Endowed

It is understood that Guyana has been encouraged to become a part of the Extractive Industry Transparency Initiative (EITI). This is work that was started by the previous administration and no doubt would be under some scrutiny by the Granger government. The EITI is neither a lending institution like the World Bank nor a trade promotion body like the World Trade Organization. However, the members of the EITI share the belief that the money obtained from the extractive sector belongs to the citizens of the endowed country and that the people should be able to benefit from the money generated from the sale of those resources. Governments through their public policies that are often reflected in their budgets believe that they do share the resources with citizens. That view diverges from the reality of poverty, corruption and human rights abuse that have taken place in many resource-rich countries.

Scrutiny

The experience of Guyana over the past 15 years does not suggest that budget policies easily bring balance in the resource allocation to communities across the country or in a manner that indicates that a cross-section of contractors and industries benefit from public spending. The neglect of Region 10 and the City of Georgetown are examples of resource bias. The bias of single sourcing in the procurement practices also reflected imbalance in resource allocation. To the extent that the resource allocation practices of governments become subject to scrutiny through a body like the EITI, it does raise questions about the sovereignty of states. Without the use of monetary or fiscal policy, the EITI is therefore a bold effort at moral suasion to get governments to act responsibly. This writer believes that the benefits of participation in the EITI outweigh the risks that could confront a country like Guyana in sharing information about the management of proceeds from its natural resources in a globally inspected database.

As Guyana thinks of developing a relationship with EITI, one should keep in mind that information sharing of macroeconomic policies like inflation and exchange rates is already taking place with institutions like the International Monetary Fund (IMF) through the country’s membership of that world body. Besides, the EITI process is linked to the relationship with Norway under the Low Carbon Development Strategy (LCDS) and eschewing a relationship could involve a financial cost to Guyana if the country failed to be a part of the global transparency standard.

The EITI is confined to the extractive sector of countries. Natural resources are the capital of a country and often enter global production through world trade. The mining sector in Guyana has an array of production models and plays a very important part in the economy of Guyana. There are small, medium-scale and large miners operating in the gold industry. Revenues from gold exports at one time were the single largest source of foreign earnings of the country and were often greater than any binary combination of foreign earnings from the other major exports of bauxite, rice and sugar. The extractive industries therefore are important to Guyana. However, many natural resources are non-renewable which means that, unless the wealth that is generated is invested or utilized sensibly, the economic fortunes of a country could diminish as the natural capital itself diminishes. Oil is one of those natural resources that falls into the non-renewable category and this commodity has the potential to dominate the economy of Guyana far more than gold did in its recent heyday if it becomes part of Guyana’s production structure.

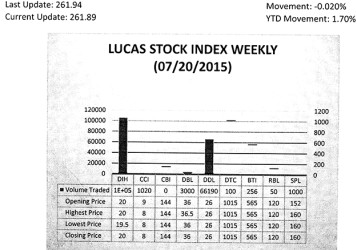

The Lucas Stock Index (LSI) fell 0.02 percent in trading during the third period of July 2015. The stocks of eight companies were traded with 177,616 shares changing hands. There was one Climber and one Tumbler. The stocks of Sterling Products Limited (SPL) rose 5.26 percent on the sale of 1,000 shares. In contrast, the stocks of Caribbean Container Inc. fell 11.11 percent on the sale 1,020 stocks. In the meanwhile the stocks of Banks DIH (DIH), Demerara Bank Limited (DBL), Demerara Distillers Limited (DDL), Demerara Tobacco Company (DTC), Guyana Bank for Trade and Industry (BTI) and Republic Bank Limited (RBL) remained unchanged on the sale of 106,000; 3,000; 66,190; 100; 256 and 50 shares respectively.

