Ninety percent of the preliminary valuation work for sugar estates to be privatized has been completed and the unit set up by the government to oversee the process also clarified yesterday that $30b in bond financing for GuySuCo has been backed by a repayment guarantee from the government and not secured by the corporation’s assets.

The Special Purpose Unit (SPU) under the National Industrial & Commercial Investments Limited (NICIL), yesterday said in a statement that the multinational PricewaterhouseCoopers (PwC) professional services network is presently completing information memoranda (IM) for each estate. The IMs will encompass the asset registry and land inventory for each estate. The completed IMs will be published for potential investors and public scrutiny within the next two weeks, the statement said.

It is expected that potential investors would begin visiting the various estates in August to make assessments of the facilities as part of the preparation of their proposal to the SPU.

Head of the SPU, Colvin Heath-London stated in the release that, “work continues apace both with the process being carried out by the PwC and with the efforts of the SPU to maintain the operations of the estates as going concerns until they’re handed over to investors at the end of the process”.

London added that “progress is also being made with the sale and lease of assets at the Wales Estate, and the conversion of the Skeldon Estate compound to the Skeldon Heritage Resort has gone very well.”

Earlier this year, NICIL, in collaboration with the Ministry of Finance, launched a strategic plan to turn around the fortunes of the sugar industry. The strategy involved the development of two cogeneration facilities, upgrading the existing sugar factories to produce white sugar, restructuring of debt, and ongoing training and education for the workers and management of GuySuCo.

The release noted that to bolster the plan, financing was sought to implement NICIL’s strategy, to the tune of $30 billion and a mandate for this was given to Republic Bank Limited.

The SPU statement yesterday said that it was noted that Leader of the Opposition, Bharrat Jagdeo publicly criticized the way that the $30 billion syndicated bond was secured by NICIL. In response to those criticisms, the SPU said that it should be noted that as standard for any debt financing, security is required to secure payments to bondholders. Rather than an attachment to the assets of NICIL, which include the Guyana Oil Company, Atlantic Hotel Incorporated and the Guyana Sugar Corporation, the security of the NICIL bond constitutes a guarantee of payment from the Government of Guyana. The term of the bond runs for five years since it is expected that the proceeds of land sale by GuySuCo will be used to repay the facility and NICIL wanted to attract the lowest possible interest rate.

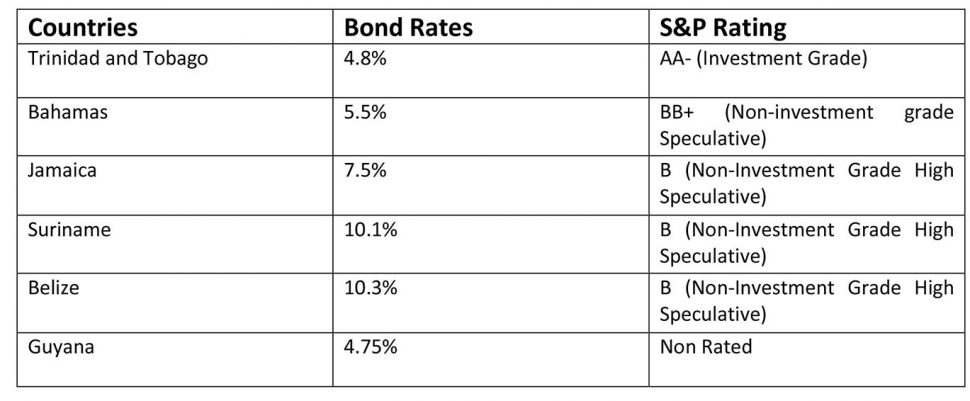

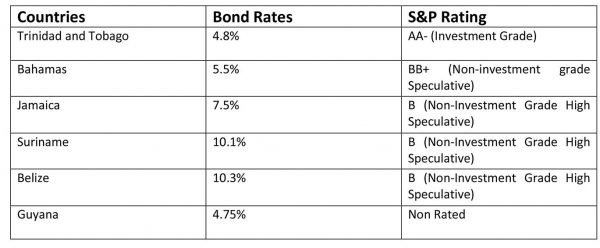

“It is therefore important to correct several inaccurate statements being made by the former President of Guyana and Minister of Finance, Bharrat Jagdeo, regarding the bond. The bond was secured solely by the full faith of bondholders in the Government of Guyana and not against any assets of NICIL or GuySuCo. The commercial lending rate for Guyana is 13.00%, while the NICIL bond was issued at 4.75%, which is 8.25% lower than the rate that most companies borrow at in Guyana.

“The current inflation rate in Guyana is 2%; therefore, any prudent investor would demand a return higher than the rate of annual inflation. Mr. Jagdeo’s comments as a former Finance Minister are very concerning, since he would certainly understand that no country in the world, including the USA, Switzerland or Germany can borrow at less than 2% for 40 years, as he mentioned. The 30-year US Treasury Bond is currently trading at 3.04%, which is expected to (rise) within the next year”, the SPU statement further said.

To further illustrate how competitive the interest rates are the SPU cited examples in other countries in the table below.

The SPU further noted that the Marriott Hotel US$27M debt financing that was secured indirectly by assets of NICIL, had a floating interest rate above 8.50% per year. The Berbice Bridge bond that is also indirectly secured against the assets of NICIL, has an interest rate of 10.0%. Both bonds were and are tax-free and were issued before May, 2015, the SPU noted.

While the NICIL bond issue is a private placement and intended solely for accredited investors, the SPU said that one of the primary beneficiaries are pension and insurance plans that are seeking to make medium-long term liquid investments at an attractive rate of return. To date, many of these plans earn less than 1.50% on T-Bills, even though they are expected to generate roughly 6% per year to meet ongoing pension obligations. It contended that many of these plans will become insolvent if the only available risk-free investment option are T-Bills.

The SPU asserted that the issuance of the NICIL bond is viewed as a precursor for increased activities within the Guyana capital markets, from corporations looking to tap affordable sources of financing.