Introduction

The noise that surrounds the presentation and debates of annual national budgets in Guyana for decades now is legendary. In recognition of this situation I recommended in last Sunday’s column that readers should begin their detailed examination of the budget by seeking to portray what it indicates for the economic outlook and macroeconomic stability over the medium term, particularly, at this political-constitutional conjuncture in Guyana. In this regard I presented a table with key macroeconomic indicators for Guyana over the period 2007-11, with official projections to 2015. I urge readers, if they have not done so already, to keep this table at hand as I proceed with the analysis of this year’s national budget.

Thus far I have identified the potentially deceptive portrayal of the economy carried in that table. This is based on the fact that the GDP estimates contained therein reflect substantially increased values because they use a new price series (based on 2006 prices) instead of the previous series (that used 1988 prices).

Size of government

I shall start with the last item (7) first. In my analysis of the 2011 National Budget last year I had raised the question: “Is the size of the government too big, too little, or, just right?” As indicated then, the answer does not depend as some readers might expect, on the absolute size of the Budget alone (or monies projected to be spent in the coming year). This can only be meaningfully done if it is expressed as a ratio to the size of the economy (GDP). The burden of my presentation then was that the Government of Guyana had become too big, too inefficient, too uncontrollable, too much engulfed in executive lawlessness and therefore dysfunctional. Indeed I postulated that, in its present configuration, government operates as a drag on the economy, preventing it from performing at its “potential output level.” Thus in 2010, central government expenditure plus public enterprises expenditure together represented 58 per cent of GDP at current basic prices, using the rebased (2006) price series.

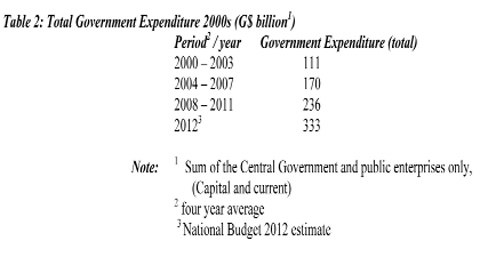

Since then for 2011, this ratio had increased to 61 per cent and further in the 2012 Budget to an estimated rate of 67 per cent of GDP (current basic prices) for this year. This information is displayed in the table below:

Source: Budget Estimates 2012

Readers should note that government tax giveaways (or tax expenditures) which I had previously suggested could be as large as the total value of the taxes collected are not included in the above measures of the size of government, as these data have not been officially estimated. To this extent therefore, the resulting ratios of government expenditure-to-GDP shown in the table above significantly understate how ‘big’ big government is, and therefore the extent to which this might impede growth.

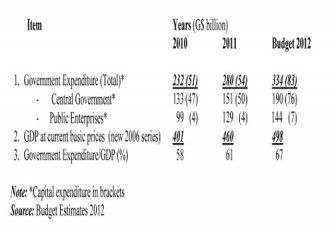

Government spending trend

During the 2000s government spending (as defined above) has more than trebled. During the first four-year period (2000-03) this spending had averaged $111 billion; in the next four-year period (2004-07) this rose to an average of $170 billion; and by (2008-2011) it had reached $236 billion. For the Budget year 2012, government spending has been projected to rise to $333 billion (see Table 2 below). This last figure trebles the average for 2000-2003. One of the clear macroeconomic revelations of this and previous national budgets therefore has been the relentless crowding out of the private sector by a state bureaucracy not known for its efficiency, transparency or accountability.

Source: Bank of Guyana and Budget Estimate, 2012

As I shall emphasize as the budget analysis proceeds, the expanding size of government in the Guyana economy has reached a level that puts it in the top decile of global economies, for which there are comparative data. However, because the capacity of the state is so limited and its regulatory and oversight mechanisms so weak, governance concerns emerge as paramount. This adds bleakness to the economic outlook and portends a number of macroeconomic challenges to come over the medium term.