Financial Review

Current Revenue earned in 2015 of $161,710 million was $1,941.4 million short of budget. While Internal Revenue exceeded budget by $528.4 million, Customs & Trade Administration receipts fell below budget by $170 million while Value Added Tax (VAT) & Excise Tax fell by $714.7 million. Other current revenue fell short of budget by $1,586.1 million. See Financial Operations of Central Government (Accounting Classification) on page 28.

Within Internal Revenue, Corporation Taxes and Income Tax on the self-employed fell short of target although not substantially. VAT which was budgeted to bring in $39,315.9 million fell short of that target by $3,942.2 million, shared almost equally between VAT on imports and VAT on Domestic Supplies. Fortuitously, the significant shortfall in VAT was compensated for by an increase of $3,247.1 million over budget in Excise Taxes. Significant shortfall in Other Current Revenue arose from Dividends from public companies of exactly $1,000 million and Bank of Guyana profits of $687.3 million.

On the expenditure side Personal Emoluments of $44,641 million was $537.1 million less than budget while Other Goods & Services was $1,803.9 million below the budget of $44,979.8 million. Transfer payments budgeted at $56,466.4 million came in at $53,314.5 million, a favourable variance of $3,151.9 million.

Interest Expenditure for 2015 amounted to $5,225.2 million compared with budget of $5,663.9 million, a saving of $438.7 million.

As a percentage of current expenditure, Transfer Payments account for a substantial 37.8%. For 2016, the percentage is expected to climb to a whopping 40.6% of current expenditure. As a percentage of revenue, Transfer Payments in 2015 was 33% while for 2016 it is projected at 38.5%.

Economist Professor Clive Thomas, in his Stabroek News column on Govern-ment Transfers, identified as the two main categories of such transfers those based on Government’s social protection and welfare programmes for example, the National Insurance Scheme, and the other, interest payments on the outstanding public debt.

The current balance in 2015 was $15,332.8 million against a budget of $11,342.7 million, due in large measure to lower realised current expenditure.

Capital revenue and grants amounted $6,329.2 million compared with budget of $7,473.6 million while Capital Expenditure of $30,664.9 million fell short of budget at $39,048.6 million by $8,383.7 million, or 21.5%.

Debt repayment of $15,038.8 million was $14,682.3 million less than budget with the entire amount being on the External debt.

The overall balance on financial operations for 2015 was $24,041.7 million compared with a budget of $49,953.4 million, a difference of $25,911.7 million or 51.9%. The overall balance was financed from external sources $14,710.5 million and $9,330.9 million from domestic sources.

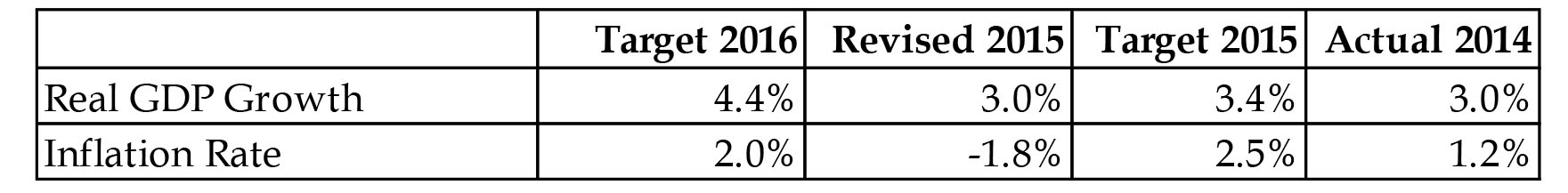

The Domestic Economy

Source: Annual Budget Speeches

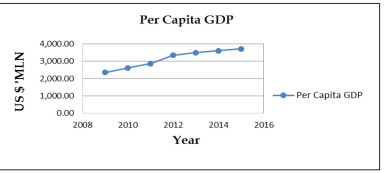

Per Capita GDP

The per capita GDP saw continuous growth over the years with an increase from US$3,606.4 in 2014 to US$3,723.6 in 2015 as shown below.

Source: Annual Budget Speeches

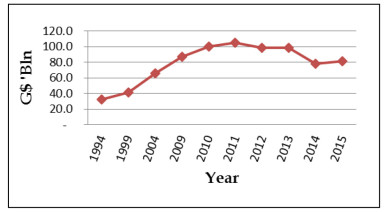

Domestic Debt

The Minister announced that domestic debt decreased by 48.6% in 2015. The growth in the domestic bonded debt from 1994 to 2014 is shown in the following graph:

Source: Annual Budget Speeches

The above graph includes only central government borrowing and therefore excludes any borrowings by public corporations and non-interest bearing debt, such as the Special Issue of Government of Guyana Securities by the Bank of Guyana.

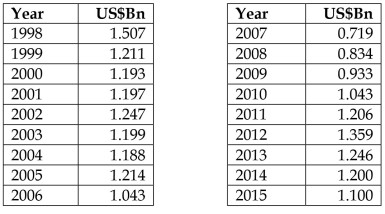

External Debt

The tables shows that over the period 1998 – 2015, the external debt has fallen by US$407 million or 27.0%.

Source: BOG Statistics and Budget Speech – All shown at December 31

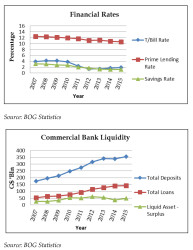

Banking and Interest Rates

There was a slight increase in the 91-day Treasury bill rate to 1.92% while the rate of interest on savings remain at 1.26%. The weighted average lending rate decreased from 10.86% to 10.63% still reflecting the wide spread which fuels the profitability of the banking sector. Most borrowers pay rates that are higher than the weighted average lending rate while the banks’ effective borrowing rate is lower than the savings rate as most demand deposit accounts earn no interest. Despite the spread, both loans and deposits have continued an upward trajectory.

The following chart shows the spread earned by the commercial banks as the financial rates continue to decline.

The Exchange Rate

The value of the Guyana dollar to the US dollar remains the same when compared to 2014 (see Highlights on page 7 for changes in market rates for the US dollar and other currencies).

Ram & McRae’s Comments

- The global economy is facing special challenges including terrorism, a glut of oil and the reduced demand for commodities by China. It is this challenging environment that Guyana’s economy will have to navigate and succeed. Given the structure of our domestic economy, focus has to be on accelerating production, stimulating growth and exports and creating jobs. This is a task as much for the private sector as it is for the Government.

- The gap between funds available for lending by the commercial banks and the amounts lent has actually increased in 2015. The whole economic argument for saving is to create the funds for investment. Insufficient use appears to be made of this huge opportunity.

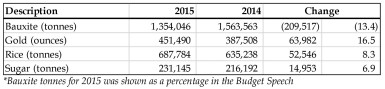

- The output for several sectors stand out in comparison with the prior year as follows:

Source: 2015 and 2016 Budget Speeches

The Gold Industry reported increased production of 16.5% from 2014 to 2015, to which Guyana Goldfields and Troy Resources would have contributed significantly. On the other hand, the Bauxite Industry saw a decline by 13.4% in 2015.

- Rice saw an increase of 8.3% and sugar followed closely with an increase of 6.9% when compared to 2014. However, both key Agricultural subsectors are facing some real challenges with the future of GuySuCo uncertain rice having to cope with weather and water problems, marketing challenges and declining confidence.