In this the 39th column I wrap up the comparison of the 1999 and 2016 contracts by looking at Annex D which is completely new in the 2016 Agreement. Annex D is derived from Article 21, addressed in Column 34 and containing a non-exhaustive list of nearly 250 classes of items which can be imported under the Agreement. As pointed out earlier, this Annex constitutes a carte blanche dispensing with any requirement for approval by the petroleum regulators. These items are now deemed approved and certified by the Chief Inspector, an office which Minister Trotman has failed to fill after nearly three years. What more can one say about Trotman and the APNU+AFC Government! For one thing, that he was being at least disingenuous earlier when he described the 2016 Agreement as a tweaked version of the 1999 Agreement.

There have been roughly two dozen columns comparing the 1999 and the 2016 Petroleum Agreements. Of course, an absolutely total comparison has not been possible because both the PPP/C and the APNU+AFC Governments have withheld important documents from the public. Even if the Granger Administration was forced into releasing the 2016 Agreement, they deserve a little credit for doing so. At the same time, they have been stubbornly resistant to releasing the Bridging Deed and have also withheld the 2016 Prospecting Licence and the 2017 Production Licence. On the other hand, the PPP/C in sixteen years kept the 1999 Agreement secret as well as the 2008 Addendum.

Sir Paul speaks

Both contracts have provisions that violate the Petroleum Exploration and Production Act while as these columns have demonstrated, the 2016 Agreement was unbelievably generous. That conclusion seems almost inescapable when one considers that the 1999 Agreement was pre-discovery while the 2016 Agreement is post-discovery. To that extent, the two cannot really be compared and makes a mockery of the patronising statement by the literal deus ex machina Sir Paul Collier who flew in and out in one day to tell Guyanese that the Esso/HESS/CNOOC Agreement is a reasonable one.

