Concern

The concern over the deal on the Berbice River Bridge is not only about the level of the investment made by the government vis-à-vis the private sector, but also about the mode of the investment. There is something to be said about the disquiet expressed concerning the integrity of the deal and the place in which the NIS finds itself in the investment. The Berbice River Bridge was sold to Guyanese as a public-private-partnership venture that made the construction of the bridge possible. This use of the public-private-partnership is the element of the deal that makes the entire investment questionable to the point of raising concerns about the motive of the decision to build the bridge. It comes from the impression given by the previous government that the public-private-partnership was the only means available to make a desirable public investment possible. However, recent disclosures about the structure of the deal, its small private ownership with an inordinate amount of control and the role of the administration in its management bring into conflict the ability-to-pay and the benefits principles of taxation. In light of this conflict, this article seeks to examine the public-private-partnership concept in the context of the construction of the Berbice River Bridge.

Monopoly

Before discussing the implications of the public-private-partnership investment vehicle, one needs to examine the economics surrounding the bridge. Prior to the construction and use of the bridge, commuters relied on the ferry service between Rosignol and New Amsterdam to get from the West Bank to the East Bank of the Berbice River. The ferry had the advantage of being able to carry large numbers of vehicles and passengers. In that sense, it had monopoly power in a niche market. The ferry has been replaced by the bridge which now has the monopoly for enabling people and vehicles to cross the river. What is more, since the bridge is available 24 hours per day, it has the added advantage of providing users with convenience under monopoly conditions. Users of the bridge with a vehicle have no choice but to comply with the terms which the Berbice Bridge Company determines, unless the public in the public-private-partnership has a say.

Hands-off approach

Reasons for the

mode of investment

The reason cited most often for the use of the public-private-partnership is the lack of funds by the public sector to carry out the many public works that are needed to keep the wheels of industry going and to meet the consumption and leisure demands of households. When governments alone have to undertake the public investment, it turns to taxpayers to raise money or to capital markets or bilateral and multilateral lenders to borrow the funds. Raising revenues to meet many deserving needs that compete with each other is not easy. Taxation means shifting money from potential private investment or consumption to pubic use and it encounters resistance when taxpayers feel overburdened and they cannot see the benefits to themselves.

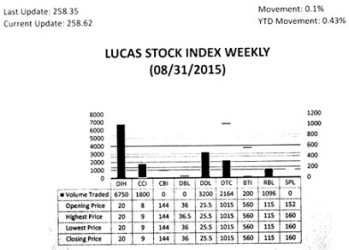

The Lucas Stock Index (LSI) rose 0.10 percent during the final trading period of August 2015. The stocks of six companies were traded with 15,210 shares changing hands. There was one Climber and no Tumblers. The stocks of Caribbean Container Inc. rose 12.5 percent on the sale of 1,800 shares. In the meanwhile, the stocks of Banks DIH (DIH), Demerara Distillers Limited (DDL), Demerara Tobacco Company (DTC), Guyana Bank for Trade and Industry (BTI) and Republic Bank Limited (RBL) remained unchanged on the sale of 6,750; 3,200; 2,164; 200 and 1,096 shares respectively.

The alternative is to turn to the private capital markets where possible or to bilateral and multilateral donors. Donors too have financial and tolerance limits and they are not always ready or interested in funding projects that do not coincide with their national interests. Public-private partnerships give the private sector a chance to invest voluntarily in the project. The potential benefits from such participation from the standpoint of public finance are that they help to reduce initial capital costs to the government and reduce the need to operate budget deficits.

Another reason proffered for using the public-private partnership is to acquire access to valuable human resource skills that otherwise might not be available to the project. The assumption here is that the private sector would make its best human resources available to the government for participation in the production and management functions of the project. The anticipated outcome is a more efficiently run operation that returns a higher welfare benefit to Guyanese.

