Anniversary

This year will mark the 25th anniversary of the passage of the Dealers in Foreign Currency (Licensing) Act, and there is clear evidence that the market has undergone significant change over the intervening period. That legislation, which was passed under the Desmond Hoyte administration, created the opportunity for individuals and private companies that were not commercial banks to sell and purchase foreign currency under normal market conditions. The law required participants in the foreign currency market to register their businesses and obtain a licence to operate them. The principal purpose of the law was to eliminate the black market and increase the safety and efficiency with which foreign currency was bought and sold. As a consequence, the money traders or cambios were born. The cambios have come a long way and are very legitimate contributors to the Guyana economy by playing an important part in the market for foreign currency. The importance of cambios is not only in giving safe and orderly access to foreign currency; they help stabilize the exchange rate by removing the hidden hand of the black market.

Anti-Money Laundering Bill

Foreign currency transactions reflect the level of international trade and travel activities and influence the level of liquidity in the economy. A discussion of this market with updated information could have provided a chance also to assess the claims of adversity of the non-passage of the Anti-Money Laundering and the Countering of Financing of Terrorism Bill. That Bill’s fate appears to be more at the mercy of the unyielding stubbornness of the administration than anything else. Without tangible evidence, the administration has been sounding alarm bells as if the sky was falling. The adverse consequences of the non-passage of the Bill would reveal themselves in the reported level of currency transactions during this supposed period of concern. However, the full economic report for 2013 is unavailable and as such this article would eschew an opinion on the matter.

Strong policing

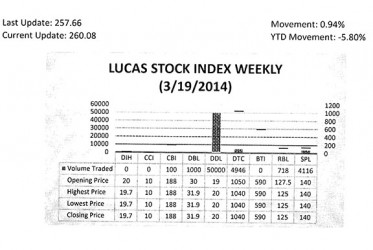

The Lucas Stock Index (LSI) increased 0.94 per cent in trading during the third week of March 2014. The stocks of six companies were traded with a total of 60,880 shares changing hands. There were two Climbers and one Tumbler. The shares of Demerara Bank Limited (DBL) rose 6.33 per cent on the sale of 1,000 shares. The shares of Demerara Distillers Limited (DDL) rose 5.26 per cent on the sale of 50,000 shares. In the meanwhile, the shares of Demerara Tobacco Company (DTC) fell 0.95 per cent on the sale of 4,946 shares. The shares of Republic Bank Limited (RBL) remained stable on the sale of 718 shares. Similarly, the shares of Citizens Bank Inc (CBI) and those of Sterling Products Limited (SPL) also remained stable on the sale of 100 and 4,116 shares respectively.

The concern of the administration must be for the non-bank cambios which continue to take a beating from the commercial banks. To the extent that they serve, knowingly or unknowingly, as outlets for shady businesses, the anti-money laundering legislation would be of no help to them. The stringent monitoring of the foreign currency market was likely to have a greater impact on their already small market share. On reflection, it must be a disappointment to many that, in a time of an unfettered and legally functioning foreign currency market, the demands for the strong policing of the market are far greater now than during the time of the dominant illicit or black market in the 1980s. In Guyana’s case, this necessity is as much a function of the global power distribution as it is the unchecked abuse of the instrument of national sovereignty, the latter being displayed in the brazen and biased application of the laws of the land.

Out-muscle

At the time of its liberalization, the view prevailed that the non-bank cambios would outperform the foreign currency departments of the commercial banks. It certainly looked that way when the law was passed. At that time, the market structure was determined by the number of participants in the industry and the value of transactions performed. The principal reason for using the number of participants was that practically all the registered foreign currency dealers were located in Georgetown. A look at the industry in 1996, seven years after the implementation of the law, revealed that there were 29 cambios in operation. Of this total, 20 were operated by non-bank entities while only nine were run by financial institutions. In addition, 97 per cent of the cambios were located in Georgetown with only one in Rose Hall on the Corentyne. It was therefore easy to see how many could have thought that the non-bank cambios would out-muscle the commercial banks in the foreign currency market.

Market realignment

The non-bank cambios are in danger of becoming extinct. According to the third quarter Bulletin of 2013 of the Bank of Guyana, their participation in the market had become inconsequential. What many did not see was the strength of the network of bank branches with their ability to jostle the non-bank operators in the market. Between 2000 and 2009, there was a marked realignment of the market in foreign currency with a more pronounced change in the structure. Much of the change was induced by the corporate and business strategies of commercial banks with the use of their branch networks. With their branches available to them, the commercial banks started taking the service closer to customers in previously underserved communities. They expanded the number of locations from which customers could buy foreign currency in 2007 to 43. By doing so, they limited the number of persons who had to depend on Georgetown for service. As a result, the structure of the market began to change. By the end of 2009, there were 46 locations in which cambio operations were taking place and the commercial banks were responsible for all the increases.

Reaffirm primacy

Without a similar network of branches, the non-bank cambios could not compete. Consequently, the commercial banks were able to reassert themselves and reaffirm primacy of the market as interested readers could see from a review of the data in the 2013 Quarterly Bulletin of the Bank of Guyana. There are now 50 locations at which foreign currency transactions could be conducted and the commercial banks control 76 per cent of them. From a concentration of 97 per cent in Georgetown in 1996, there are now more cambio locations, 27 or 54 per cent, outside Georgetown than in the capital city. The number of cambios has dwindled largely due to the decline in the number of non-bank cambios. Their numbers have fallen from the high of 20 in 1996 to 11 in 2013.

Volume of business

The volume of business performed by the cambios also has grown over time and is also dominated by commercial banks. In 1996, cambios conducted an estimated US$976.1 million in business. That was equivalent to US3.7 million per day changing hands. At that time, none of the commercial banks had cambios outside Georgetown and only one non-bank operator was conducting business beyond the limits of the capital. With the competition concentrated in Georgetown, the cambios of the commercial banks accounted for 85 per cent of the transactions and there was a feeling that the share of the bank cambios would dwindle further.

Disappearing share

That never happened. As at the end of 2012, foreign currency transactions had reached US$6.8 billion with the cambios accounting for nearly 53 per cent of the value. Consistent with the expansion of their network of locations, the banks have also expanded their share of the volume of transactions. They account for close to 97 per cent of the foreign currency trade by cambios. This means that the share of the non-bank market has fallen by over 80 per cent over the past 25 years. With the volume of business declining, it is not surprising that the number of non-bank cambios has also declined by 45 per cent during the same period. As of September 2013, the reported volume of the non-bank cambios had declined even further by US$67.3 million from US$94.8 million in September 2012. This is a contraction of 29.0 per cent, and a market share of a meagre 2.8 per cent of total cambio volume.

Sole preserve

If the current trend continues, the non-bank cambios would disappear and the foreign currency trade could become virtually the sole preserve of the commercial banks again. The exceptions could be the international hotels which in many instances would need to serve their international guests and those cambios with import/export services. Nonetheless, stringent anti-money laundering laws once adopted could add pressure to the remaining marginal players and force them out of the market.