Pioneer

About 10 days ago, it was reported that Guyana had granted a licence to a company called Creditinfo Guyana to carry on the services of a credit bureau. The new company, a Greenfield foreign investment, was identified as a subsidiary of Creditinfo International. Creditinfo Guyana would be breaking new ground in the financial intermediation market in Guyana by becoming the first enterprise to serve as a ‘middleman’ between Guyanese borrowers and commercial banks and other creditors. Based on the type of service that it will be providing, Creditinfo Guyana could truly be described as a pioneer of the credit information industry in Guyana. The rationale for establishing a credit bureau is to ease access to credit and help stimulate economic expansion. This development should certainly be of interest to Guyanese since many persons, for a variety of reasons, experience much difficulty gaining access to the high levels of liquidity sitting in the deposit accounts of the commercial banks and other lenders in Guyana.

One question that arises from this event is what are the implications of the credit bureau for the loan industry in Guyana? Another question is what impact would it have on borrowers seeking access to credit? Even as one thinks of the answers to those two questions, other questions come to mind. What impact would this initiative have on the informal economy? Would it push it further underground? Or, would it liberate it from its unscrupulous architects and managers? The answers depend on many things, but one point is certain Guyanese would need a new attitude to live in the age of the newly licensed enterprise. To grasp its likely impact on the credit industry and on the lives of Guyanese, it is necessary to understand the nature and functions of a credit bureau.

Exchange of information

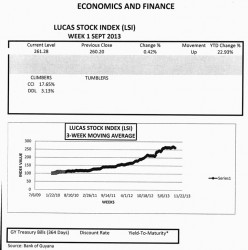

The Lucas Stock Index (LSI) rose slightly by 0.42 per cent in trading during the first week of September 2013. Trading involved five companies in the LSI with a total of 460,598 shares in the index changing hands this week. There were two Climbers and no Tumblers while the stocks of three companies remained unchanged. The two Climbers were Caribbean Container Inc. (CCI) which rose 17.65 per cent on the sale of 17,000 shares and Demerara Distillers Limited (DDL) which increased 3.13 per cent on the sale of 135,853 shares. Banks DIH (DIH) remained unchanged on the sale of 306,095 shares, and so did Guyana Bank for Trade and Industry (BTI) and Sterling Products Limited (SPL) on the sale of 1,150 and 500 shares respectively.

A credit bureau is a type of risk assessment agency that serves consumers and small businesses. It differs from a credit rating agency, such as Standard and Poor, which focuses on risk assessments of large corporations and the creditworthiness of governments. According to the Ease of Doing Business Report for 2013, 50 per cent of the 185 countries that are part of the survey do not have private credit bureaus. The majority of the private credit bureaus could be found in the USA. However, the three principal ones are Equifax, Experian and TransUnion. The credit bureaus produce reports of a consumer’s credit and payment history which are sold to creditors seeking information on customers with which they plan to do business. Utilizing a similar business model, the new credit bureau in Guyana would therefore be helping to facilitate an exchange of information between individuals and small business owners on the one hand and creditors on the other.

Risk profile

Loan decisions are made by the commercial banks and other creditors and those decisions are based on the risk profile that they develop of a customer. Without the aid of a credit bureau, each lender is forced to do its own due diligence. The due diligence takes time and it costs money to verify the information provided by a customer. Where the lender lacks confidence in the data provided, the lender errs on the side of caution and rejects the loan application. The very low loans-to-deposit ratios of the commercial banks suggest an abundance of caution in making loan decisions and that loan rejection rates in Guyana are very high. This could change with the entry of the credit bureau and there could be an expansion in credit. With the arrival of a credit bureau, lenders could now share information about borrowers. By supplying whatever information each has about a borrower to the credit bureau through its business transactions, the bureau is able to produce a credit report that reflects the risk profile of any customer.

The construction of the risk profile of each borrower is done using his or her personal and behavioural data. The credit bureau would be able to form its conclusions by collecting personal identification data like name, date of birth and national identification number. The baseline data are then joined with other data that include the credit history and the payment history of each person. The credit history considers how long the prospective borrower had a loan or credit card, how many accounts were relatively new, how many credit inquiries were made about a customer, the types of credit that a person had in use and the amounts owed. This type of information lets the bureau know how deeply in debt a person is and if his or her credit potential was maxed out. This latter group would include things like car loans, mortgages, credit cards and even student loans. The payment history of a person would consider how many times a person missed a monthly payment, how often payments were late, and if the person filed for bankruptcies or had any judgments or wage garnishments against his or her name. The several factors mentioned in this paragraph carry the most weight, typically about 80 per cent, in determining a credit score.

