Volatility

There is much volatility in the flow of foreign direct investment (FDI) to Guyana. After increasing by 49 and 17 per cent respectively in 2007 and 2008, the flow of FDI to Guyana declined by eight and seven per cent in 2009 and 2010. The rise by seven per cent in 2011, though welcomed, is no exceptional accomplishment with respect to the inward flow of investment resources into the country. The US$165 million reported by the United Nations Conference on Trade and Development (UNCTAD) as invested in Guyana last year merely reverses the loss suffered in the prior year. When juxtaposed to remittances (US$415 million) and the revenues earned from the export of gold in 2011 (US$517 million), FDI into Guyana is still to reflect the economic potential of the nation and investor confidence in its attractiveness as a place to do business. As will be seen later, the growth in FDI is coming more from retained earnings and not necessarily from the establishment of new businesses in the country. Stronger investor sentiment about the capacity of Guyana to deliver desired returns on foreign investment, as such, is still in the making.

Low profile

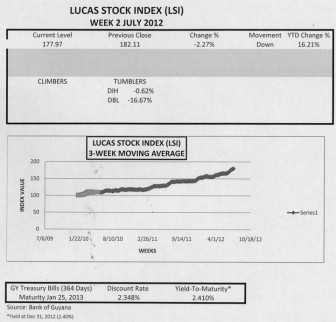

In week two of July 2012, the Lucas Stock Index (LSI) fell 2.27 percent. The decline was primarily as a result of a 16 percent drop in the stock price of Demerara Bank Limited (DBL). Banks DIH also declined by 0.62 percent. Guyana Bank for Trade and Industry (BTI) and Demerara Distillers Limited (DDL), the two other stocks traded this week, remained unchanged. As a result, the LSI lost momentum and now exceeds the yield of the 364-day Treasury Bills by about 14 percentage points.

When compared to other members of the Caribbean Single Market and Economy (CSME), FDI into Guyana has a low profile. Among the 15 countries making up the integration movement, Guyana attracts about three per cent of the investment to the region. The bulk of the resources coming to Caricom destinations go to three countries. The Bahamas gets an average of 29 per cent of the resources. Trinidad and Tobago gets about 20 per cent while Jamaica accounts for about 13 per cent. The remaining 35 per cent of the flows to the region is distributed among the other 11 countries. Suriname averages about seven per cent and Antigua and Barbuda gets about four per cent, placing them both above Guyana. They also leave every other Caricom country with between one and three per cent of the investments coming to the Caricom area.

Positive trends

Despite the low numbers and the volatility, there are some positive developments for Guyana. It was one of six countries that enjoyed positive growth in its FDI from 2006 to 2011. More importantly, the inflows to Guyana grew by an annual average of 10 per cent, making it one of the destinations with a fast flow of foreign financial resources. Indeed, Guyana had the second fastest growth rate after Suriname which saw FDI grow by 29 per cent per annum over the last five years. No other country that experienced a positive growth rate came close to recording double-digit movement. The best performances among the remaining 13 members of the community came from St Kitts & Nevis with a five per cent growth and St Vincent & the Grenadines which saw flows from direct foreign investment grow at a rate of four per cent annually. Among the three largest recipients of foreign investment, the Bahamas is the only one that had a positive growth rate, barely recording a one per cent expansion. Trinidad and Tobago saw a negative growth rate of between five to seven per cent while Jamaica experienced an even worse situation of between 20 to 23 per cent. The country with the worst experience was Antigua and Barbuda with a decline in the growth of direct foreign investment of close to 30 per cent.

Main driver

In terms of value, the main driver of FDI into Guyana is the natural resource endowment of the country and its capacity to absorb increased investments in transport and telecommunications. According to the Bank of Guyana, the transport and telecommunication sector received US$284 million in the last five years, representing about 30 per cent of the flows coming to Guyana. A similar trend was observed for the extractive industry of mining which brought in US$277 million or close to 30 per cent of foreign investment during the same period. When the investments are combined, the primary sector has a big advantage. Made up of forestry, energy, quarrying and mining activities, the primary sector accounts for 45 per cent of the foreign flows to the country. The services sector, which includes transportation, telecommunications, tourism and hospitality activities, accounts for 38 per cent. Manufacturing and other activities account for the remaining 17 per cent.

Fastest growth

The small share of foreign investment in the manufacturing sector belies an important trend in the flow of FDI to Guyana. Manufacturing has seen the fastest growth in the financial flows through FDI into Guyana over the last five years when compared with investments in the high profile industries in Guyana. Foreign investment in the manufacturing sector in Guyana grew at an average of 56 per cent per annum from 2007 to 2011. At that rate, FDI in the manufacturing sector could expect to reach the levels currently seen in the mining sector in three to four years if the overall trends continue. Another area of rapid FDI with potential for substantial economic impact is that of the hospitality industry. This part of the economy has experienced a similarly high rate of growth in FDI as that as manufacturing. Foreign investment in the tourism and hospitality sector grew by 46 per cent in the last five years and suggests that the sector also has a chance to see inflows reach levels like those seen in the mining sector in less than five years. It is thus critical for Guyana to create and maintain a hospitable environment for foreign investment and to continue developing policies that promote positive contributions from such flows.

Existing operations

While the BOG could not give details, the UNCTAD report indicates that mergers and acquisitions (M & As) were used in four instances last year to provide US$3 million in new investments in Guyana. This meant that four existing companies in Guyana were bought by other companies with headquarters that were foreign based. Another vehicle used to bring FDI to Guyana is described as “Greenfields” which is a different way of saying brand new or without prior existence. There were two such projects to the tune of US$15 million in Guyana last year. Accordingly, the bulk of the FDI flows to Guyana last year came from retained earnings. This meant that existing companies were plowing back their profits into their operations. Given that many of the companies in the mining and energy industries are still in the discovery stage of operations, it is likely that the investments could be from additional capital aimed at sustaining operations in the country. This means that nearly 90 per cent of FDI flows to Guyana result from spending by existing companies.

Such spending indicates the likelihood that companies might have a favourable long-term outlook on the economic prospects of the country. This outlook gives hope that many of the additional benefits, such as value-added activities, tax revenues, and even research and development, which accrue from FDI, could come to Guyana and help to expand services and human resource capacity. Without a doubt, the critical factor remains creating and maintaining an accommodating environment.