The Guyana Gold Board (GGB) yesterday sought to assure miners that they didn’t incur losses from the suspected manipulation of loopholes in the agency’s financial systems, which has seen an accountant and another employee sent home as a broad investigation opens.

As has happened in the past at various GGB offices, miners would have expressed concerns that the purity of gold which they submitted to the GGB would have been understated, resulting in them incurring losses.

“[The GGB] and senior management take the opportunity to reassure miners that their assay accounts have not been compromised,” a statement from the Board said yesterday.

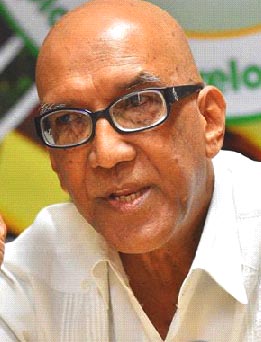

“So far, it is financial irregularities, which can cover a whole spectrum of things… people certainly bypassing policies to arrive at this stage,” GGB Chairman Gabriel Lall later told a press conference yesterday, as he reiterated that there was no “shaving of gold” and “despite our numerous discoveries, no miner’s assay is compromised.”

However, a Board source disputed this claim, saying that while monies in the alleged fraud have shorted the agency of the “bulk of the monies,” amounting to “millions,” a large percentage came from what miners were paid or should have collected.

“A person’s assay is 92% but when RCM [Royal Canadian Mint] sends back the sheet with the list they tested, it says that person had 95%, we owe them 3% and [we] would have it for them to collect. The client comes in and is told by [word of] mouth, [they are] not shown the entire sheet, because it could be compromised. So if the accountant tells them ‘it came back at 93% from RCM,’ they would pay them and have them sign to that. But they would go back in the system and manipulate the voucher to show the client collected the entire 95% and they collect that money (the 2% difference),” the official explained.

The GGB official also pointed out that when the client’s gold was tested, it was not associated with a name, since a code was applied to it, in order to avoid the lab staff being able to identify whose gold was being tested.

But the noted that employees knew of the system’s loopholes and have complained about the computerised system being implemented. The upgrading would have closed these loopholes. “They wanted a system that would not allow persons to re-enter, to make changes after final payments are made,” the official said. “They wanted the old system that had no controls. When the new system was implemented, they complained and the Board gave them the go ahead to continue using the old system… this is a system that irregularities would be very difficult to pick up because you have signatures from the miners and you have required paperwork,” the official added.

The official said that concerns have been raised by miners and other observers of the lifestyles of employees of the agency since they drive some of the most expensive vehicles and have built palatial homes in some cases “without a loan from the bank.”

When Lall was subsequently asked about miners’ concerns of being “shortchanged” through a manipulation of the system, he dismissed this. “None of the miners’ monies were troubled. This is not a case about miners’ money. People who were not entitled to assays were put down on paper, as if they should be and that money was paid from the Gold Board treasury [to the alleged perpetrators], not from any miner’s account,” he stressed.

Half of a system

However, the resistance by staff to an upgraded and ironclad data processing system was corroborated by the board Chairman.

“You have just got me a little angry there, not with you, but with what I inherited here, in that, we paid tens of millions of dollars for a complete system and what was delivered here was half of a system and when I raised my voice at somebody, they reported to the minister that I threatened them,” Lall said, when asked about the Board’s sloth in implementing a more robust system.

“We have a half of a system where there are people in the trenches who know that this is how it operates and they try to work their way around it…the people in the Accounts Depart-ment are aware of the limitations of the system,” he added.

The acting Chief Execu-tive Officer of the GGB, Eondrene Thompson, explained that she too wanted to assure miners that the fraud did not involve the testing of the agency’s over 200 clients’ gold. Thompson said that gold is tested at the Gold Board and clients are present when this is done.

However, in the case, of gold over 10 ounces, the metal is sent to the RCM for additional testing. She said that some clients even request that the RCM test their gold, instead of the GGB’s lab as they feel more confident using that medium. But the process takes at least a month and clients sign to payments, in lieu of the results from the RCM.

The RCM certification, however, is not shown to the clients, as there is a master sheet with all the clients’ results as opposed individual results for specific codes. Hence, the clients have to take the GGB’s word on the results received from the RCM. Both Lall and Thompson said that the RCM’s certification wasn’t manipulated, but Lall said that the Board took the initiative to inform the RCM that internal financial irregularities were being investigated. He was quick to point out that the investigation was not in any way connected to anti-money laundering or the source of gold.

Thompson said that the probe began when she noticed that a client who usually brings in a high quality of gold came back with very low purity from the RCM.

“One client who had a very low quality came back with a very high quality. It was most unlikely. We checked what we called the profile and we observed over the years that particular client the high quality is consistent. So, we took the initiative to comb the system to see what else is there,” she said noting that the “combing” went back to January 1st of this year.

Similar inconsistencies were discovered and then it was noticed that the signatures of the duo who are now under probe were on those transactions which called for further review. It is at this stage that the investigation is currently at, but both GGB officials said that the police could be called in if allegations are substantiated.