Introduction

In my last week’s column, I gave a background to the Public Corporations Act 1988 and assessed the implications of the notification of 18 July 2000 relating to the vesting in NICIL movable and immovable property of the State. We noted that NICIL was not deemed a public corporation and therefore the provisions of the Act cannot be made applicable to it, except as provided for in the above-mentioned notification. The notification itself is not in keeping with the Act since Section 5, to which it refers, is applicable to a new corporation whereas NICIL was incorporated since 1990.

In addition, the Minister has been applying Section 8 of the Act as his authority for disposing of State assets vested in NICIL. That section, however, deals with transfers of undertakings to public corporations and not to a company such as NICIL, notwithstanding that it is a government company. There was also evidence that the vesting of State assets in NICIL, as well as their disposal, commenced prior to the coming into effect of the notification.

Today, we look at the auditing arrangements for NICIL, the accounting implications of the vesting of State assets in NICIL and their disposals, and the accountability for the proceeds.

Auditing arrangements

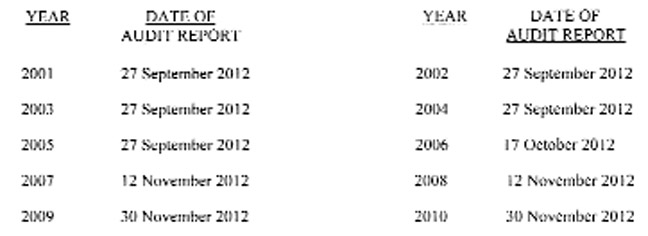

The Companies Act also specifies annual financial reporting and audit and for the audited accounts to be laid at the annual general meeting of the company. This implies the availability of audited accounts as soon as possible after the close of the financial year. There has, however, been a lack of compliance over the years in this regard, as can been from the following.

The above audits were finalized within a little over one month and a “clean bill of health” was given to NICIL’s accounts. In particular, the audit reports for the first five years, that is, 2001 to 2005, were issued on 27 September 2012. It is not clear when these accounts were submitted for audit. However, the established practice is for one year to be submitted at a time to allow for adjustments/corrections to be made based on the results of the audit. These adjustments/corrections will obviously affect the following year’s opening balances. It is therefore unusual for audit reports for several years to be issued at the same time, especially as it relates to such complex entities as NICIL.

Accounting implications for the

vesting and disposals of assets

When an asset is vested in a new public corporation, the Chief Valuation Officer carries out an assessment of the state and condition of the asset and places a value on it. The corporation is then required to enter the details of the asset in its assets register and make the appropriate accounting entries, increasing the asset account as well as the government’s capital contribution to the corporation with the value assigned to it. However, according to the notes to the audited financial statements of NICIL for 2002-2010, the assets vested were recorded at nominal amounts. Since these are not realistic values, the fair presentation of the financial statements would be called into question. In the circumstances, modified audit opinions would have been more appropriate rather than a “clean bill of health”.

The notes to the 2004 accounts repeated those of 2003 with the addition that LINMINE was wound up and specific assets vested in NICIL. However, a negative adjustment of $1.949 billion was made in NICIL’s income statement for 2004 but no further explanation was given. It would appear that the negative adjustment of $1.949 billion was a downward adjustment to the two previous years’ upward adjustments!

There were therefore fundamental errors in the audited accounts of 2001, 2002 and 2003 which NICIL sought to rectify in the following year. These errors should have been picked during the course of the audit and brought to NICIL’s attention so that the necessary corrections could be made to the accounts of the year in question. In addition, the rationale for adjusting the recorded income because of the “recognition of assets understated” is not clear. If a fundamental error has been made in the previous year’s financial statements, any adjustment should not affect the results of operation of the current year. Rather, there should have been a statement of prior year adjustments and the comparative figures in the financial statements re-stated.

Accountability for the

disposal of State assets

According to the audited accounts, gross revenue from the disposal of properties for the period 2001 to 2010 amounted to $2.139 billion while capital proceeds totaled $2.250 billion, giving a combined total of $4.389 billion. Despite the large sum involved, there was no explanation of what constituted capital proceeds. However, this might be in relation to the transactions undertaken by the Privatisation Unit.

It will be recalled that a Management Co-operation Agreement dated 31 December 2001 was entered into between the Privatisation Unit, NICIL and the Government. This agreement, however, cuts across legal boundaries in that one cannot transfer an entire department of a Ministry to a company incorporated under the Companies Act. This could have only been done if NICIL was deemed a public corporation in which case Section 8 of the Public Corporations Act could have be applied to transfer the Privatisation Unit to NICIL.

The amount of $4.389 billion should have been paid over to the Consolidated Fund, net of expenses, and not treated as NICIL’s revenue. This was the practice prior to 2002. Since NICIL did not pay for the assets that were inappropriately vested in it, the proceeds of any disposal do not belong to NICIL, as they will result in a windfall gain. This was never the intention of Section 5 of the Public Corporations Act, and any disposal should conform to Section 23(7) of the Act, as previously discussed.

There is an accounting convention called the matching concept whereby revenue is matched with the cost of earning it, to arrive at a profit. The latter is really the mark-up which, for many businesses, varies from roughly 15 to 25 per cent, depending on the nature of the business. NICIL’s mark-up for the years 2002 to 2010 relating to the disposal of assets, averaged over 300 per cent! This was mainly due to the nominal values assigned to the properties vested in it. It is also testimony to the flawed accounting arrangements.

In addition, the audited accounts of NICIL for the years 2002 to 2010 showed that dividends received from public corporations as well as from other investments, amounted to $8.634 billion. NICIL also showed this amount as its revenue but there were no matching costs, hence another source of windfall gain. Taking this into account, NICIL’s mark-up over the ten year period was over 900 per cent i.e. its revenue was more than nine times its operating costs.

Prior to 2002, all dividends received were paid over directly to the Consolidated Fund. NICIL then was a small outfit that provided a monitoring role of the Government’s investments in public corporations and other entities, and ensured that all revenues derived therefrom were paid over to the Consolidated Fund. For this, NICIL received a small subvention. The Privatisation Unit was also under the Ministry of Finance, and all proceeds from the Government’s privatization were paid over to the Consolidated Fund, net of expenses.

In total, for the period 2001 to 2010, NICIL received $13.089 billion in funds mainly from the sale of State assets and dividends for public corporations and other entities. However, only $7.577 billion was shown as having been paid over to the Treasury, as dividends from what NICIL deems to be its profits, a shortfall of $5.512 billion.

Conclusion

The operations of NICIL are shrouded with controversy both from a legal perspective as well as in terms of established accounting practice. NICIL in effect has been made a parallel treasury since funds meant for the Consolidated Fund are retained and used at the discretion of its directors in violation of Articles 216 and 217 of the Constitution.

In order to regularize matters, we need to do the following:

(a) Re-align NICIL to what it was prior to 2002 or alternatively wind up its operations;

(b) Ascertain precisely how much should have been paid over to the Consolidated Fund from 2002 to present date against what was actually paid;

c) Initiate an investigation as to what happened with the difference; and

(d) Take appropriate disciplinary action against the concerned officials if it can be established in a Court of Law that there has been a violation of Articles 216 and 217 of the Constitution.