Financial Review

Current Revenue for 2017 is projected at $192,673 million, exceeding budget by $6,651 million or 4%. Internal Revenue and Customs & Trade Administration receipts are expected to surpass their budgets by $8,098 million and $2,376 million respectively, while Value-Added and Excise taxes are expected to have a shortfall of $3,983 million.

More specifically, Corporation Taxes and Income Tax will exceed budget by $6,091 million and $2,082 million respectively. Value Added Tax (VAT), which was budgeted to bring in $45,180 million will fall short of that target by $4,749 million. Excise Tax is expected to increase by $806 million compared to a budgeted of $34,369 million.

The Minister indicated that tax receipts from oil and gas support activities are expected to increase by $3.2 billion while international trade transactions are projected to rise to $19.4 billion, an increase of 11.2 percent.

In 2017 the standard rate of VAT was reduced to 14%, the registration threshold was increased to $15 million from $10 million, the range of zero-rated items moved to exempt or standard rated with the result that the number and range of items that were exempted from VAT increased significantly.

Personal Emoluments and Other Goods and Services are projected to fall short of budget by $563 million and $1,879 million respectively while transfer payments are expected to increase by $974 million over the budget of $71,094 million.

Interest Expenditure for 2017 is expected to decrease by $528 million compared with budget of $6,862 million.

The current balance in 2017 is projected at $10,278 million against a budget of $1,631 million, due in large measure to lower realised current expenditure.

Capital revenue and grants are expected to be $14,315 million compared with budget of $13,152 million while Capital Expenditure is projected at $58,146 million which is an increase of $1,388 million, or 2% over the budgeted figure of $56,758.

Debt repayment is projected to decrease by $83 million compared with budget of $8,974 with the entire decrease being on the External debt.

The overall balance on financial operations for 2017 is expected to be $42,447 million compared with budget of $50,949 million. The overall balance is expected to be financed from external ($19,714 million) and domestic ($22,730 million) sources.

Sectoral Performance

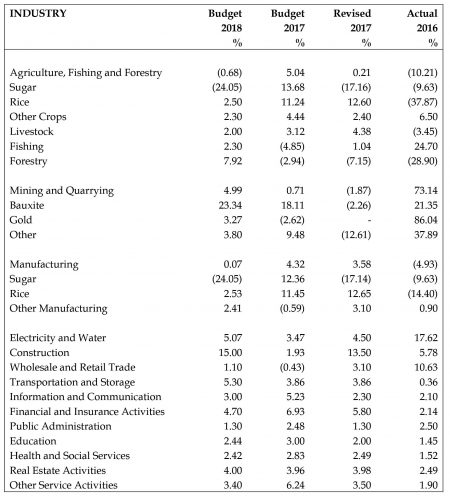

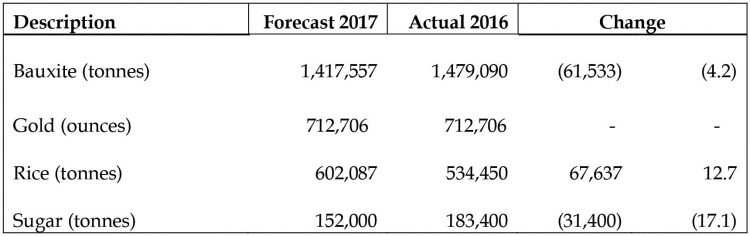

The Table below shows the sectoral growth, budgeted and forecasts for 2017 and actual 2016. For convenience, we also show the projections for 2018.

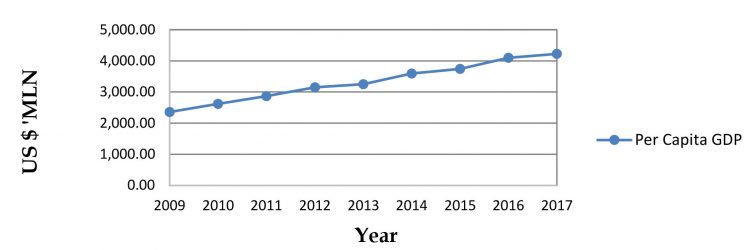

Per Capita GDP

The per capita GDP saw continuous growth over the years with an increase from US$4,096.6 million in 2016 to US$4,223.5 million in 2017 as shown below.

