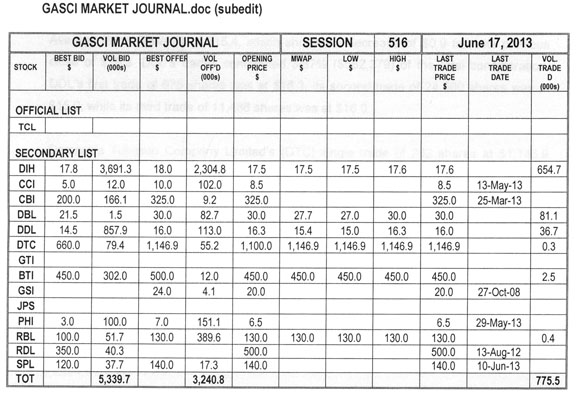

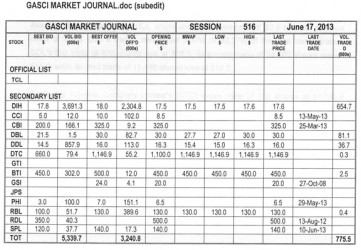

Reports that session 516’s trading results showed consideration of $15,757,600 from 775,492 shares traded in 18 transactions as compared to session 515 which showed consideration of $12,784,559 from 233,605 shares traded in 24 transactions. The stocks active this week were DIH, DBL, DDL, DTC, BTI and RBL

Banks DIH Limited’s (DIH) three trades totalling 654,651 shares represented 84.42% of the total shares traded. DIH’s shares were traded at a Mean Weighted Average Price (MWAP) of $17.5, which showed no change from its previous close. DIH’s trades contributed 72.72% ($11,458,656) of the total consideration. DIH’s first two trades totalling 632,026 shares were at $17.5, while its third trade of 22,625 shares was at $17.6.

Demerara Bank Limited’s (DBL) six trades totalling 81,051 shares represented 10.45% of the total shares traded. DBL’s shares were traded at an MWAP of $27.7, which showed a decrease of $2.3 from its previous close of $30.0. DBL’s trades contributed 14.24% ($2,244,089) of the total consideration. DBL’s first trade of 1,145 shares was at $29.9, its second trade of 2,506 shares was at $28.8, its third and fourth trades totalling 26,400 shares were at $28.7, its fifth trade of 50,000 shares was at $ 27.0, while its sixth trade of 1,000 shares was at $30.0.

Demerara Distillers Limited’s (DDL) three trades totalling 36,661 shares represented 4.73% of the total shares traded. DDL’s shares were traded at an MWAP of $15.4, which showed a decrease of $0.9 from its previous close of $16.3. DDL’s trades contributed 3.57% ($562,279) of the total consideration. DDL’s first trade of 675 shares was at $16.3, its second trade of 24,500 shares was at $15.0, while its third trade of 11,486 shares was at $16.0.

Demerara Tobacco Company Limited’s (DTC) single trade of 282 shares at $1,146.9 represented 0.03% of the total shares traded. DTC’s shares were traded at an MWAP of $1,146.9, which showed an increase of $46.9 from its previous close of $1,100.0. DTC’s trade contributed 2.05% ($323,426) of the total consideration.

Guyana Bank for Trade and Industry Limited’s (BTI) four trades totalling 2,497 shares represented 0.32% of the total shares traded. BTI’s shares were traded at an MWAP of $450.0, which showed no change from its previous close. BTI’s trades contributed 7.13% ($1,123,650) of the total consideration. All of BTI’s trades were at $450.0.

Republic Bank (Guyana) Limited’s (RBL) single trade of 350 shares at $130.0 represented 0.05% of the total shares traded. RBL’s shares were traded at an MWAP of $130.0, which showed no change from its previous close. RBL’s trade contributed 0.29% ($45,500) of the total consideration.

NOTES:

Best bid: The highest price that a buyer is willing to pay for a security.

Best offer: The lowest price at which a seller is offering to sell securities.

TERM OF THE WEEK

Book Entry: The term to describe the electronic recording of an asset which is either in an immobilized or dematerialized form.

Source: Dictionary of Financial and Securities Terms

Source: Dictionary of Financial and

Securities Terms

Contact Information: Tel: 223-6175/6

Email: info@gasci.com

gasci@networksgy.com

Website: www.gasci.com

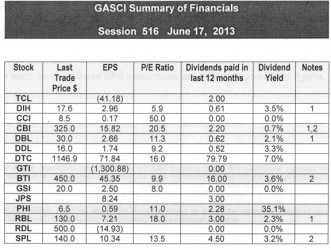

GASCI Summary of Financials Session 516 June 17, 2013

Notes

1 – Interim Results

2 – Prospective Dividends

3 – Shows year-end EPS but Interim Dividend

EPS: earnings per share for the 12-month period to the date the latest financials have been prepared. These include:

2005 – Final results for GTI.

2008 – Final results for PHI.

2011 – Final results for RDL.

2012 – Interim results for BTI.

2012 – Final results for TCL, CCI, DDL, DTC, GSI, JPS and SPL.

2013 – Interim results for DIH, CBI, DBL and RBL.

As such, some of these EPS calculations are based on un-audited figures.

P/E Ratio: Price/Earnings Ratio = Last Trade Price/EPS

Dividend yield = Dividends paid in the last 12 months/last trade price.