Functions of the Budget

At the time of the annual budget proposal, Guyanese get to learn many things about the national economy. In one of its three functions, the budget sets out the financial plan that the administration intends to use to deliver its programmes and policies for the fiscal year. When put together, the budget spells out the revenues expected and the sources from which the revenues will come. It also lays out how the money received will be spent, giving an indication of the priorities and preferences of the administration, and what will happen to any excess or how to finance any shortfall. However, the national budget serves two other purposes. One of those functions is to provide evidence of how the economy performed during the previous fiscal period or periods. The evidence comes in the form of comparative data that allow interested Guyanese to draw conclusions about the direction in which the economy might be headed, and to compare and contrast that with the direction of their personal lives. That is where the good or bad feelings about life in Guyana are reinforced.

The other additional function of the budget is to permit the country to take corrective action when performance varies from the planned course. One rarely hears about this situation except when it comes to the sugar and electricity industries since the administration cannot afford to ignore either of them. In an environment of political insecurity and gridlock, representatives of the administration appear lately to have a misplaced sense of achievement. This article examines the 2013 budget proposal to determine if that attitude is justified.

Make Judgments

There is much in the 2013 budget proposal to discuss. Apart from the attempt to redistribute income through the income and property tax structures, the last two functions of the budget offer Guyanese a chance to make judgments of whether the planned expenditure will work for them and how responsive the administration is being to their concerns. This means that the investments to be made must create an enabling environment for Guyanese to pursue their goals in life and to do so with minimal difficulty with the extra cash they expect to have from the 2013 tax concessions. It must also respond to their long-standing grievances and complaints about an unsatisfactory quality of life reflected in unsafe and unhealthy discoloured water coming through the taps when it comes; a discourteous and unhelpful security force that seeks to brutalize and not protect them; discourteous and unprofessional service from public servants; undependable electricity, education, and social services; and a distressing physical environment.

See and Feel Changes

It is not enough to make commitments in the budget proposal if the aforementioned matters do not form part of the attention given to the national economy. Guyanese must see and feel the changes in their everyday lives and in the support that they get to keep their children safe, healthy and well prepared to participate constructively in the society, and to start and operate their businesses. Substantial expenditure on the maintenance of infrastructure is critical as is rational investment in new ones. Transparency and accountability might start with the budget proposal, but it ends with effective monitoring and evaluation of the effective operation and management of the resources and programmes. Some of the tools to do so like the Public Procurement Commission and a properly staffed Office of the Auditor-General must be in place to inspire confidence in Guyanese taxpayers.

Both have problems which the budget proposal will never address. The Public Procurement Commission has not been established and the Office of the Auditor-General is caught up in a conflict of interest. The public accounts, of which the budget is the basis, start off with a handicap and with the corruption Sword of Damocles hanging over its head. The danger that this insecurely hanging sword presents is being missed by the administration, and could fall on the body of the budget proposal leaving it fatally wounded.

One Side of the Argument

As Guyanese examine the budget proposal and follow the debates on the issues, they were likely to encounter contrasting evidence that could leave them confused. The opening salvos in the debate on the 2013 budget proposal make that clear. The administration tends to use the budget proposal to present one side of the argument. It often extols the large amount of money that it spends or plans to spend on infrastructure and other items. The G$208 billion requested this year represents 42 percent of the nominal GDP of the preceding year. At the time of the budget presentation, the administration down plays the amount that it intends to spend. But, the level of spending is often higher, in excess of 60 percent of gross domestic product (GDP), according to estimates of some economists.

Since the administration has a habit of asking for the same level of money, there is no reason to think that it would spend any less than 60 percent of the 2012 GDP in 2013. While the disclosed request is G$208 billion, actual spending could be closer to G$300 billion with the additional money coming from sources of funds that currently are beyond the control of the National Assembly. In contrast to what is required, the true value and intent of the 2013 budget proposal before the National Assembly are unknown. This constitutional violation appears to have little chance of surviving in the 2013 budget, and ought to be a source of concern for the administration.

Money Flowing

But, the high level of spending keeps money flowing through the economy and the level of aggregate demand high. The administration seeks to keep the attention of taxpayers on the flow of resources such as spending on infrastructure, the inflow of direct foreign investment, the inflow of aid funds, the flow of export receipts and the elevated levels of bank lending to support claims of economic progress. These variables, along with traditional ones like rice, bauxite, and the distributive trade, have expanded the value-added of the economy. Even non-traditional agriculture and information and communication have contributed positively to the expansion of the economy in 2012. The continuous access to financial resources through the tax structure of the value-added tax (VAT), special purpose entities like NICIL, aid flows and debt financing could easily make the administration feel invincible. It controls the money and feels that it should speak for all Guyanese, irrespective of what the political reality affords it.

(To be continued)

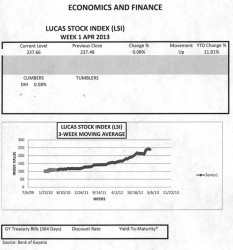

The Lucas Stock Index (LSI) increased slightly on very light trading following the Easter holidays in the first week of April 2013. The 15,500 stocks of two companies traded with varying results. Banks DIH (DIH), which saw 13,500 of its stocks change hands, increased its stock value by 0.58 percent while Demerara Bank Limited (DBL) traded a volume of 2,000 stocks with no change in value. Consequently, the LSI moved up by 0.07 percent to 11.81 for the year.