There are serious issues with Gross Domestic Product as a measure, including:

- GDP is a measure of production within the country, whether by nationals or non-nationals. As foreign companies play a greater role in the economy, particularly in enclave type of activities, the value of the measure can be extremely misleading. It is not without some significance that the Minister reported a 20% increase in the repatriation of employee compensation by foreigners during 2017.

- GDP places the same value on activities of positive benefit to the country as those that are harmful, such as pollution. In other words, a positive GDP is not always beneficial.

- GDP is an average and can mask extreme inequality. It is not therefore a measure of human development.

Domestic Debt

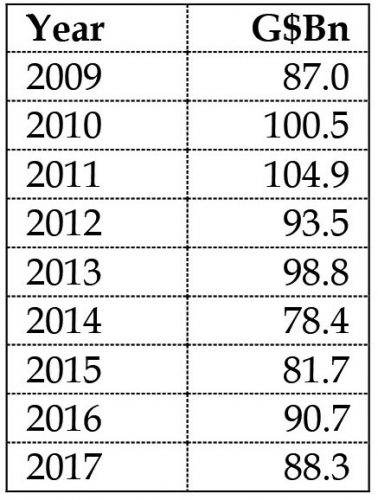

The Minister announced that the stock of domestic debt is projected to decline from US$438.6 million, in 2016, to US$427.8 million, in 2017, representing a decrease of 2.5 percent. However, domestic debt service is expected to increase by 16.8 percent, from US$9.3 million, in 2016, to US$10.9 million, in 2017, primarily due to the payment of the National Insurance Scheme (NIS) debentures issued in 2016 to assist in recovering the impaired investment in the Colonial Life Insurance Company (Guyana) Limited (CLICO). Debt during the years 2009 – 2017 is shown in the table below:

The Domestic Debt includes only central government borrowing and therefore excludes any borrowings by public corporations and non-interest bearing debt, such as the Special Issue of Government of Guyana Securities by the Bank of Guyana.

Debt is the principal vehicle to finance budget deficits and in an illiquid market can crowd out private borrowings.

External Debt

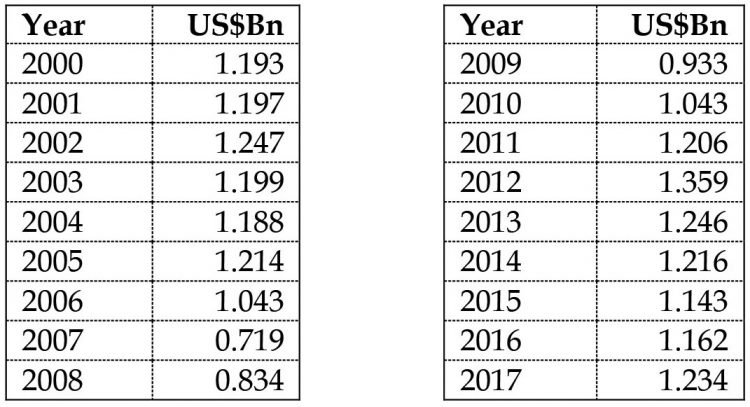

The table below shows that over the period 2000 – 2017, the stock of public debt has increased.

The external debt increased by US$72 million in 2017 over 2016. The Minister

indicated that the increase was attributed to higher principal and interest payments to several multilateral creditors, one bilateral creditor and one private creditor. The cost of servicing the external debt is perceived to be manageable, consuming a mere 5.7 percent of the projected central government revenue for 2017. The net international reserves as at September 2017 was US$579.5 million.

Banking and Interest Rates

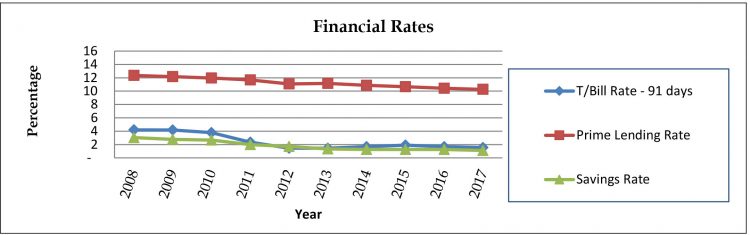

Prime lending rate reflected a minor decrease of 17 basis points while the 91-day Treasury bills and saving rates decreased by 14 and 15 basis points respectively which reflects excess liquidity and higher demand for treasury bills.

The following chart shows the spread earned by the commercial banks as the financial rates continue to decline.