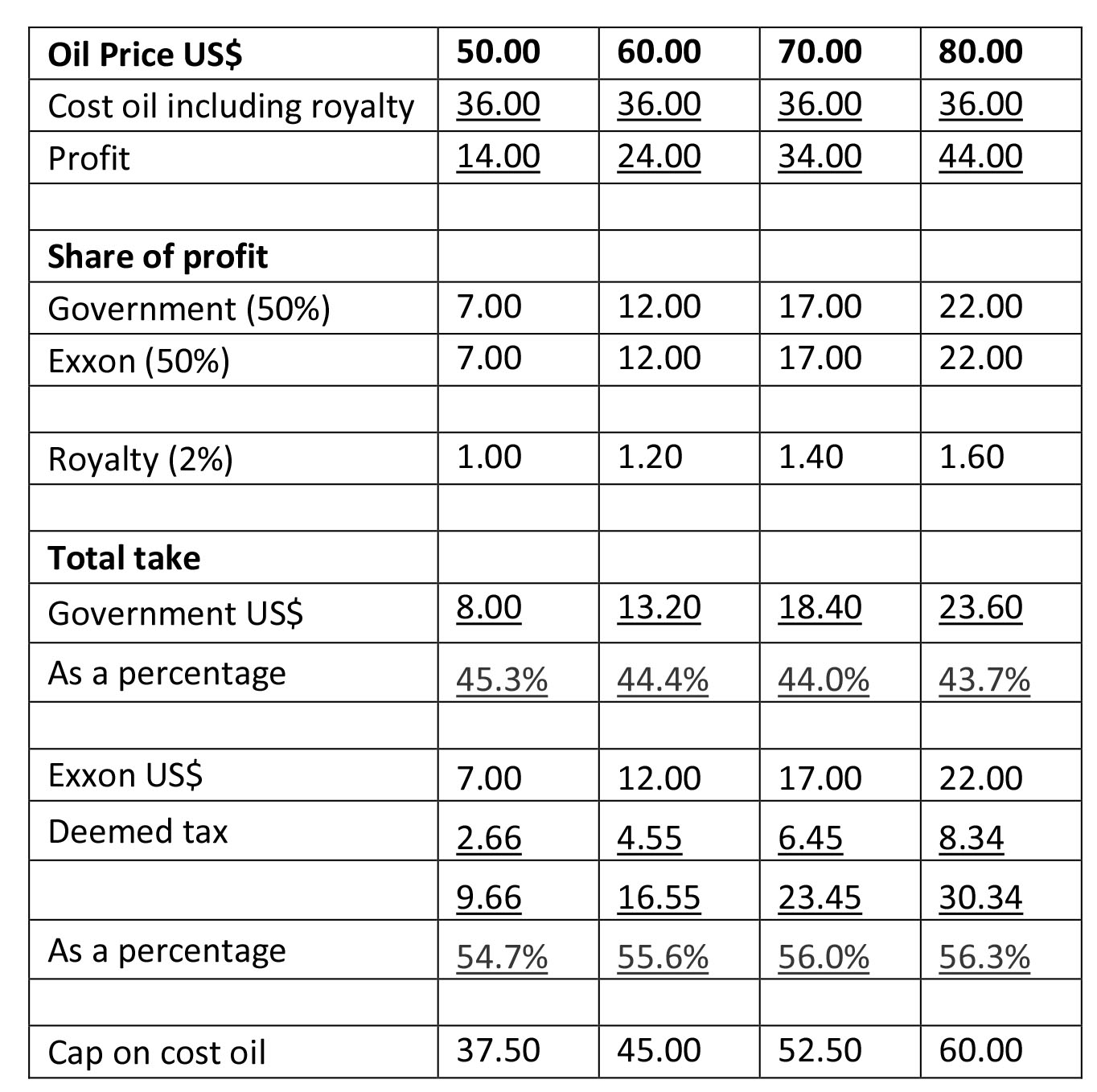

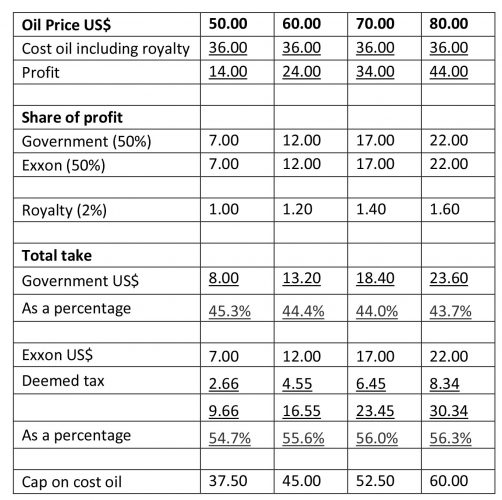

And so talking about reasonable contract, let us look at the relative takes by Guyana and the Oil Companies under the 2016 Agreement. The table below has been constructed using some simple assumptions about oil prices ranging from US$50 per barrel of crude to US$80 per barrel. At the time of writing, the price is US$69 so if anything the higher end seems more probable. The other assumption is that a barrel of oil will cost approximately US$36, inclusive of royalty. I have previously heard of a cost of US$35 but ExxonMobil USA has been signalling lower numbers owing to its superior technology. If these assumptions are realised or the actual numbers turn out to be more favourable, then returns will be higher.

Valuing the deemed tax

One critical element in the Petroleum Agreement which has so far been given little or no consideration is the tax benefit which the Exxon and its partners will receive as a result of the deemed tax payment. Recall that the oil companies will pay no taxes but will be credited – out of the Government share of profit oil – with a deemed tax payment. The current applicable tax rate of course is 27.5% and the Agreement gives the Contractors a tax credit as if it has paid such a tax. In simple terms, if the oil company actually pays tax at 27.5%, its after-tax income will be 72.5%. So, let us apply this to the line items showing Exxon US$. It means that the US$7.00 is 72.5% and so to get to 100%, the US$7.00 has to be grossed up by dividing it by 72.5% which gives US$9.66. The difference is the effective deemed tax.

According to Sir Paul, Guyanese are expected to accept that a foreign company comes and exploits our non-renewable resource, effectively bans all fishing in a huge swathe of the country’s maritime territory, gets full deduction for all the funds it makes available to exploit the resources, renders barren the environment, pretends to pay taxes in Guyana, cons its home country with a certificate that it has paid taxes in Guyana, and takes away more than Guyana keeps! And guess what: as Finance Minister Jordan gloated, this is after the area has been de-risked. In financial management, as the level or risk decreases, the investing company will apply a lower internal rate of return, with a lower level at which super profits are earned.

The shareholders of Exxon, Hess and CNOOC probably still cannot believe their good fortune. Guyanese will wonder about their politicians.

See you next week.