Important principle

An important principle in taxation is the ability-to-pay principle and when taxpayers are already feeling overwhelmed by the amount of taxes that they pay, they are reluctant to pay more. In using the public-private-partnership, the government is implying that taxpayers did not have the ability-to-pay for the construction of the bridge. If that were so, one must wonder why the taxpayers ended up financing the bulk of the cost of the bridge with external loans and their NIS contributions and to a lesser extent their deposits in public financial institutions. They did it at tremendous risk and sacrifice since substantial amounts of money were taken from their NIS contributions which they are unable to benefit from now. Further, Guyanese taxpayers had to forego additional alternatives since money might have been taken also from the Geology and Mines Commission for use in the bridge. The sacrifice seems never-ending as the new government will have to take money from the Consolidated Fund to subsidize the reduced fares to commuters.

Another important principle in taxation is the benefits principle. Those persons who saw benefits in the erection of the Berbice River Bridge would not have had any qualms paying more taxes to build the bridge. Most Guyanese who live in Region 4, the most populated region and the one with the largest individual and corporate taxpayers, welcome the existence of the bridge. But like others, they wonder about the benefits that accrue to them.

Hard choices have to be made, but they should not come at the undue expense of the taxpayer. Those who could not foresee any substantial future benefits from the structure might have been reluctant to fork over additional money for its construction. If that were true, the private sector should have been bearing a greater share of the cost and risk. In exchange, it gets to control the project and the revenues that flow from it as a means of ensuring that it received the returns for which it was looking.

Efficiency and effectiveness

Another reason that governments use the public-private-partnership is to increase efficiency and use available resources more effectively. The efficient use of scarce public resources is a great challenge for governments. They have very little incentive to structure their investments to produce efficiency and effectiveness. Private operators enter the deal with the aim of achieving maximum profits. This should be accompanied by increased efficiency in the investment. It should also lead to efficiency in the operation of the bridge. An increase in the efficiency of the operation of the bridge should also lead to access at affordable prices. Even in situations where the private sector is given control over the project, the government exercises oversight and supervision. This approach should result in a lower outlay for the government.

Metrics

One has to understand the strategic intention of the PPP/C government in deciding to build the bridge. It is hard to imagine that the PPP/C would build a bridge with the money of taxpayers and then turn around and expect that they would be the ones carrying the burden of the investment for the private investors. But that is what is happening. The bridge as a monopoly is a classic case of market failure which was not addressed fully by the PPP/C government. Taxpayers having agreed to pay for the construction of the bridge find that the market is being stage-managed by the government to their exclusion with the extremely high tolls. What is worse, the equity investors do not want the new government to correct the market failure on behalf of those taxpayers bearing the burden of the tolls. This attitude is surprising especially since from all indications the returns to bond holders would be secured by the subsidy proposed by the new government.

The way around the conundrum

It is odd that the taxpayers are the ones who built the bridge and are now being asked to bear the burden of its operation. The way around the conundrum is to re-evaluate the strategic intentions of the PPP/C government against the cost and benefits of the project to both the taxpayers and the private investors. This could be done with the use of a series of metrics which could tell Guyanese whether or not the government pursued the best deal for the taxpayers of Guyana. Five of the metrics are given below. They are the internal rate of return of the project, the return on equity of the project, the annual debt-service coverage ratio, the loan life debt-service coverage ratio, and the net present value of subsidies.

The internal rate of return would tell us the return on the project regardless of the financing structure. By examining that figure, Guyanese would know if the project was seen as feasible or not at the time that the decision was made to go ahead with it. According to disclosures of the former PPP/C government, the private investors were expected to earn at least 12 per cent on their meagre equity investment. Guyanese need more information on the ROE, a measure of the profitability of the project for those persons who were expected to own the project and receive dividends from it. It would offer an idea of what motivated the private investors to put just five per cent of the equity but control 100 per cent of the profits made from it. Equally valuable would be an awareness of the annual debt-service coverage ratio of the company. This metric would enable Guyanese to determine if the project company has the ability to repay debt.

Reasonable outcome

Even if the project revenue was below that which was forecast in the financial model at the time of the decision, the company should still be able to pay its debts as long as the ADSCR was above one. Similarly, the loan life debt service coverage ratio would tell taxpayers if the company could meet its debt obligations even if there was an occasional shortfall of cash. The net present value of the subsidies would tell Guyanese the real amount of the subsidies if any were given to the private company. The data on the investment must be made fully available if a reasonable outcome about the bridge is to be reached.