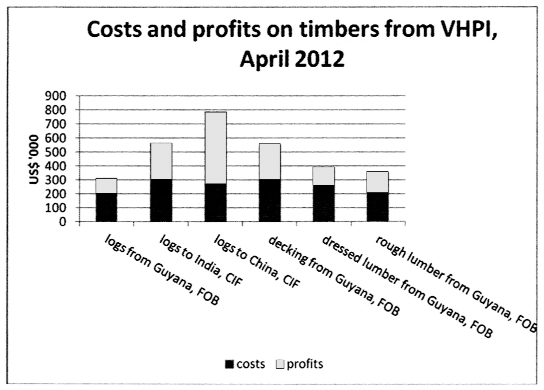

This sixth article which will show how the debate on revision of the GFC log export policy can show transparently the costs and profits of log exports versus in-Guyana processing.I use the method of the Guyana Forestry Commission (GFC) in its background paper ‘National log export policy, version 2, year 2012 to 2014’ (January 2012) and the GFC-estimated costs of production, but I have used market prices as reported by the GFC or by the International Tropical Timber Organization (ITTO).

Unprocessed logs

In 2005, the GFC estimated a production cost of US$ 55/m3 from forest to mill gate or ship side, and US$ 62/m3 in 2007. Asian loggers such as Barama and Ja Ling estimated US$ 80/m3 in their Initial Public Offering background papers in 2007, apparently including an internal profit margin. By January 2012 this GFC estimate had increased to US$ 100/m3. No reason was given for the increase, but rising fuel prices could account for much of the difference.

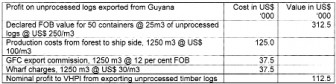

VHPI’s 50 containers loaded to the maximum weight would take 1250 m3. The average declared FOB price for purpleheart was US$ 236/m3 according to the GFC Forest Sector Information Report for calendar year 2011 but the higher value timber washiba was the major component in these containers (Kaieteur News, 05 April 2012 – ‘Indian coffee company ships out 50 containers of logs in 2 months’) so here I use US$ 250/m3. So the nominal income and profit to VHPI in Guyana from these shipments of 50 containers are –

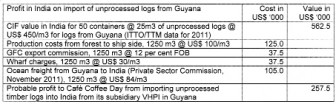

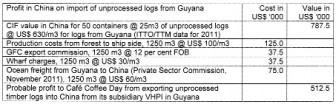

ITTO does not report a CIF price for logs imported into China from Guyana so I have used the price for merbau, a South East Asian timber nearly equivalent technically to Guyanese purpleheart (ITTO Timber Trade Market Report 16 (23) 1-15 December 2011, page 14, price for merbau logs at Guangzhou City imported timber wholesale market = Yuan 3500-4000/m3 = US$ 551-629/m3). Guyanese timbers in the Special Category royalty class are better than merbau for flooring because they resist better the impact of high heels.

The large probable profits on log exports from Guyana at the points of entry into India (New Mangalore port) and China (Guangzhou) are associated with the consistently low FOB rates reported from Guyana to ITTO in contrast to the rates for technically comparable timbers from other tropical regions. This consistent difference is a strong indicator of (illegal) transfer pricing. Note also the comment from Professor C Y Thomas that ‘Guyana is the prototypical price-taker in international commodity markets’ (Guyana: Economic performance and outlook (the recent scramble for natural resources), Institute of Development Studies, University of Guyana, April 2012, page 8).

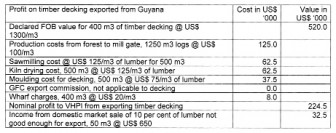

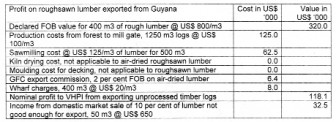

Timber decking

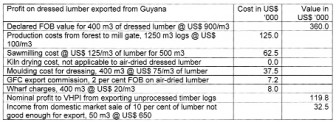

Sawn lumber, dressed

Nominal profits are of course lower for exported timber which is only dressed or rough

sawn –

The figure below shows the comparison between the export options. The ITTO diagnostic mission to Guyana in 2002 noted in its 2003 report that ‘It is hard to see that the current practice of exporting logs at very low prices is helpful to Guyana’ (ITTO 2003 executive summary, page 13) and this remains true a decade later. This analysis also shows how ineffective in changing the behaviour of log exporters is the export commission when that tax is set so low and adjusted only at long intervals by administrative decision. Instead, the log export commission should be set more conventionally and frequently in relation to a floor price verified by independent trade specialists.

It is entirely rational for the Asian log traders and their Guyanese spokespersons to argue for a lowering or elimination of the log export commission, in order to enhance their already huge profits especially in the trade to China, but such a lowering would be absolutely contrary to national policies endorsed by the National Assembly in 1997.

Note that the costs and profits from exporting logs to India, and from producing and exporting timber decking from Guyana, are almost identical. However, once the logs are in India they can be converted to added-value products. So from the point of view of Café Coffee Day and its subsidiary VHPI it makes sense to export unprocessed logs. Contrariwise, it makes sense in terms of national policy in Guyana to increase the export commission substantially and so lower the commercial profit on log export, thus providing a commercial stimulus to process in Guyana. The tables above can easily be converted into spreadsheets and Excel charts. The GFC, Forest Products Association, Guyana Manufacturing and Services Association, and any individual enterprise can use such spreadsheets and charts to test the effects on costs and profits of changing disaggregated costs (such as higher or lower electricity bills) and changing sale prices.

► rationalize the foreign direct investment (FDI) arrangements and eliminate the absurd cost advantage given to Asian log traders through tax concessions when they provide no added value in Guyana;

► ensure that Go-Invest and the Guyana Revenue Authority operate a level playing field for tax audits and tax concessions in the forest sector, instead of the political favouritism now evident;

► re-creating a development bank, perhaps similar to GAIBANK, to make use of the excess liquidity in Guyanese commercial banks for investing in the forest products industry, but learning from the bad experiences of loan defaults of the 1970s and 1980s with sector-related credit;

► reduce the opportunities for corruption in the Customs and Trade Administration which I have detailed in a previous article (Stabroek News, 30 January 2012 – ‘The rule of law – inefficiency and corruption in the export of timber logs to Asia’) and continue the simplification of the Customs bureaucracy by reducing the choke points for administrative discretion;

► similarly reduce the opportunities for corruption in the Guyana Forestry Commission, eliminating all opportunities for administrative discretion and negotiated penalties, rationalizing the use of the ‘compounding’ system of minor penalties in accordance with the valid Forest Act 1953 and Forest Regulations 1954, and eliminating the grossly unfair and mis-applied system for sharing out penalty income among GFC staff;

Guyana does not have to be a basket case in forest products processing, and does not have to be the prototypical price taker. Not only the Government agencies but also the private sector enterprises need to operate like normal businesses in developed countries.