The credit bureau, even though staffed by humans, ends up creating a risk contour of individuals that is rather impersonal. With the use of statistical models, Creditinfo Guyana, for example, would develop a number called the credit score. The credit information systems of the USA are linked to a company known as the Fair Isaac Corporation. As a result, the credit scores of borrowers are known as the FICO score, a moniker derived from the abbreviation of the company’s name. It is understood that for now Creditinfo Guyana would be using a generic scoring system with a number range of 200 to 900. It plans to develop its own scoring system later after it obtains more information about prospective borrowers.

Measure of attitude

At its core, the credit score is a measure of the attitude one adopts towards financial responsibility and financial stewardship. It combines the good with the bad information of a person. The number therefore plays a very important role in telling a potential lender whether or not a borrower was a worthy customer who took their financial responsibilities seriously. A low score denotes a person with a high risk profile and the likelihood of not repaying the loan while a high score signifies a person with a low risk profile, and the likelihood of fulfilling the financial obligation. So, by developing the credit score, the credit bureau helps to reduce the emphasis on a person’s ability to repay a loan and helps to increase focus on a person’s willingness to do so.

In addition to removing the imbalance in information between borrowers and lenders, the use of the credit bureau should help lending institutions to lower borrower default rates. This is achieved through what McIntosh and Wydick called the screening and the incentive effects in a USAID-funded study on the subject of credit bureaus published in June 2009. Where the screening effect is concerned, better and more reliable information about borrowers leads to loans with less risk being given by banks. The incentive effect suggests that borrowers themselves want to be seen as good customers and try to demonstrate this attitude by paying their debts, and doing so on time knowing that their credit scores matter to their jobs and lifestyles. As we were reminded by Klein and Richner in their 1992 article entitled In Defense of The Credit Bureau, “Man is in need of the cooperation and assistance of the multitude” in his efforts to avoid moral hazard. The credit bureau with its comprehensive data on prospective borrowers behaves like the multitude keeping an eye on their behaviour and attitude.

Better rates

Lower default rates mean banks could reduce interest rates while giving even better rates to customers of good quality. A high credit score means a high probability of approval with low interest rates while a low credit score means a high probability of disapproval and the payment of higher interest rates. So, a person who is financially endowed, but displays financial irresponsibility for whatever reason could end up paying a higher rate of interest than a person of lesser means. The existence of the credit bureau also leads to competition among banks. The credit information about borrowers is very portable and could be passed around to creditors with great ease once a request is made to the credit bureau. This allows a borrower to shop around with greater comfort and seek out the lenders with the best loan terms. A borrower with a good credit score is an attractive customer to creditors. They too will want to do business with the more creditworthy customers and the competition for such customers could also result in lower interest rates being offered to borrowers with high credit scores.

The cheaper cost of credit through lower rates could also lead to an expansion of credit. Persons who maintain high credit scores will get additional credit. Persons who could not afford to participate in the credit market at the higher rates of interest might be able to do so if and when rates come down. The expansion in consumption and investment that was likely to follow helps to increase economic output and growth.

Impartial arbiter

A credit bureau is of value to both borrowers and creditors. But, for it to work, Guyanese would have to use the bureau and provide the necessary information. Credit bureaus make mistakes in calculating credit scores by either omitting critical information from, or by including erroneous information in, a borrower’s file. News reports reveal that having these errors corrected could be frustrating and costly since credit bureaus are not always willing to admit error. As a consequence, legitimate queries and concerns about the accuracy of records go unresolved for long periods. During that time period, the lifestyle and job prospects of affected borrowers are crippled. There is therefore cause for concern about the introduction of the credit bureau initiative in Guyana. These are early days, but evidence already exists that some creditors are reluctant to join the user group setup for their participation. It is not clear if such resistance would be found among borrowers. No matter how one feels about the credit bureau at this point in time, it is hard to ignore that it could serve as an impartial arbiter of the attitude of Guyanese to repay their debts.