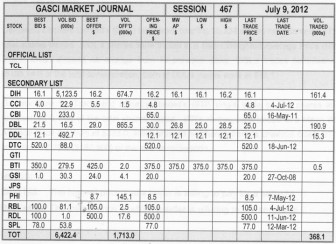

GASCI (www.gasci.com/telephone Nº 223-6175/6) reports that session 467’s trading results showed consideration of $8,075,409 from 368,139 shares traded in 12 transactions as compared to session 466 which showed consideration of $4,175,786 from 263,203 shares traded in 15 transactions. The stocks active this week were DIH, DBL, DDL and BTI.

Demerara Bank Limited’s (DBL) five trades totalling 190,935 shares represented 51.86% of the total shares traded. DBL’s shares were traded at a Mean Weighted Average Price (MWAP) of $26.8, which showed a decrease of $3.2 from its previous close of $30.0. DBL’s trades contributed 63.21% ($5,104,148) of the total consideration. DBL’s first trade of 10,000 shares was at $28.0, its second trade of 115,000 shares was at $27.0, its third trade of 5,935 shares was at $28.5, its fourth trade of 50,000 shares was at $26.0, while its fifth trade of 10,000 shares was at $25.0.

Demerara Distillers Limited’s (DDL) two trades totalling 15,334 shares represented 4.17% of the total shares traded. DDL’s shares were traded at a Mean Weighted Average Price (MWAP) of $12.1, which showed no change from its previous close. DDL’s trades contributed 2.30% ($185,541) of the total consideration. Both of DDL’s trades were at $12.1.

Guyana Bank for Trade and Industry Limited’s (BTI) single trade of 500 shares at $375.0 represented 0.14% of the total shares traded. BTI’s shares were traded at a Mean Weighted Average Price (MWAP) of $375.0, which showed no change from its previous close. BTI’s trade contributed 2.32% ($187,500) of the total consideration.

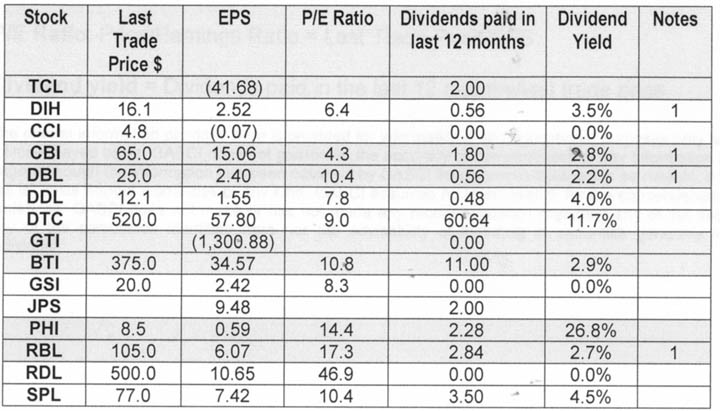

NOTES:

Best bid: The highest price that a buyer is willing to pay for a security.

Best offer: The lowest price at which a seller is offering to sell securities.

Notes

1 – Interim Results

2 – Prospective Dividends

3 – Shows year-end EPS but Interim Dividend

EPS: earnings per share for 12 months period to the date the latest financials have been prepared. These include:

2005 – Final results for GTI.

2008 – Final results for PHI.

2010 – Final results for RDL.

2011 – Final results for TCL, CCI, DDL, DTC, BTI, GSI, JPS and SPL.

2012 – Interim results for DIH, CBI, DBL and RBL.

As such, some of these EPS calculations are based on un-audited figures.

P/E Ratio: Price/Earnings Ratio = Last Trade Price/EPS

Dividend yield = Dividends paid in the last 12 months/last trade price.