Falling interest rates on loans are typically accompanied by falling savings rates as lending institutions try to maintain their profitability. They can also signal a levelling off of borrowings in the economy and a fall in investments, a key driver of economic activity and job creation.

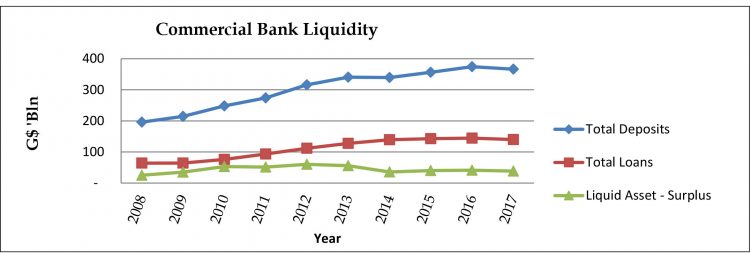

Total Deposits, Loans and Liquid Assets all experienced decreases by 2%, 3% and 7% respectively.

The Exchange Rate

The central bank exchange rate of the Guyana dollar to the US dollar remains the same when compared to 2016 but declines are seen in market rates (see Highlights on page 7 for changes in market rates for the US dollar and other currencies).

Ram & McRae’s Comments

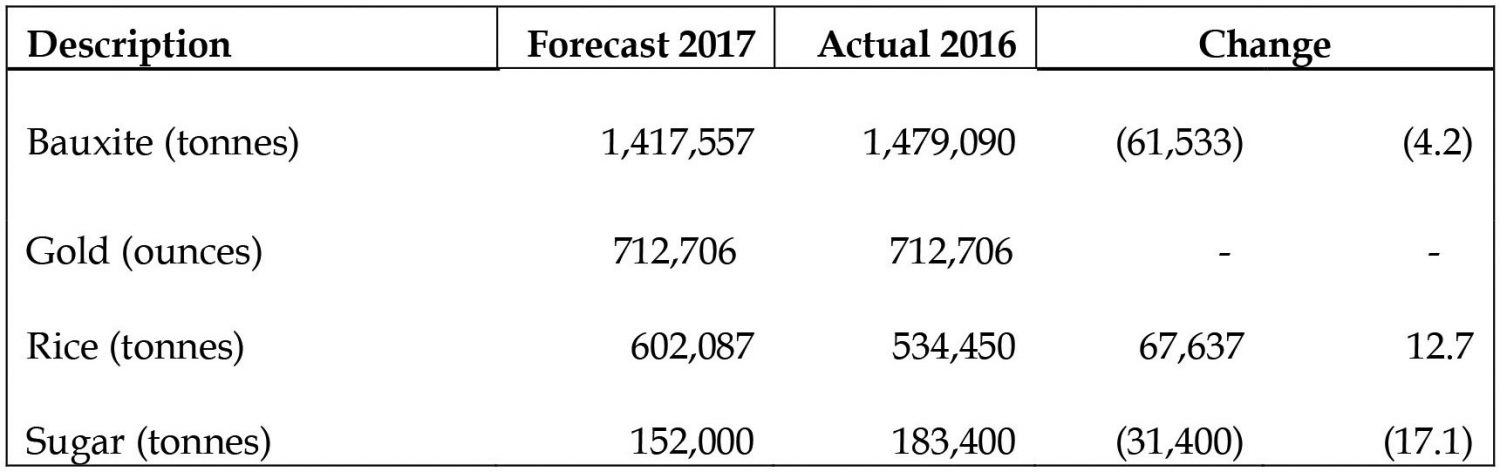

The output for several sectors stand out in comparison with the prior year as follows:

Sugar production continues its inexorable decline, mired in financial, industrial relations and management issues at the operations level and uncertainty at the policy level. If current trends continue, Guyana may once again find itself importing the commodity.

The Minister stated that gold declarations for 2017 are expected to remain stable when compared to the prior year. The Bank of Guyana noted in their 2016 Annual Report growth in the mining sector in 2015 and 2016 being fostered by the upsurge in gold declarations by local and foreign companies.

Conclusion

The economy has failed to respond to the continuing spending of ever increasing sums of money and unemployment may in fact be rising. The total capital expenditure by Central Government over the past ten years amounts to $472,735 million, a considerable sum on a per capita basis. The wish for some stimulus to move the economy to another level remains unanswered and despite the theme of A Good Life, confidence in the economy remains low. What Guyana needs is transformational management that will produce growth of real GDP in excess of 5% per annum.