Philosophy

The philosophy behind EITI accommodates the risks and benefits that all natural resources, both renewable like forestry and fishery resources, and non-renewable resources like bauxite, gold and oil, have on the wealth of the country and the condition of its citizens. A relationship with the EITI has to be understood through the principles that guide its operations and to which member countries must adhere. Though it addresses a range of issues, the underlying purpose of the EITI principles is to guard against corruption and to achieve transparency and accountability in the management of the natural resources of a country. In one form or another, eight of its 12 principles drive home the point about accountability and the rule of law. In the view of this writer, joining EITI could help reinforce the efforts that the Granger administration is making to tackle the scourge of corruption that has plagued this nation, restrained foreign investment and sullied its image abroad. Some domestic initiatives are at risk as a result of the fractured political environment stemming from the unsubstantiated claims of election rigging by the PPP/C and the poisonous rhetoric that it spewed during the recently-concluded election campaign. The co-operation of the opposition is needed to have an important accountability body like the Public Procurement Commission created and the lack of co-operation from the opposition could prevent it from being established. The reconstitution of the Integrity Commission is another body that could suffer a similar fate.

Compliance

In addition, compliance with the terms of foreign investment agreements has been a problem for Guyana. The previous administration has been heavily criticized for its management of the resources and revenues of the forestry and the mining industries. Another problem has been the poor management of the tax incentives which are available to persons or companies that invest in Guyana. These issues have taken a heavy toll on the economy of Guyana as the country lost an undisclosed amount of revenues from lax application of tax expenditure policies while the benefits of jobs and value-added output that should have accrued from the investments never materialized. Much of this failure was linked to investment in the natural resource sector and the burden for the losses falls on both the government and the private operators in the particular industry.

The principles of EITI require both the government and the private operators in the chosen industry to be transparent in their dealings with each other. This means that all companies operating in the extractive sector must be willing to disclose publicly the payments that they make to the government. The government in turn must have a way of enabling citizens to understand what revenues were received and to have a say in how the revenues are utilized. Towards these ends, a civil society group has to be part of the oversight and management process. At the same time, governments have to develop a consistent and workable methodology by which the payments and revenues that they receive from third party operators could be disclosed. The figures provided by the government and the figures provided by the operating companies have to be reconciled by an independent auditor. The complete financial information helps citizens to understand what happened to their natural resources and to make informed judgements about the equity and benefits of its expenditure.

External solution

Noting those advantages, membership of the EITI could be a back-up to national transparency and accountability initiatives. The acceptance of such an external solution in Guyana’s case could be justified by the apparently haphazard and, in some cases, the mysterious way in which the funds of PetroCaribe, the Geology and Mines Commission and the Guyana Forestry Commission were managed by the previous administration.

There is a good chance of membership being successful and working in Guyana’s favour, because many of the country’s key trading partners are part of the EITI. Guyana would be in familiar company too being among members of the Commonwealth like Australia, Canada, Cameroon, Ghana, New Zealand, Nigeria, Trinidad and Tobago and the United Kingdom. The success of the EITI depends on the willingness of private investors and governments to trust each other. While information disclosure is voluntary, private investors who operate in member countries are expected to cooperate with the host government’s request for information. Guyana therefore could expect also compliance by investors that come from those same countries.

Pattern of relationships

With Guyana likely to become an oil-producing state, an interesting pattern of relationships could develop with other EITI members. So, while Guyana might be seeking membership of EITI as a mineral producer, its performance was likely to be evaluated more as an oil producer by the time it completed the member application process. With EITI candidate and compliant members who are major oil-producers on board, EITI as an organization could be just as significant and influential as the members of the Organization of Petroleum Exporting Countries and the BRICS. Current estimates put EITI members as being responsible for as much as 34 per cent of global oil output. This is a mere seven percentage points lower than that of OPEC and 13 percentage points higher than those of the BRICS. If it is good business and financial management practices that keep EITI member countries working together, it might be easier for countries to cooperate on other issues. EITI therefore has the potential to alter global economic and political relations in a meaningful way. Consequently, for the foregoing reasons, this writer feels that joining the transparency body would be beneficial to Guyana.